- United States

- /

- Software

- /

- NYSE:CXM

A Look at Sprinklr’s Valuation Following CFO Appointment and Launch of New AI Solutions

Reviewed by Kshitija Bhandaru

Sprinklr (NYSE:CXM) has named Anthony Coletta as its new Chief Financial Officer, a move that puts renewed focus on financial discipline and operational execution. Coletta’s appointment comes as the company advances its strategy with new AI-powered solutions.

See our latest analysis for Sprinklr.

After a period of steady growth, Sprinklr’s 1-year total shareholder return stands at 3.2%, reflecting modest gains even as its share price has pulled back about 12% so far this year. Recent volatility follows both new AI product launches and the CFO transition, which are key moves that could set the stage for renewed momentum if investor confidence in the company’s transformation builds from here.

If the latest leadership changes and tech upgrades spark your curiosity, now’s a timely opportunity to discover fast growing stocks with high insider ownership.

With shares now trading well below analyst targets and fresh leadership at the helm, investors are left to weigh whether the market is overlooking Sprinklr’s long-term potential or has already priced in future growth prospects.

Most Popular Narrative: 28.6% Undervalued

With the most followed narrative assigning a fair value of $10.44, Sprinklr’s last close at $7.46 implies notable upside in the eyes of analysts. This valuation setup signals a sharp disconnect between current sentiment and what is embedded in consensus forecasts, inviting a closer look at what is driving the bullish case.

Sprinklr's accelerated integration and deployment of advanced AI functionality across its Marketing, Insights, and CCaaS products is enabling customers to harness actionable insights from complex, unstructured data. Customers directly benefit from the broader enterprise demand for AI-powered analytics and automation, which supports higher platform adoption, customer expansion, and ultimately improves both revenue growth and net margins over time.

Want to know the bold assumptions behind this price target? The valuation rests heavily on future profitability and sales fueled by AI adoption, but one pivotal financial forecast could change everything. Unpack what is factored in and what could unseat this view by reading the full analysis.

Result: Fair Value of $10.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer churn or shrinking margins from rising AI costs could quickly challenge the current bullish outlook and potentially disrupt Sprinklr’s growth plans.

Find out about the key risks to this Sprinklr narrative.

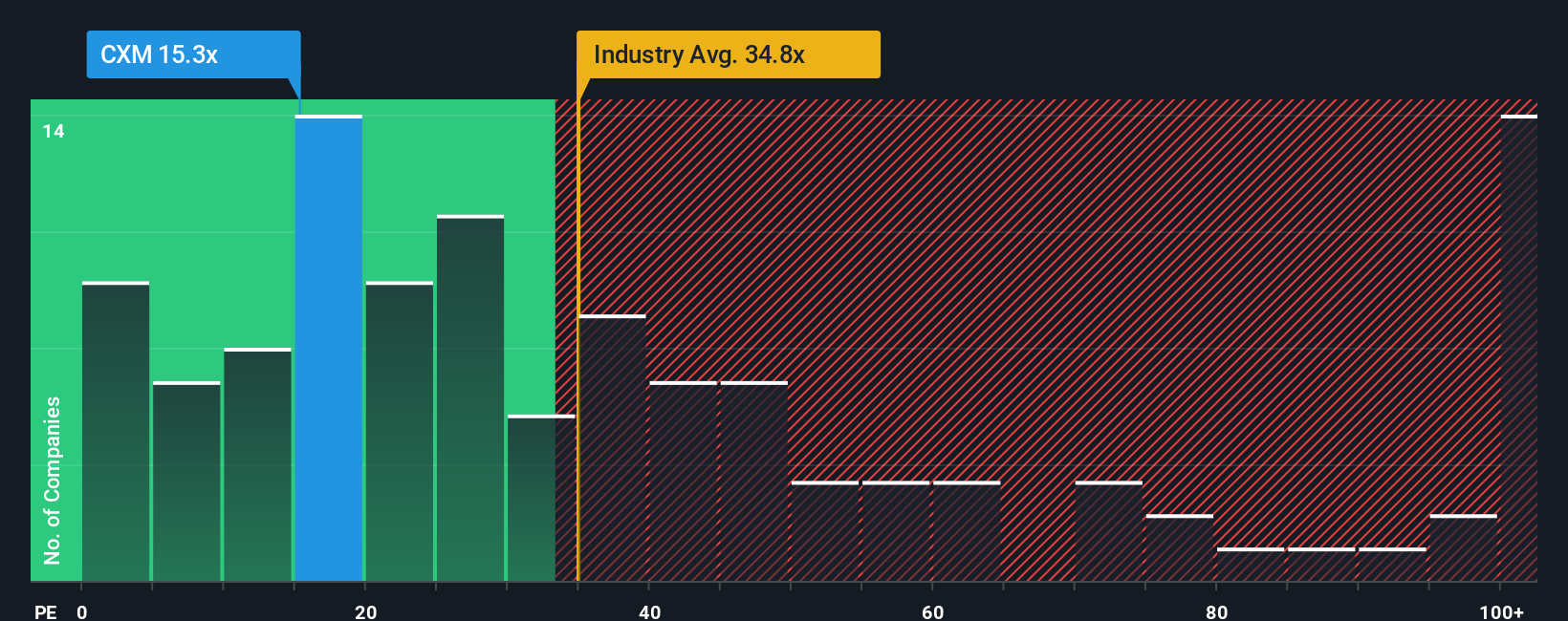

Another View: Multiples-Based Valuation

Looking beyond analyst targets, the market is pricing Sprinklr at 15.2 times earnings. This figure is much lower than both the industry average of 35.8 and its peer group average of 100.1. However, its fair ratio is estimated at just 11.4. Is the market underestimating risk or overlooking a real opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sprinklr Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by checking out the latest trends and hidden gems. Don’t let opportunity pass you by when the market’s next winner could be one click away.

- Uncover high-yield opportunities by jumping into these 19 dividend stocks with yields > 3% for stocks boasting yields above 3% and robust fundamentals.

- Ride the tech transformation as you scan these 24 AI penny stocks powering tomorrow's breakthroughs in artificial intelligence and automation.

- Supercharge your research with these 3581 penny stocks with strong financials featuring emerging companies with strong financials and explosive growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXM

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives