- United States

- /

- IT

- /

- NYSE:DXC

DXC Technology (NYSE:DXC): Evaluating Valuation After Landmark Iberdrola Cloud Transformation and New AI Partnerships

Reviewed by Simply Wall St

If you have been watching DXC Technology (NYSE:DXC), the recent headlines might prompt a closer look. The company just completed a transformative, multi-year partnership with Iberdrola, modernizing the Spanish energy giant's most critical systems by migrating them to the Azure cloud. At the same time, DXC announced new alliances with startups to advance AI solutions in automotive and manufacturing, highlighting the company’s expanding reach into high-growth sectors. These projects are not just technical wins; they give DXC real-world credibility as a digital transformation leader for clients with complex challenges.

There’s a wider story unfolding here, and it’s not only about high-profile partnerships. DXC stock has been volatile this year, and momentum has been hard to maintain. Shares are down almost 29% over the past year and more than 25% year-to-date, even as recent project announcements gave only brief price lifts. Ongoing revenue and profit headwinds have weighed on sentiment, but these new client wins and innovation efforts suggest management is actively steering the company toward more resilient, tech-forward growth engines.

With all eyes on DXC’s moves in automation and AI, is the market undervaluing the company’s future earning power, or are these transformation wins already reflected in the current share price?

Most Popular Narrative: 3.1% Undervalued

According to the most widely followed narrative, DXC Technology is seen as slightly undervalued versus fair value based on future growth and profitability assumptions. Analysts believe the stock price does not fully reflect the potential impact of the company's ongoing digital transformation initiatives and operational improvements.

"DXC's strong bookings momentum, with three consecutive quarters of double-digit growth and a sustained trailing 12-month book-to-bill ratio above 1.0, suggests improving deal flow linked to client demand for digital modernization. This trend may convert to organic revenue stabilization and growth over the next 12-18 months."

What is driving this subtle disconnect between DXC's current price and analyst targets? The answer lies in bold forecasts for earnings and margins, as well as a game-changing shift toward next-gen technology services. Are you curious about the crucial financial projections anchoring this outlook? The full narrative reveals the surprising calculations shaping DXC's fair value today.

Result: Fair Value of $15.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue declines and ongoing margin pressures could still challenge DXC's turnaround and reduce analyst optimism regarding its future growth potential.

Find out about the key risks to this DXC Technology narrative.Another View: Our DCF Model

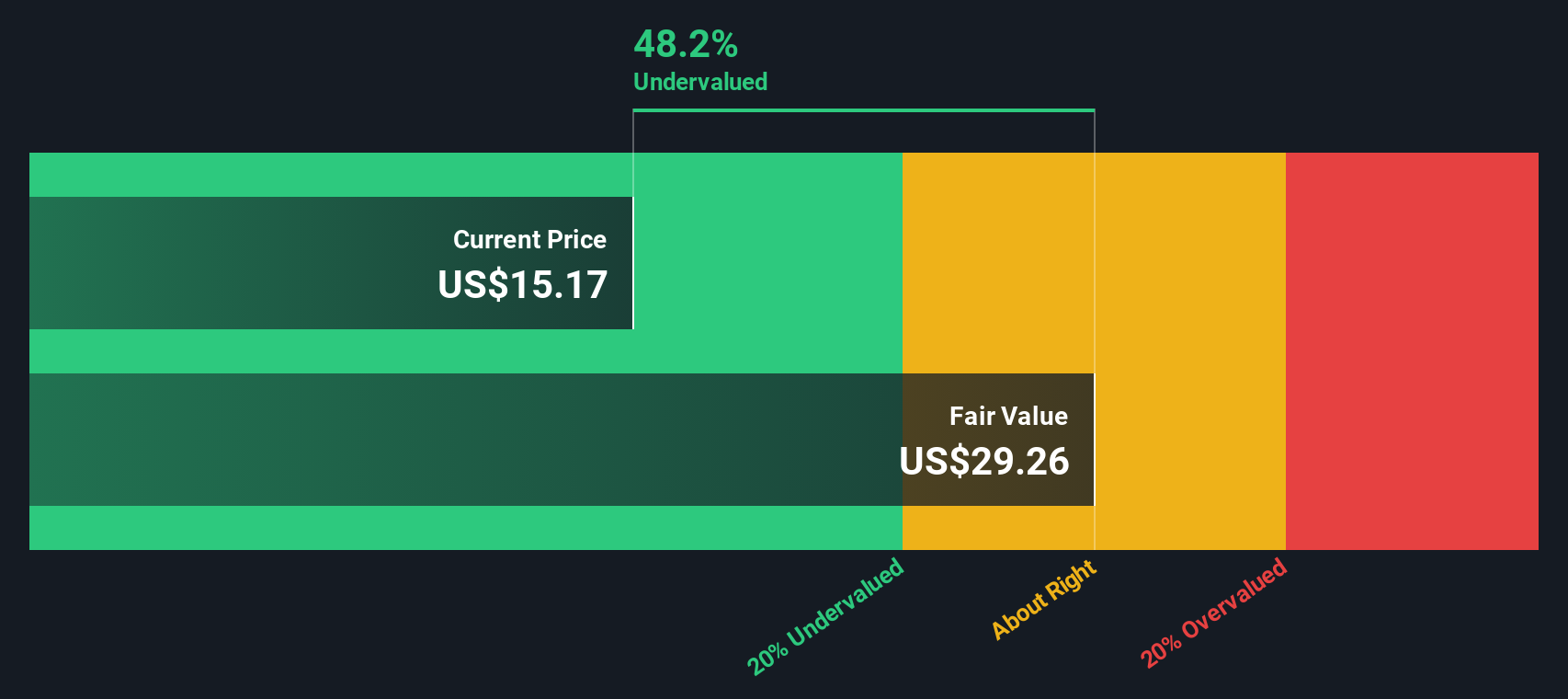

Looking from a different angle, the SWS DCF model paints a more bullish picture for DXC, suggesting much greater upside than what analysts forecast. Can this cash flow outlook be trusted, or is it too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DXC Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DXC Technology Narrative

If you see things differently, or want to dig into the data and assemble your own investment case, you can build a custom view in just a few minutes. Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

The right idea can make all the difference, so don’t let opportunities pass you by. Uncover your next prospect using these tailored strategies:

- Tap into high-potential companies at bargain prices when you browse undervalued stocks based on cash flows, handpicked for standout value based on future cash flows and growth.

- Secure powerful income streams for your portfolio by sorting through dividend stocks with yields > 3% offering robust yields exceeding 3%, ideal for anyone seeking steady returns.

- Accelerate your search for tomorrow’s tech champions with AI penny stocks, designed to spotlight visionary businesses reshaping the future with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the Rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)