- United States

- /

- Software

- /

- NYSE:DT

Evaluating Dynatrace (DT): How New AI Survey Insights Reshape the Company’s Valuation Story

Reviewed by Kshitija Bhandaru

Dynatrace (DT) just released results from a global survey showing that AI adoption is picking up speed, but reliability and trust issues still challenge businesses looking to scale. Investors are watching how Dynatrace's observability and security offerings fit into this evolving landscape.

See our latest analysis for Dynatrace.

Following the survey announcement, Dynatrace’s share price has cooled this year, slipping 11.8% since January, with a one-year total shareholder return of -13%. Despite the recent dip, the stock’s three-year total return of 47% shows that long-term momentum remains intact.

If you’re scanning for other standout tech and AI companies with growth stories of their own, our curated screener lets you See the full list for free.

With shares now trading at a sizable discount to analyst targets and long-term returns well above peers, the real question is whether Dynatrace’s current price marks a compelling entry point or if the market has already accounted for its future growth.

Most Popular Narrative: 24% Undervalued

With Dynatrace closing at $47.96 and the most popular narrative setting fair value at $63.09, the valuation gap is sparking investor interest. The stage is set for major growth, given the magnitude of the discount and evolving analyst forecasts.

Dynatrace is well positioned to capture incremental share of the expanding addressable market created by enterprises accelerating digital transformation and cloud modernization initiatives, as evidenced by multi-million dollar, end-to-end observability deals and a pipeline heavily weighted toward large, strategic consolidations. This is catalyzing sustained revenue growth and increased average ARR per customer over time.

Want to understand exactly how Dynatrace could become the next tech market darling? There’s a twist: everything comes down to a powerful blend of recurring revenue, platform expansion, and some surprisingly bold growth targets built into this consensus. Find out what those bullish assumptions are, and why they could move the needle for investors who dig deeper into the numbers.

Result: Fair Value of $63.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and reliance on large, strategic deals could disrupt projections and make it challenging for Dynatrace to sustain its growth narrative.

Find out about the key risks to this Dynatrace narrative.

Another View: Multiples Tell a Different Story

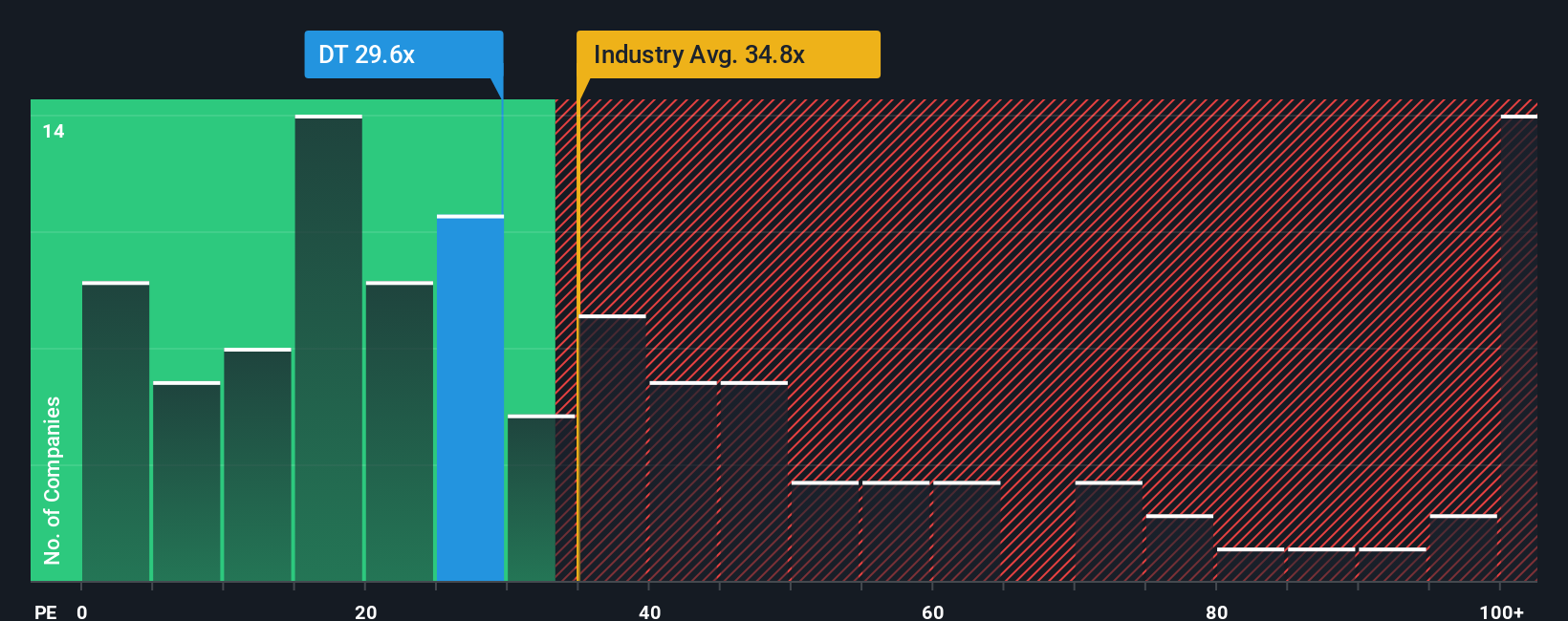

Looking at valuation using the price-to-earnings ratio, Dynatrace trades at 29.3x. This is lower than the US Software industry average of 34.8x and well below peer averages of 65.4x. However, it still sits above its estimated fair ratio of 27.8x, meaning investors see potential, though some premium is included. Does this suggest more room to fall, or is the market just ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dynatrace Narrative

If you have a different perspective or want to dive into the numbers on your own terms, it only takes a few minutes to build your custom view. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dynatrace.

Looking for More Investment Ideas?

Smart investing means always scanning for fresh opportunities. If you want to stay ahead and supercharge your portfolio, check out these powerful ways to target tomorrow's winners:

- Spot cash flow bargains by checking out these 898 undervalued stocks based on cash flows for stocks priced below their true value, before the rest of the market notices.

- Supercharge your strategy with dividend power by browsing these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Embrace innovation with these 26 quantum computing stocks at the leading edge of computing, tackling challenges that could transform entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives