- United States

- /

- IT

- /

- NYSE:CINT

Can CI&T's (CINT) New EMEA AI Leadership Shift Competitive Dynamics in Digital Transformation?

Reviewed by Sasha Jovanovic

- In October 2025, CI&T bolstered its EMEA leadership by appointing Melissa Smith Machado as Chief Strategy Officer and Alex Cross as Chief Technology Officer, aiming to accelerate time-to-value for clients and enhance the firm’s regional technology and operational expertise.

- This senior leadership expansion highlights CI&T’s intent to deepen its digital and AI capabilities in EMEA, positioning the company to better capture business transformation opportunities across the region.

- We’ll examine how the addition of AI and digital transformation expertise to CI&T’s EMEA team could shape the company’s investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CI&T Investment Narrative Recap

The case for CI&T centers on the belief that rapid enterprise adoption of AI and digital modernization will sustain strong demand for the company’s technology and consulting services. While the October 2025 appointments of Melissa Smith Machado and Alex Cross in EMEA bolster management depth and local AI expertise, this move alone does not materially alter CI&T’s biggest near-term catalyst: deepening client partnerships and expanding high-value project pipelines. However, client concentration risk remains a key concern if major accounts shift AI work in-house.

Among recent announcements, CI&T’s inclusion as one of 19 global partners in the AWS Generative AI Partner Innovation Alliance stands out. This affiliation further aligns with CI&T’s focus on embedding advanced AI capabilities in client solutions, echoing the themes behind the leadership changes in EMEA and reinforcing ongoing efforts to capture larger, multi-phase digital transformation opportunities.

By contrast, investors should remain aware that a heavy reliance on a small number of clients means CI&T’s revenue stability could shift if...

Read the full narrative on CI&T (it's free!)

CI&T's outlook projects $659.8 million in revenue and $73.0 million in earnings by 2028. This is based on an expected annual revenue growth rate of 13.4% and a $40.2 million increase in earnings from the current $32.8 million.

Uncover how CI&T's forecasts yield a $7.83 fair value, a 88% upside to its current price.

Exploring Other Perspectives

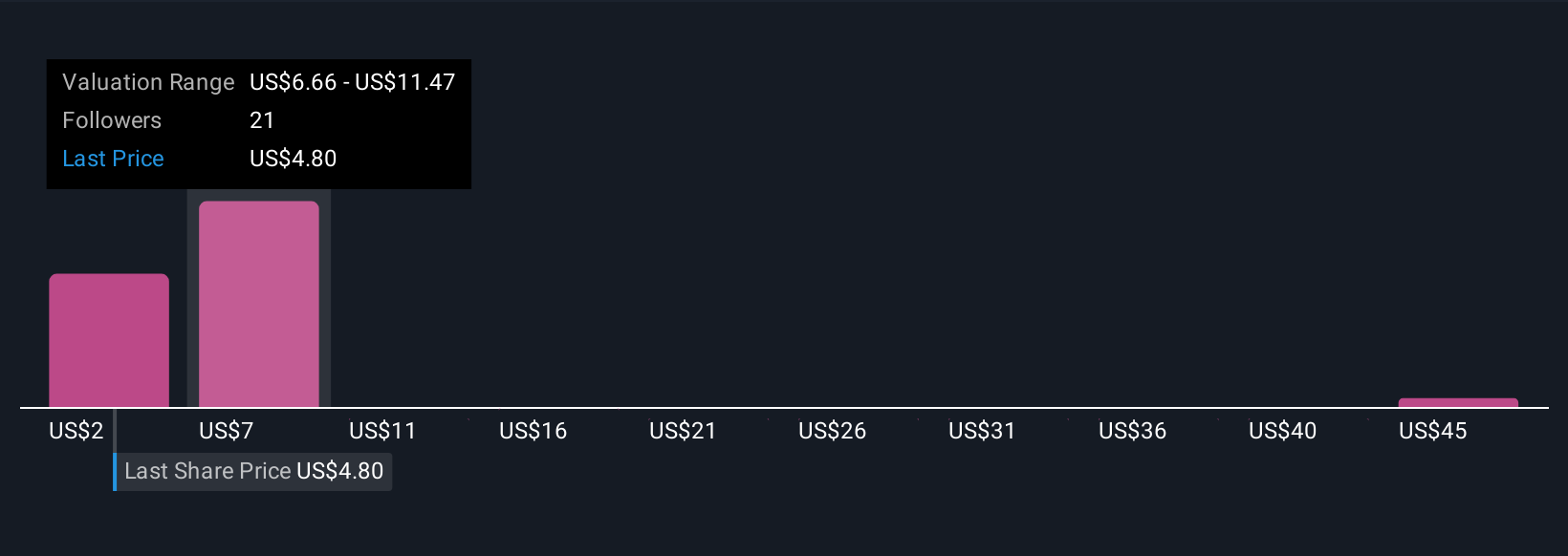

Eleven fair value estimates from the Simply Wall St Community span a wide range, from as low as US$1.84 to as high as US$50. As many expect demand for AI-enabled solutions to drive growth, investors should consider the risk of clients internalizing these functions and its impact on future revenue streams.

Explore 11 other fair value estimates on CI&T - why the stock might be a potential multi-bagger!

Build Your Own CI&T Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CI&T research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free CI&T research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CI&T's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CINT

CI&T

Provides strategy, design, and software engineering services worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)