- United States

- /

- IT

- /

- NYSE:EPAM

EPAM Systems (EPAM): Evaluating Valuation After a 35% Three-Month Share Price Rebound

Reviewed by Simply Wall St

EPAM Systems (EPAM) has quietly staged a sharp rebound, with the stock up around 17% over the past month and more than 35% in the past 3 months after a difficult year.

See our latest analysis for EPAM Systems.

That rebound comes after a tough stretch, with the 1 year total shareholder return still down in the mid teens. The recent 3 month share price momentum suggests sentiment is finally starting to thaw around EPAM at about $209.63 a share.

If EPAM’s turnaround has your attention, it could be a good time to see what other software and digital leaders are doing across high growth tech and AI stocks.

With shares still well below multi year highs, yet trading almost exactly at Wall Street’s target and only modestly under some intrinsic value estimates, is EPAM a genuine rebound bargain or is the market already pricing in its next leg of growth?

Most Popular Narrative: 0.8% Overvalued

Compared with EPAM Systems most recent close at $209.63, the most popular narrative places fair value only slightly lower, implying the market is almost perfectly aligned with its long term earnings power.

EPAM's strategic investments in AI native services, proprietary platforms (such as DIAL and AI/RUN), and upskilling of over 80% of its workforce have positioned it as a transformation partner for clients moving beyond pilot AI programs to large scale deployments, supporting sustainable revenue growth and the potential for improved net margins as EPAM moves up the value chain.

Curious how steady, mid teens earnings growth, rising margins, and a future earnings multiple below many IT peers can still justify today’s near perfect pricing? The full narrative reveals the exact revenue ramp, margin lift, and valuation multiple that have to line up almost flawlessly for this fair value to hold.

Result: Fair Value of $207.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts from generative AI tools and intensifying competition from hyperscalers could limit EPAM’s ability to win and grow high value transformation work.

Find out about the key risks to this EPAM Systems narrative.

Another View, DCF Points to Upside

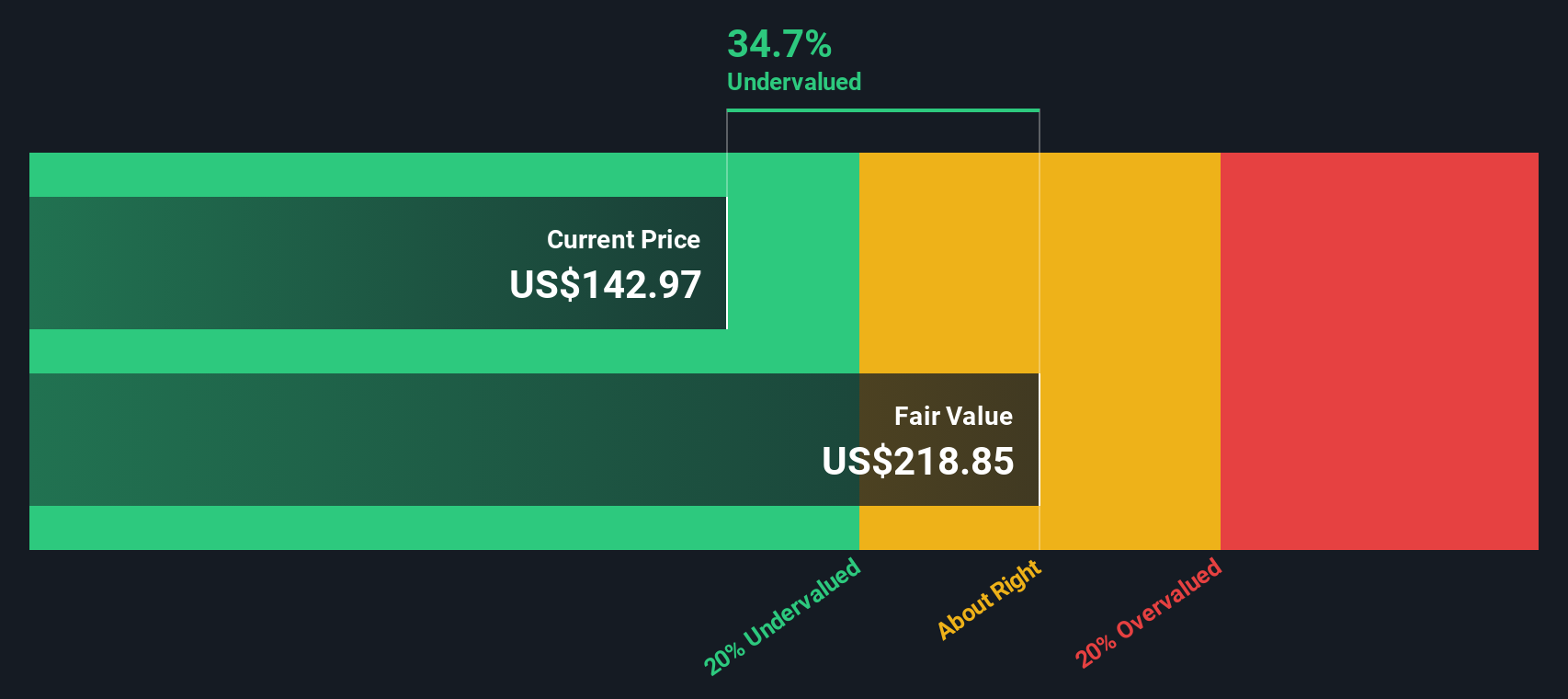

While the popular narrative says EPAM is about 0.8% overvalued, our DCF model tells a different story, putting fair value closer to $219.37, around 4.4% above today’s price. If cash flows are accurate, this may indicate that the market is underestimating the recovery.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EPAM Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EPAM Systems Narrative

If you see the story differently or simply want to test your own assumptions against the numbers, you can build a custom EPAM view in just a few minutes, Do it your way.

A great starting point for your EPAM Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before EPAM runs too far ahead, you may want to explore other opportunities on Simply Wall St where the data highlights your next potential idea.

- Consider companies with strong cash generation by reviewing these 908 undervalued stocks based on cash flows that may be trading at a discount to their estimated future cash flows before the broader market recognizes them.

- Explore structural growth themes by scanning these 26 AI penny stocks involved in automation, analytics, and intelligent software adoption worldwide.

- Review potential income opportunities by comparing these 13 dividend stocks with yields > 3% that offer a combination of yields and balance sheets that may support ongoing payments through different parts of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)