- United States

- /

- IT

- /

- NYSE:DAVA

Evaluating Endava (NYSE:DAVA): Is the Latest Stock Plunge a Sign of Real Undervaluation?

Reviewed by Simply Wall St

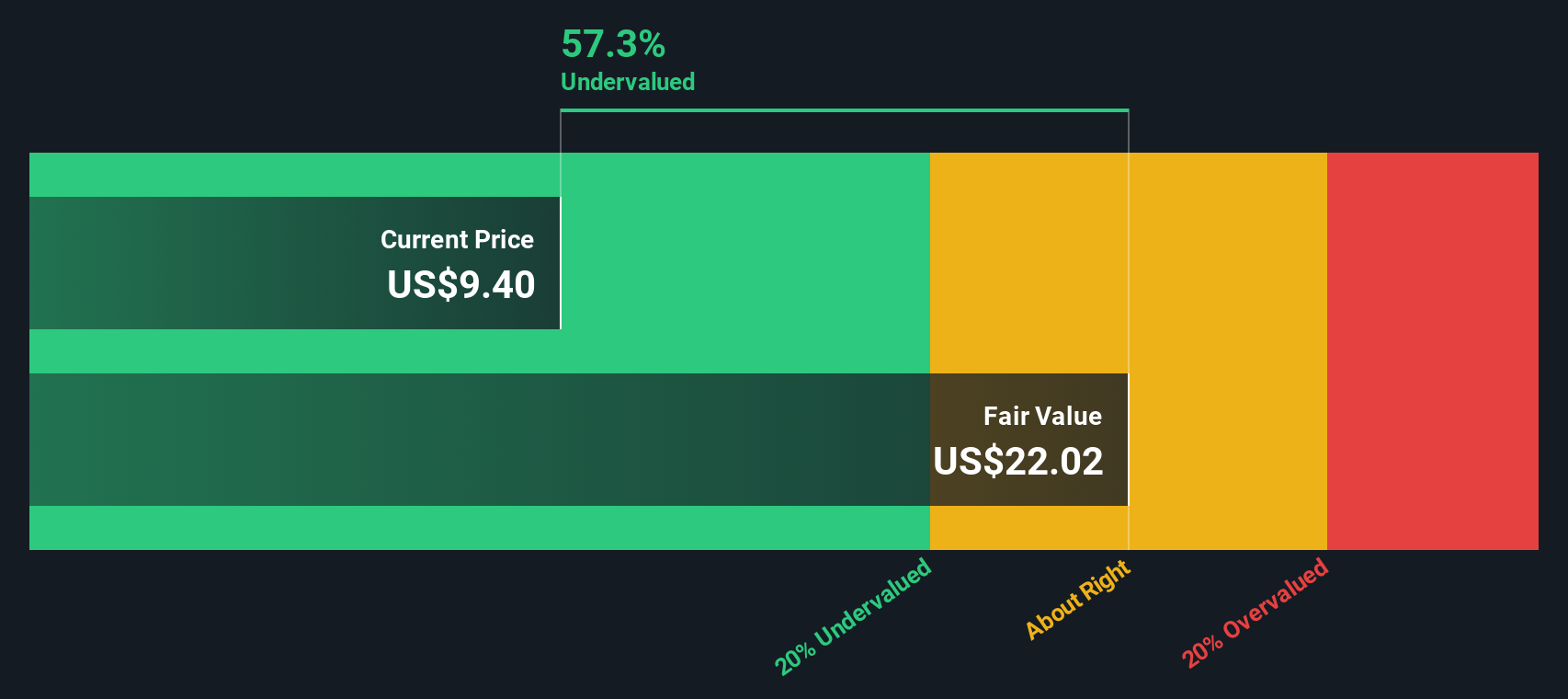

If you own stock in Endava (NYSE:DAVA) or are debating a buy, the last few days have probably gotten your attention. The company posted fourth quarter results that cleared the earnings bar, but its leadership signaled caution ahead, forecasting softer revenues for both the current quarter and the full 2026 fiscal year. In addition, management pointed to challenging macroeconomic conditions and client hesitation on project spending, highlighting that the short-term outlook remains turbulent even as Endava delivered a record order book.

This blend of good and bad news has not gone unnoticed. Endava shares plummeted 31% after the results and guidance were released. The drop extends a much tougher run for the stock, which has lost two-thirds of its value over the past year and nearly 90% from its highs multiple years ago. Other recent moves, such as a sizeable share buyback completed last quarter, have not yet restored investor confidence amid ongoing uncertainty about the recovery timeline for spending in its key markets.

With all these moving parts, the big question is whether the market is now underestimating Endava's future potential or if ongoing risks are being fully priced in at these levels. Is this a buying opportunity, or is caution still warranted?

Most Popular Narrative: 46% Undervalued

According to the most widely followed narrative, Endava is trading at a significant discount to its fair value. This perspective is built on expectations of future growth and business transformation initiatives.

Endava's focus on AI-enabled capabilities, such as Morpheus and Compass, positions it to leverage the digital shift, potentially expanding its addressable market and driving future revenue growth through AI-driven services. The company's strategy of securing larger and longer-term deals, particularly in core modernization projects, is expected to contribute to meaningful revenue growth and stability in earnings, despite longer sales cycles.

Ever wondered what’s driving such a deep valuation gap? The narrative hinges on bold growth projections and a sharp move toward margin-rich, high-value work. Could underlying financial assumptions and sector-defining strategies justify such a steep upside? Uncover the financial story behind this standout undervaluation and see how the pieces fit together to shape that fair value number.

Result: Fair Value of $18.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent client hesitation and unpredictable sales cycles could dampen Endava's near-term growth, which may challenge even the most optimistic valuation assumptions.

Find out about the key risks to this Endava narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, the SWS DCF model also points toward Endava being undervalued. By looking at long-term cash flows and discounting them back to today, this method backs up the earlier fair value call. However, does it capture all the uncertainties in play, or could the picture shift as forecasts change?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Endava for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Endava Narrative

If you want to look through the numbers yourself or challenge the story so far, you're free to build your own perspective in just a few minutes with Do it your way.

A great starting point for your Endava research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities are often missed by waiting on the sidelines, so make your next smart move. The Simply Wall Street Screener is your shortcut to finding exceptional stocks that align with your strategy. Don’t let the next big winner slip by.

- Grow your wealth with strong yields. Jump into a curated list of dividend stocks with yields > 3% and spot reliable income generators.

- Get ahead of the tech curve by finding AI penny stocks shaping tomorrow’s breakthroughs in artificial intelligence.

- Capitalize on market mispricing by targeting undervalued stocks based on cash flows poised for their next step up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Endava might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:DAVA

Endava

Provides technology services in North America, Europe, the United Kingdom, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)