- United States

- /

- Software

- /

- NYSE:CXM

Sprinklr (CXM): Valuation Update Following Strong Earnings, Guidance Raise, and Leadership Changes

Reviewed by Simply Wall St

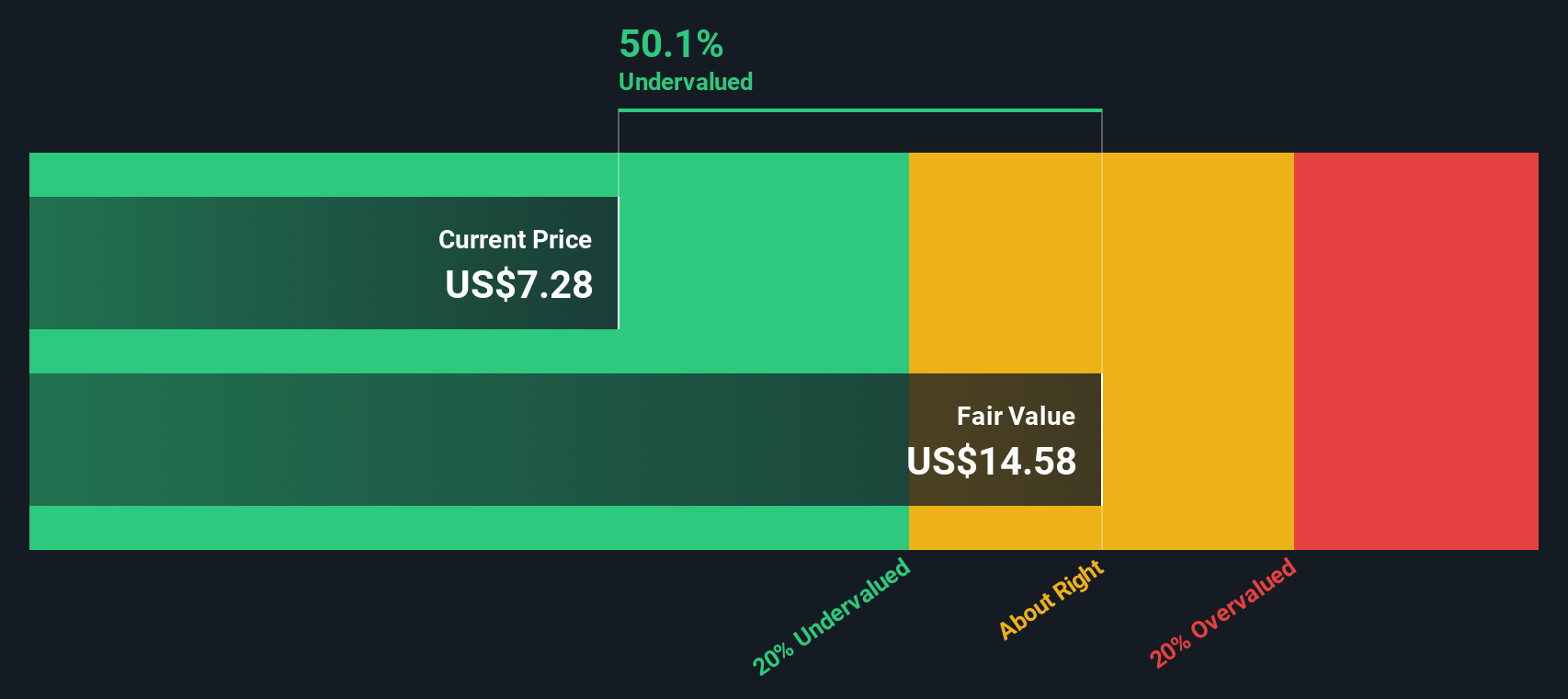

Sprinklr (CXM) just wrapped up a busy week, announcing quarterly earnings that topped Wall Street’s revenue expectations and nudging its full-year guidance even higher. Investors are also digesting a series of leadership moves including the arrival of Scott Millard, a seasoned tech executive, as Chief Revenue Officer, and news of a planned CFO transition later this month. Combined, these updates signal that Sprinklr is not only keeping pace with growth targets but also making strategic bets on leadership to drive future expansion.

All this comes as the stock delivered a 1% gain on the day of the earnings release, even as the past quarter showed a sliding trend. For context, shares are up nearly 6% over the past year but down 10% in the last 3 months and sitting about 7% lower year-to-date. The current momentum appears mixed, with some long-term recovery, yet not much follow-through in recent months, even as revenue climbed and profit guidance ticked upward. The string of operational updates, including new faces at the executive table, seem to have steadied short-term sentiment, at least for now.

With all this change, including strong results, fresh leadership, and shifting guidance, do these moves hint at an undervalued opportunity for investors, or is the market already factoring in Sprinklr’s next leg of growth?

Most Popular Narrative: 25% Undervalued

According to the most followed narrative, Sprinklr is trading well below its fair value. Analyst optimism remains regarding future potential, despite a challenging outlook for profits.

Sprinklr's accelerated integration and deployment of advanced AI functionality across its Marketing, Insights, and CCaaS products is enabling customers to harness actionable insights from complex, unstructured data. This directly benefits from the broader enterprise demand for AI-powered analytics and automation. These trends support higher platform adoption and customer expansion, ultimately improving both revenue growth and net margins over time.

Curious why the market is still bullish even with declining profit forecasts? There is a key ingredient that powers this valuation—it is not just AI buzz. See which core financial levers analysts are focusing on to unlock value, even as profit pressures increase. Be prepared to examine the numbers behind the headline growth story.

Result: Fair Value of $10.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing customer churn and rising AI-related costs could quickly undermine the bullish outlook if these challenges are not managed effectively.

Find out about the key risks to this Sprinklr narrative.Another View: Do the Numbers Back Up the Optimism?

While the fair value estimate signals upside, our DCF model takes a deeper dive into future cash flows and also points to undervaluation. The question remains: does this independent view bolster the analysts' case, or challenge it?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sprinklr Narrative

If you see things differently, or want to dig deeper into Sprinklr’s numbers, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself up for success by checking out different companies that might be the next big thing. Miss these, and you could skip tomorrow’s most exciting trends.

- Uncover undervalued gems positioned for upside by using undervalued stocks based on cash flows to filter for stocks with strong cash-flow potential and overlooked growth stories.

- Target high-yield options by tapping into dividend stocks with yields > 3% to see which companies are delivering reliable income and strong financial health with yields above 3%.

- Get ahead of the curve in quantum tech by exploring quantum computing stocks for exciting businesses advancing next-generation computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CXM

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)