- United States

- /

- IT

- /

- NYSE:EPAM

EPAM Systems (NYSE:EPAM) Valuation in Focus After FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

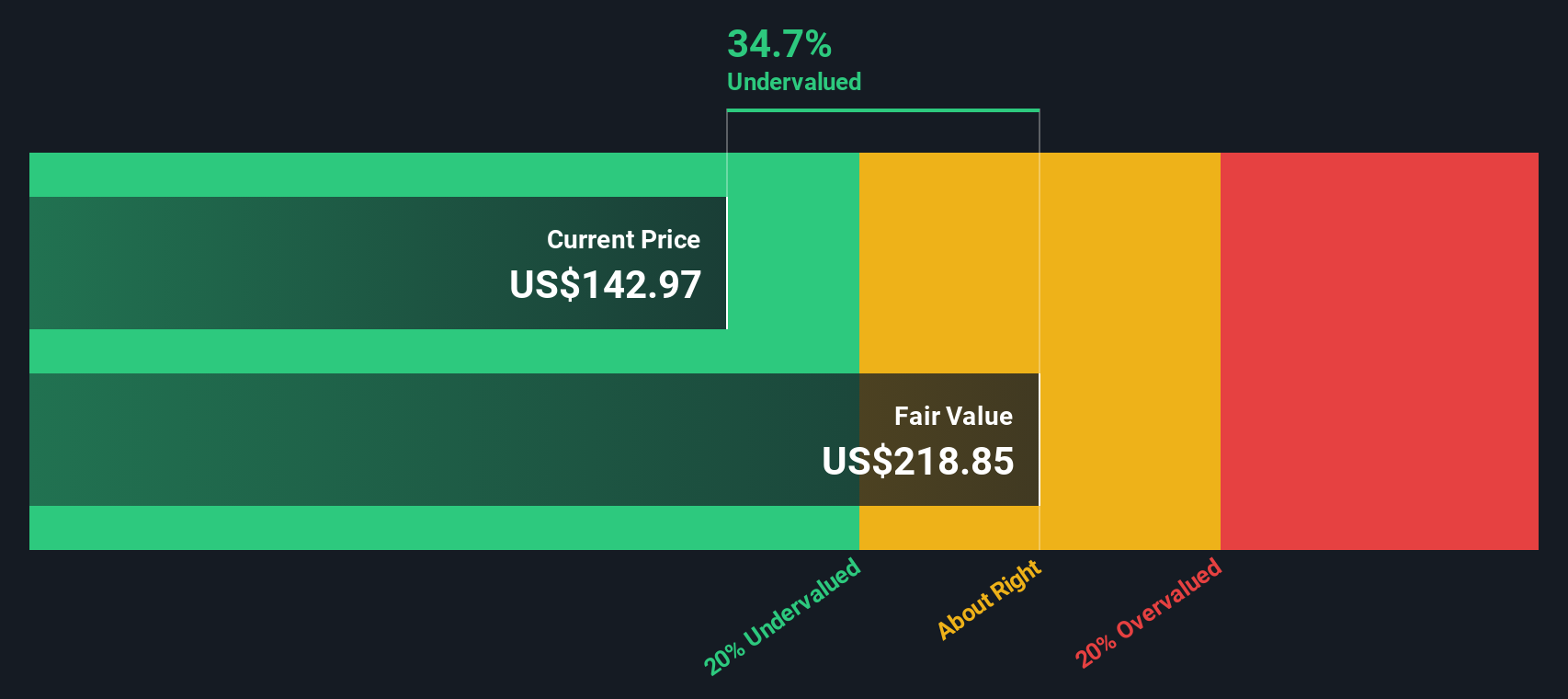

Most Popular Narrative: 25.9% Undervalued

According to the most widely followed narrative, EPAM Systems shares are trading well below perceived fair value, with analysts suggesting the market has yet to fully appreciate improving business momentum and company reorganization.

Expanding AI expertise and proprietary platforms are enabling EPAM to secure larger, high-value client engagements and move further up the value chain. Diversification across industries and geographies, coupled with operational efficiencies, is boosting resilience, supporting sustainable growth, and improving margins.

Curious about why analysts see so much upside? The driving forces behind this bullish price target come down to a blend of accelerated top-line growth, margin improvement, and future profit multiples that signal a major rerating opportunity. The specifics behind these projections might surprise you. Dig into the full narrative to discover the critical assumptions that fuel this 25% undervaluation call.

Result: Fair Value of $211.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent wage inflation and rising competition for IT talent could pressure EPAM's margins. This may challenge the optimistic undervaluation thesis despite recent progress.

Find out about the key risks to this EPAM Systems narrative.Another View: Discounted Cash Flow Perspective

Our DCF model tells a similar story, indicating that EPAM might be undervalued according to future cash flow projections. This approach examines longer-term fundamentals. Still, can a single method really capture investor sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EPAM Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EPAM Systems Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EPAM Systems.

Looking for more investment ideas?

Uncover more winning opportunities before they’re front-page news. The market never waits, so take action now and give your investing edge a real boost.

- Tap into the growth wave by tracking penny stocks with strong financials. See which emerging leaders are capturing profits with penny stocks with strong financials.

- Chase high-yield income: handpick top dividend stocks with yields over 3% and build a portfolio that pays you back through dividend stocks with yields > 3%.

- Ride the AI revolution by finding innovative companies at the forefront of artificial intelligence and automation using AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion