- United States

- /

- Software

- /

- NYSE:DT

Dynatrace (DT): Examining Valuation After Wells Fargo Initiation and New AI Partnerships

Reviewed by Kshitija Bhandaru

Dynatrace (DT) is drawing attention after Wells Fargo initiated coverage with a positive outlook, citing the company's momentum in artificial intelligence adoption. Recent milestones, including AWS Generative AI competency and a partnership with Crest Data, reinforce Dynatrace’s position in enterprise observability.

See our latest analysis for Dynatrace.

While the latest share price has been relatively steady at $49.88, Dynatrace’s momentum is building with recent breakthroughs in AI partnerships and recognition driving greater attention to its growth story. The company’s three-year total shareholder return of 32% showcases its strong long-term performance despite short-term fluctuations.

If you’re watching how AI adoption is reshaping software, it might be the perfect moment to explore other standout tech opportunities with our curated See the full list for free..

With the stock holding steady and Wall Street targeting significantly higher prices, the question remains: is Dynatrace trading at a discount that offers compelling upside, or is the market already pricing in its future growth prospects?

Most Popular Narrative: 20.9% Undervalued

The most widely followed narrative sets Dynatrace’s fair value much higher than its recent closing price, implying significant upside potential if the estimates hold. The following perspective highlights what is energizing this narrative’s valuation.

The company's unified platform approach, particularly the growing success of Grail-powered log management (over 100% YoY log consumption growth and targeting $100M in annualized consumption), is driving multi-product adoption and higher customer stickiness. This should improve net retention rates, recurring revenue, and long-term earnings predictability.

Want to know what powers that eye-catching number? The fair value here relies on an ambitious recipe of revenue acceleration, margin shifts, and a bold future profit multiple. This narrative is driven by bets on strong retention and a major log management push. What are the exact figures behind such a bullish target? Only a deeper dive will reveal the full set of assumptions fueling this valuation.

Result: Fair Value of $63.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in AI observability and longer sales cycles remain key risks that could challenge the bullish valuation narrative for Dynatrace.

Find out about the key risks to this Dynatrace narrative.

Another View: Checking Against Peers and the Market

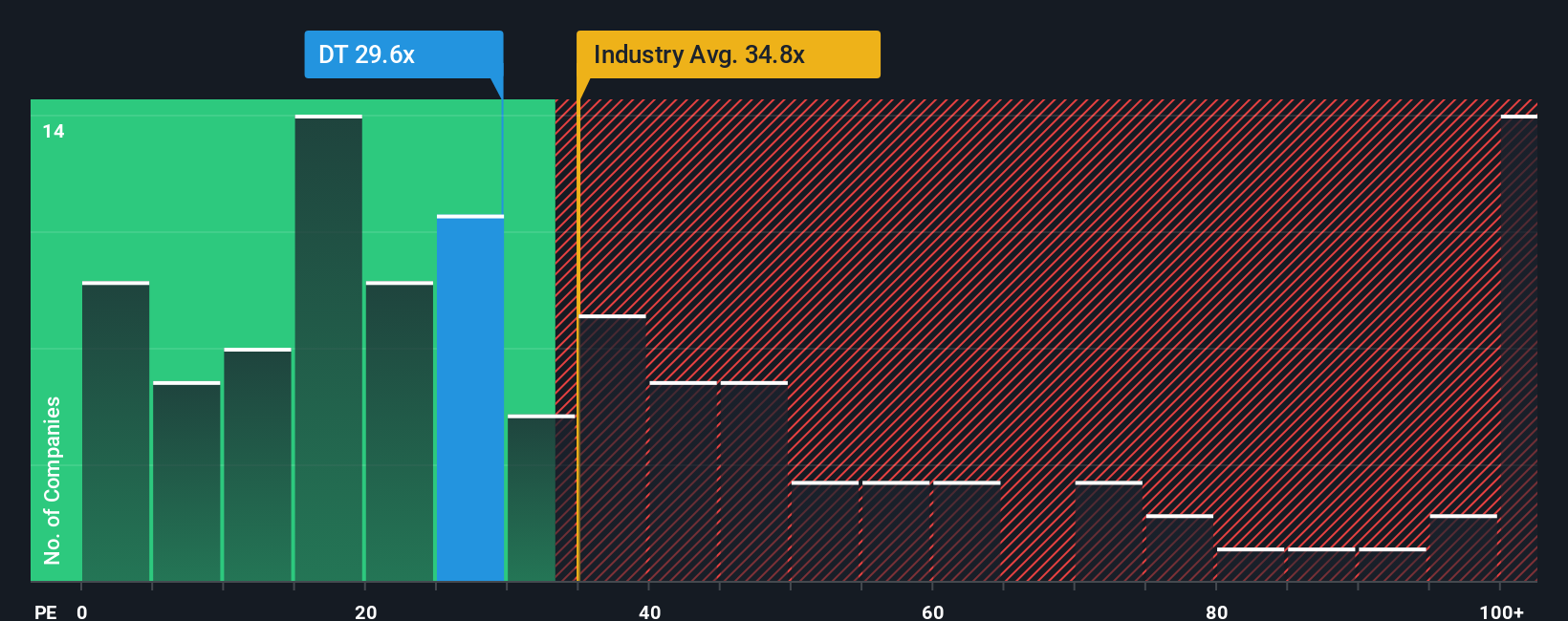

Taking a step back from fair value estimates and looking at how Dynatrace trades compared to its US Software industry peers, the numbers land in interesting territory. Its price-to-earnings ratio sits at 30.5x, much lower than the peer average of 70.7x, and also under the sector’s 35.6x. However, this number is above the so-called fair ratio of 27.7x, which suggests the share price could face pressure if market expectations cool off.

So, is Dynatrace truly offering a value play or could it be vulnerable if investors push for “fairer” multiples? The real judgment may lie in which comparison you trust most.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dynatrace Narrative

If you’d rather dig into the details or try your own approach, you can craft a personal perspective from scratch in just a few minutes with our Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dynatrace.

Looking for more investment ideas?

Cut through the noise and stay ahead of the crowd, so you never miss a breakthrough stock with strong fundamentals and future potential.

- Capture emerging artificial intelligence winners by checking out these 24 AI penny stocks, which are reshaping industries and driving rapid innovation.

- Add reliable income to your portfolio when you scan these 19 dividend stocks with yields > 3%, offering yields above 3% even in changing markets.

- Harness market shifts and find untapped value by targeting these 910 undervalued stocks based on cash flows for compelling growth potential based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives