Anyone interested in Elastic N.V. (NYSE:ESTC) should probably be aware that the CEO & Director, Ashutosh Kulkarni, recently divested US$438k worth of shares in the company, at an average price of US$75.30 each. However, the silver lining is that the sale only reduced their total holding by 4.1%, so we're hesitant to read anything much into it, on its own.

Check out our latest analysis for Elastic

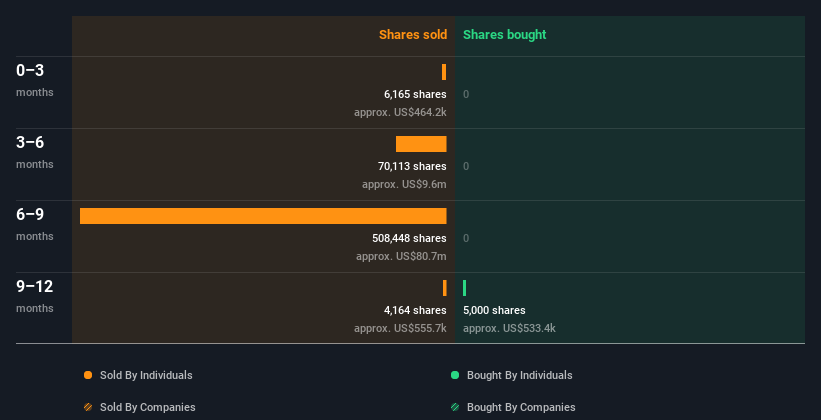

Elastic Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Co-Founder & Non-Executive Director, Steven Schuurman, sold US$83m worth of shares at a price of US$165 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (US$77.36). So it may not tell us anything about how insiders feel about the current share price.

In total, Elastic insiders sold more than they bought over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Elastic insiders own 19% of the company, currently worth about US$1.3b based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Elastic Insiders?

Insiders sold stock recently, but they haven't been buying. Despite some insider buying, the longer term picture doesn't make us feel much more positive. It is good to see high insider ownership, but the insider selling leaves us cautious. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we've found that Elastic has 5 warning signs (1 is a bit unpleasant!) that deserve your attention before going any further with your analysis.

Of course Elastic may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026