- United States

- /

- Software

- /

- NYSE:CXM

Should Sprinklr’s (CXM) New CFO Appointment Spark a Rethink of Its Growth and Profitability Roadmap?

Reviewed by Sasha Jovanovic

- On October 7, 2025, Sprinklr announced the appointment of Anthony Coletta, previously an executive at SAP, as its new Chief Financial Officer, reporting to CEO Rory Read.

- Coletta's extensive global finance experience across technology giants is expected to add operational discipline and sharpen Sprinklr’s focus on financial oversight during a period of industry change.

- We'll explore how the addition of a seasoned CFO could shape the outlook for Sprinklr’s growth and profitability initiatives.

Find companies with promising cash flow potential yet trading below their fair value.

Sprinklr Investment Narrative Recap

For shareholders, the core belief in Sprinklr centers on its ability to drive recurring growth through AI-powered customer experience solutions and stable enterprise relationships. The appointment of Anthony Coletta as CFO may bolster investor confidence in operational discipline, but it does not directly change the most important near-term catalyst: successfully expanding AI platform adoption across top customers. The largest risk remains heightened customer churn or downsell pressure among key enterprise accounts, a factor largely independent of management shifts.

Of the recent announcements, Sprinklr’s launch of advanced AI products like Copilot and AI Agents most closely aligns with current catalysts. These solutions are tailored to deepen adoption within existing accounts and appeal to enterprises seeking unified, AI-enabled platforms, making product execution a focal point for near-term performance even as leadership changes unfold.

On the flipside, investors should be mindful that continued reliance on a concentrated base of top customers could mean revenue is sensitive to shifts in just a few large accounts…

Read the full narrative on Sprinklr (it's free!)

Sprinklr's outlook anticipates $1.0 billion in revenue and $36.8 million in earnings by 2028. This scenario assumes an 8.0% annual revenue growth but a sharp decrease in earnings, down $83.4 million from current earnings of $120.2 million.

Uncover how Sprinklr's forecasts yield a $10.44 fair value, a 39% upside to its current price.

Exploring Other Perspectives

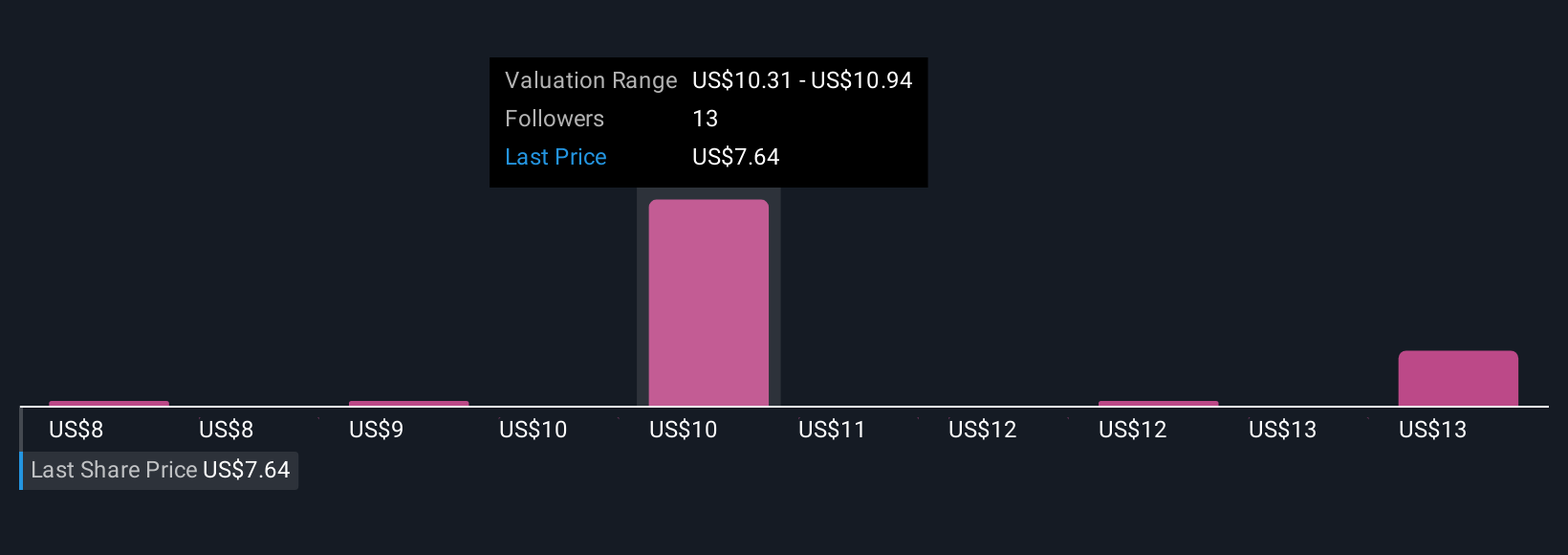

Five members of the Simply Wall St Community put Sprinklr’s fair value at US$7.79 to US$14.12 per share. While future AI expansion creates revenue opportunities, concentrated customer risks mean market opinion is far from settled.

Explore 5 other fair value estimates on Sprinklr - why the stock might be worth as much as 88% more than the current price!

Build Your Own Sprinklr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sprinklr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprinklr's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXM

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives