- United States

- /

- Software

- /

- NYSE:CXM

How Investors May Respond To Sprinklr (CXM) Q3 Beat And New 2026 Revenue Guidance

Reviewed by Sasha Jovanovic

- In early December 2025, Sprinklr reported third-quarter revenue of US$219.07 million and net income of US$2.9 million, alongside new fourth-quarter and full-year 2026 revenue guidance of US$216.5–217.5 million and US$853–854 million, respectively.

- Award recognition from ADWEEK and L’Oréal’s large-scale use of Sprinklr Advocacy, which generated very large organic impressions and a 4x return on investment, underline how major brands are using Sprinklr’s AI-native platform to run social media, customer experience, and employee advocacy at global scale.

- We’ll now explore how stronger-than-expected Q3 execution, including L’Oréal’s employee advocacy success, may influence Sprinklr’s existing investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Sprinklr Investment Narrative Recap

To own Sprinklr, you need to believe its AI-native, unified customer experience platform can deepen relationships with large global brands faster than churn, pricing pressure, and competition erode that progress. The stronger than expected Q3 revenue and reaffirmed guidance help the near term execution story, but softer profitability and ongoing transformation efforts keep customer retention and margin pressure as the key watchpoints for now, rather than materially changing the main catalyst or risk.

The most relevant update here is Sprinklr’s Q3 earnings, where revenue of US$219.07 million and net income of US$2.9 million came in ahead of market expectations while management emphasized Project Bearhug and improving renewal rates. When you pair that with L’Oréal’s 33 million organic impressions and 4x return from Sprinklr Advocacy, it highlights how stronger large account execution could support the core catalyst of deeper enterprise adoption and expansion.

But even with these positives, investors should be aware that rising AI related cloud and data costs could still...

Read the full narrative on Sprinklr (it's free!)

Sprinklr's narrative projects $1.0 billion revenue and $36.8 million earnings by 2028. This requires 8.0% yearly revenue growth but implies an earnings decrease of $83.4 million from $120.2 million today.

Uncover how Sprinklr's forecasts yield a $11.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

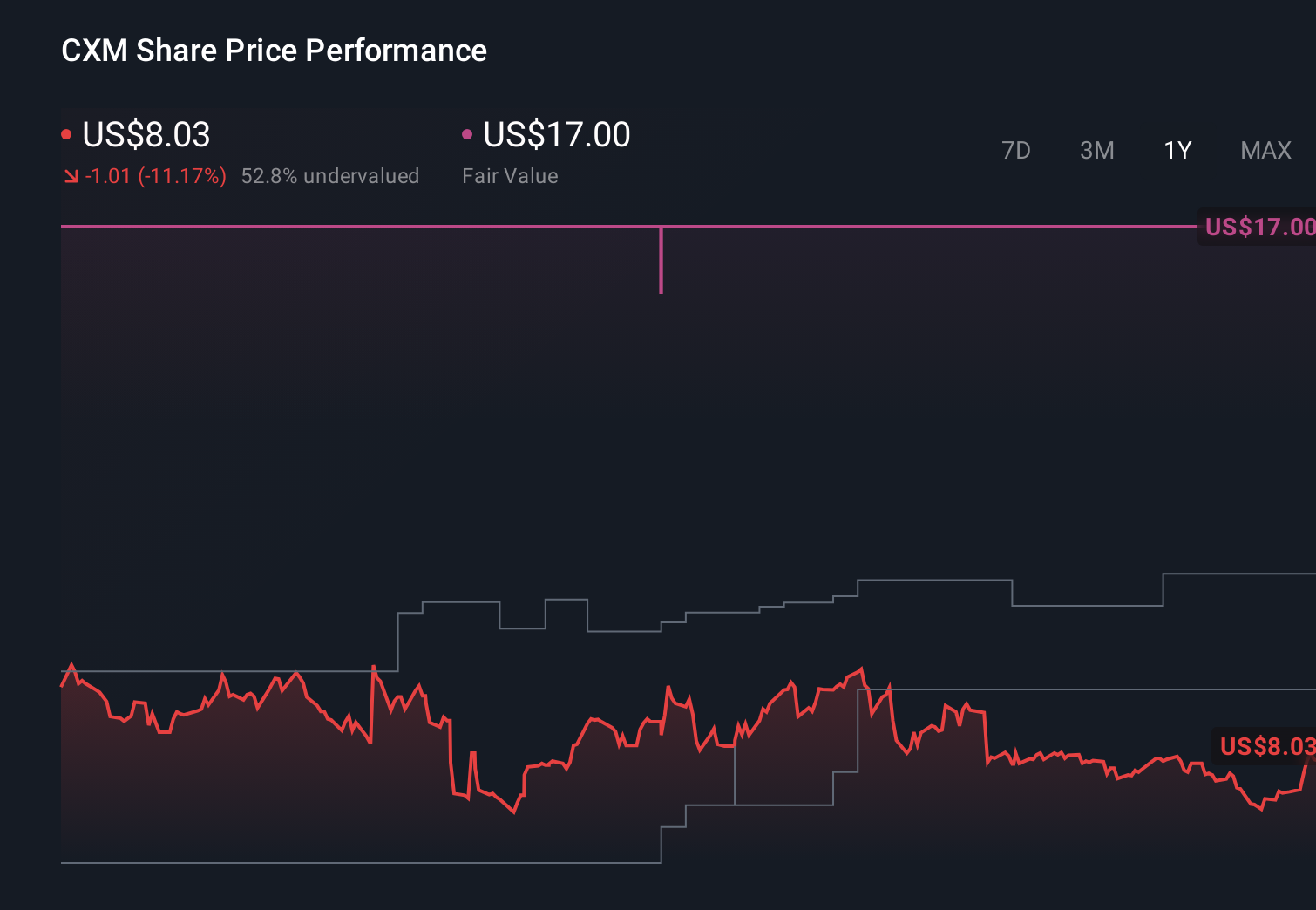

Four members of the Simply Wall St Community currently see Sprinklr’s fair value between US$7.79 and US$12.20, reflecting quite different expectations. Set against this, the recent Q3 beat and renewed focus on stabilizing renewals highlight how much future performance may hinge on improving enterprise retention and monetizing its AI capabilities, so it is worth weighing several viewpoints before forming a view.

Explore 4 other fair value estimates on Sprinklr - why the stock might be worth as much as 52% more than the current price!

Build Your Own Sprinklr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sprinklr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprinklr's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXM

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026