- United States

- /

- Software

- /

- NYSE:CRM

Here is why salesforce.com's (NYSE:CRM) 16% Estimated Annual Revenue Growth Might not be Enough for Investors

Salesforce.com, inc. (NYSE:CRM) shareholders may have mixed feelings since the stock is up 12% in the last three months. The last financial results, released on the 27th August, outline a trailing twelve-month revenue of US$23.5b. The company has high and steady estimated revenue growth of about 16.4% annually. However, the recent stagnation in stock performance, prompts us to take a deeper dive and see what is behind it.

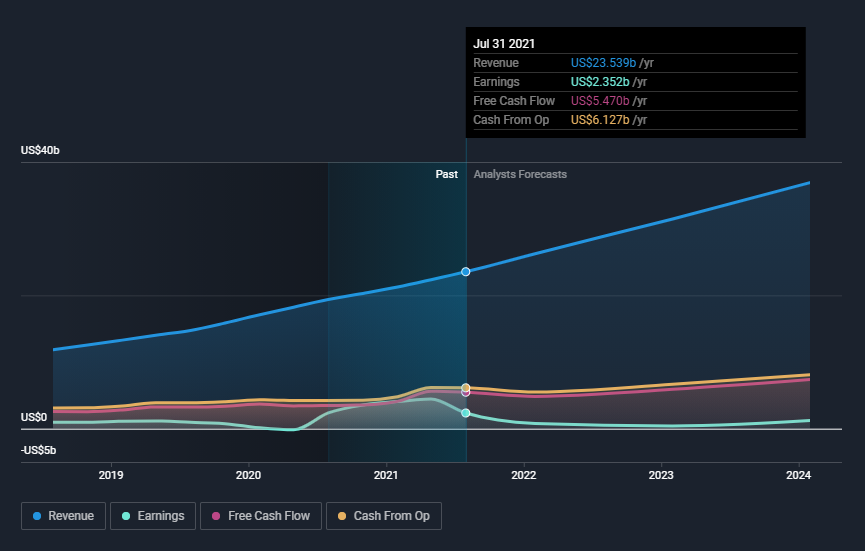

We will start by analyzing the fundamental performance and analyst estimates, which will give us a clearer picture of the current status. In the chart below, we have gathered the yearly financial performance, including the recently announced Q2 report:

You can catch up on the most recent data by reading our company report.

We can see that the company has less net income than free cash flows - this suggests that the company is fueling growth with what is left of the free cash flows.

This is important for a growing company, because it needs to continuously invest in its business in order to reach more of its potential market and stay competitive against large players like Oracle (NYSE:ORCL) and SAP (XTRA:SAP).

After the growth phase ends, and a company like Salesforce starts maturing, we can expect to see profits converge with free cash flows and get a better sense of the money-making capacity of the business.

Let's look into the current earnings performance of the company and see what investors are paying for.

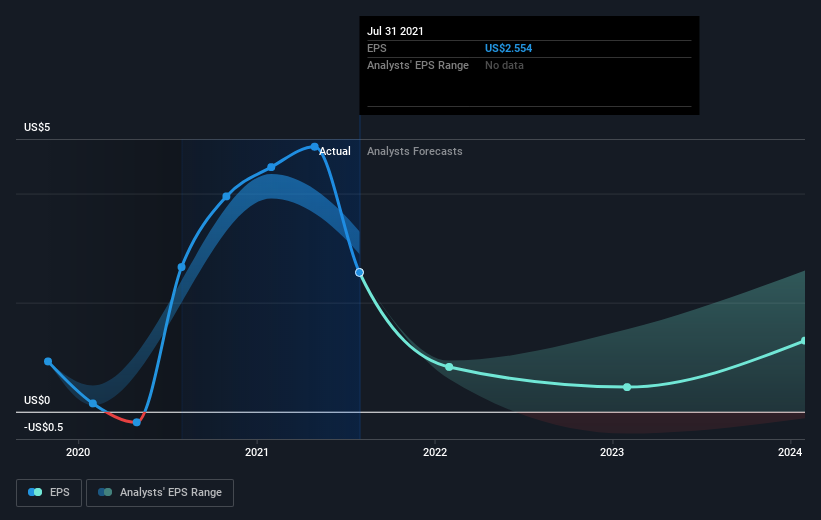

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, salesforce.com achieved compound earnings per share (EPS) growth of 51% per year.

This EPS growth is higher than the 29% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

See our latest analysis for salesforce.com

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It looks like investors are expecting a slump in EPS, and are cautious on Salesforce. While EPS is expected to jump up in 2024, the market prefers cashflows today as opposed to cash flows in the future, so we can see why there might not be high enthusiasm for the company.

It might be well worthwhile taking a look at our free report on salesforce.com's earnings, revenue and cash flow.

A Different Perspective

salesforce.com shareholders are down 1.7% for the year, but the market itself is up 31%. Even the share prices of good stocks sometimes drop, but we want to see improvements in the fundamental metrics of a business, before getting too interested.

Salesforce is experiencing high top line growth, but this comes at the expense of margins, and investors can see beyond the surface of high revenue growth rates. The company's bottom line needs to keep up with revenues, otherwise high volatility may continue.

Considering risk factors before investing is always important. For instance, we've identified 2 warning signs for salesforce.com that you should be aware of.

But note: salesforce.com may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:CRM

Salesforce

Provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives