- United States

- /

- Electrical

- /

- NasdaqCM:FTCI

December 2024's Top US Penny Stocks To Consider

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a surge, driven by positive inflation data and a rally in mega-cap technology stocks, with the Nasdaq reaching new highs. Amidst this backdrop, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area for those interested in smaller or newer companies. These stocks can offer unique opportunities when supported by strong financial foundations, potentially providing significant returns for investors seeking hidden value in quality firms.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.807 | $6.3M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.58 | $1.89B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $153.34M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.879 | $79.96M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7413 | $13.25M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.94 | $422.84M | ★★★★☆☆ |

Click here to see the full list of 707 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

FTC Solar (NasdaqCM:FTCI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FTC Solar, Inc. provides solar tracker systems, software, and engineering services across various regions including the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia with a market cap of $43.06 million.

Operations: The company generates revenue of $57.35 million from the manufacturing and servicing of solar tracker systems.

Market Cap: $43.06M

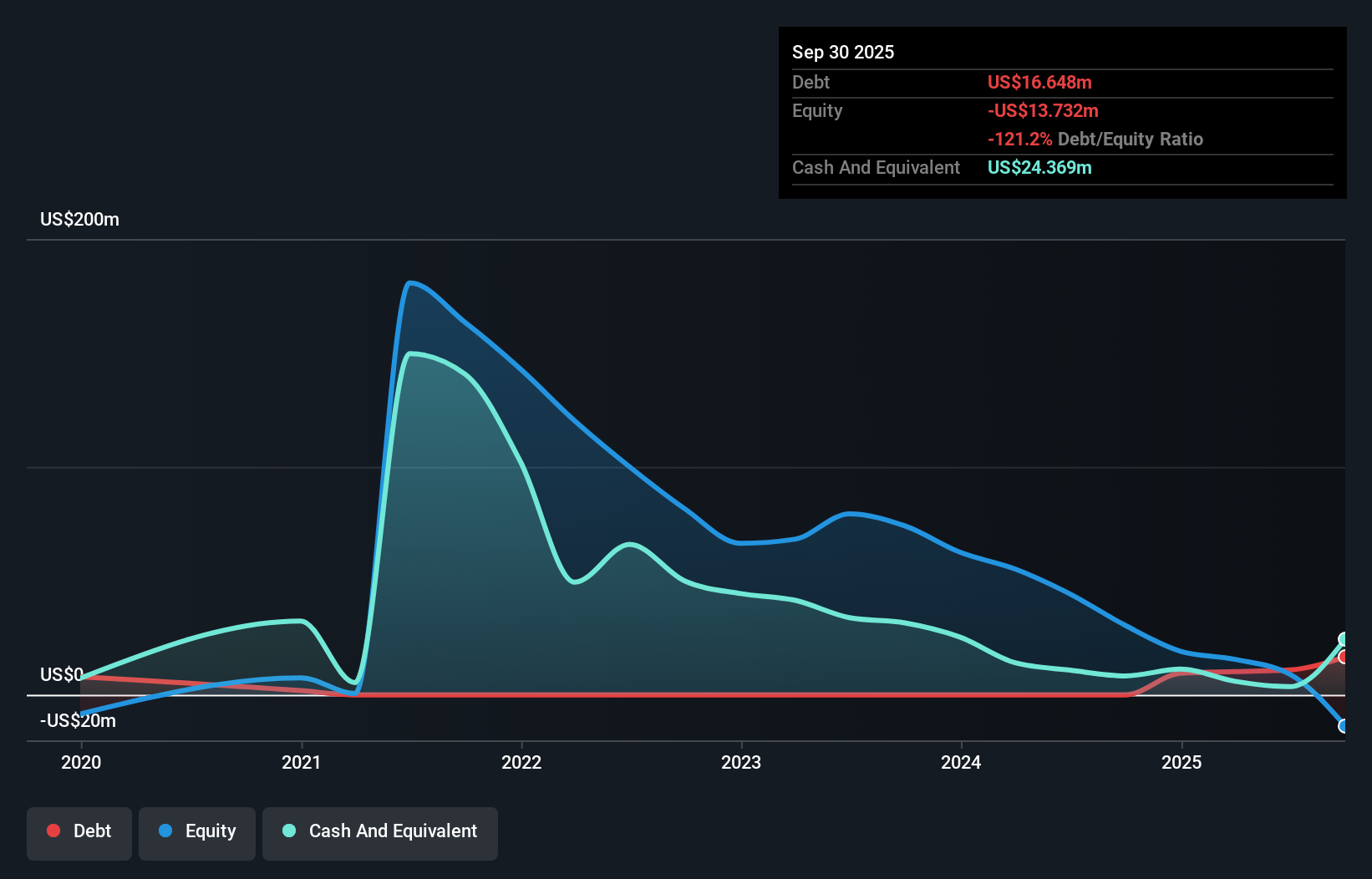

FTC Solar, Inc., with a market cap of US$43.06 million, has faced challenges as reflected in its declining revenue to US$10.14 million for Q3 2024 from US$30.55 million a year ago and continued net losses. Despite being debt-free, the company is unprofitable with negative return on equity and increased shareholder dilution over the past year. Recent strategic moves include a reverse stock split and securing significant contracts for solar projects set to commence in 2025, potentially enhancing future revenues. The issuance of senior secured promissory notes worth US$15 million may provide necessary liquidity but also adds financial obligations through interest payments.

- Navigate through the intricacies of FTC Solar with our comprehensive balance sheet health report here.

- Examine FTC Solar's earnings growth report to understand how analysts expect it to perform.

PodcastOne (NasdaqCM:PODC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PodcastOne, Inc. operates as a podcast platform and publisher, with a market cap of $60.61 million.

Operations: The company generates revenue of $47.46 million from its Internet Information Providers segment.

Market Cap: $60.61M

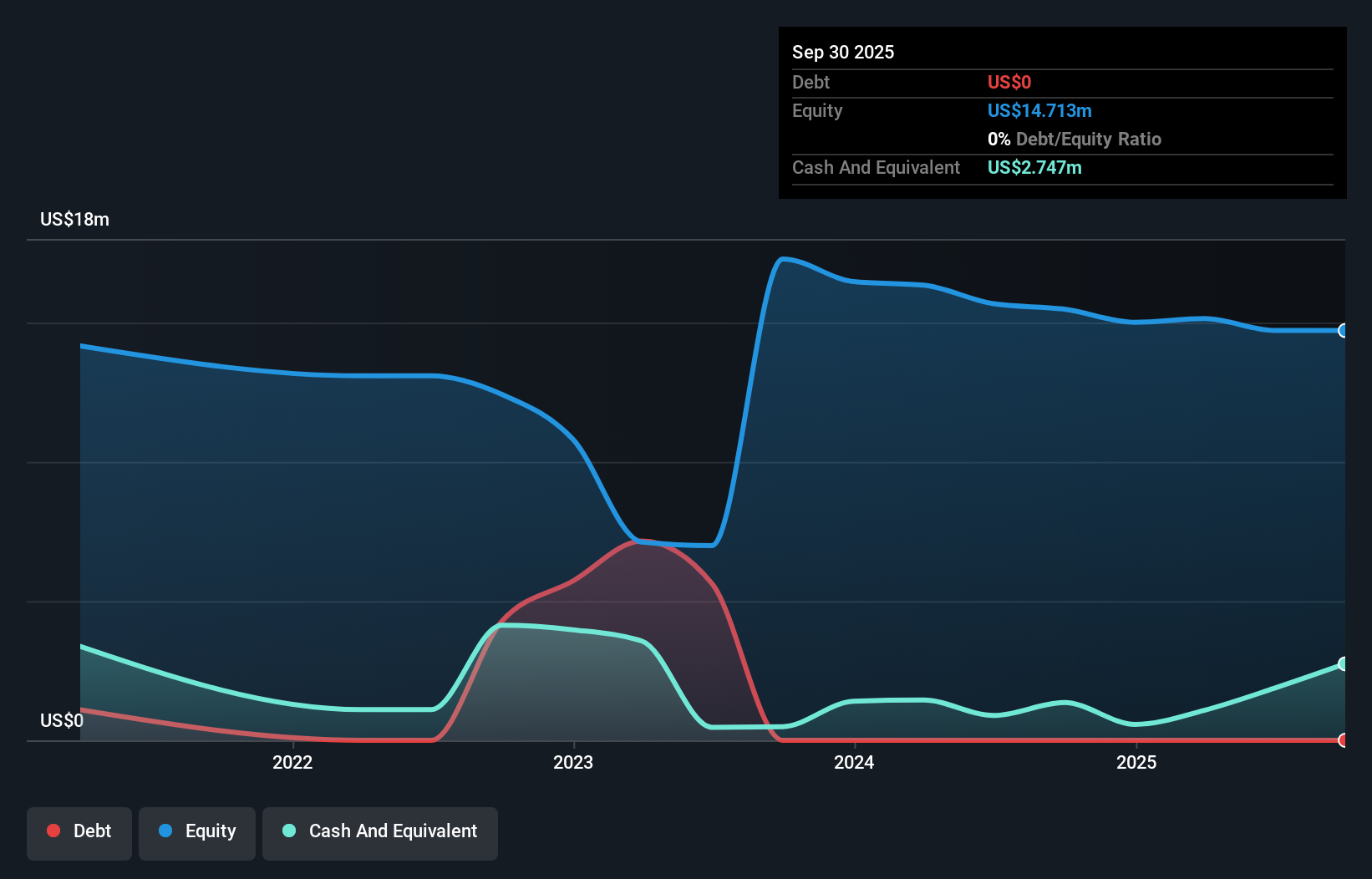

PodcastOne, Inc., with a market cap of US$60.61 million, is navigating the penny stock landscape by leveraging its podcasting platform to drive revenue growth, reporting US$25.31 million in sales for the first half of 2024. The recent launch of PodcastOne Pro aims to capitalize on the growing podcast audience by offering comprehensive production services to brands like Microsoft and Boost Mobile. Despite being unprofitable with a negative return on equity, it maintains a stable cash runway exceeding three years due to positive free cash flow. However, shareholder dilution and high share price volatility remain concerns for investors.

- Click to explore a detailed breakdown of our findings in PodcastOne's financial health report.

- Assess PodcastOne's future earnings estimates with our detailed growth reports.

BIT Mining (NYSE:BTCM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BIT Mining Limited is a cryptocurrency mining company operating in Mainland China, the United States, and Hong Kong with a market cap of $42.71 million.

Operations: The company generates revenue from its Data Center operations, amounting to $33.50 million, and Cryptocurrency Mining activities, which contribute $19.06 million.

Market Cap: $42.71M

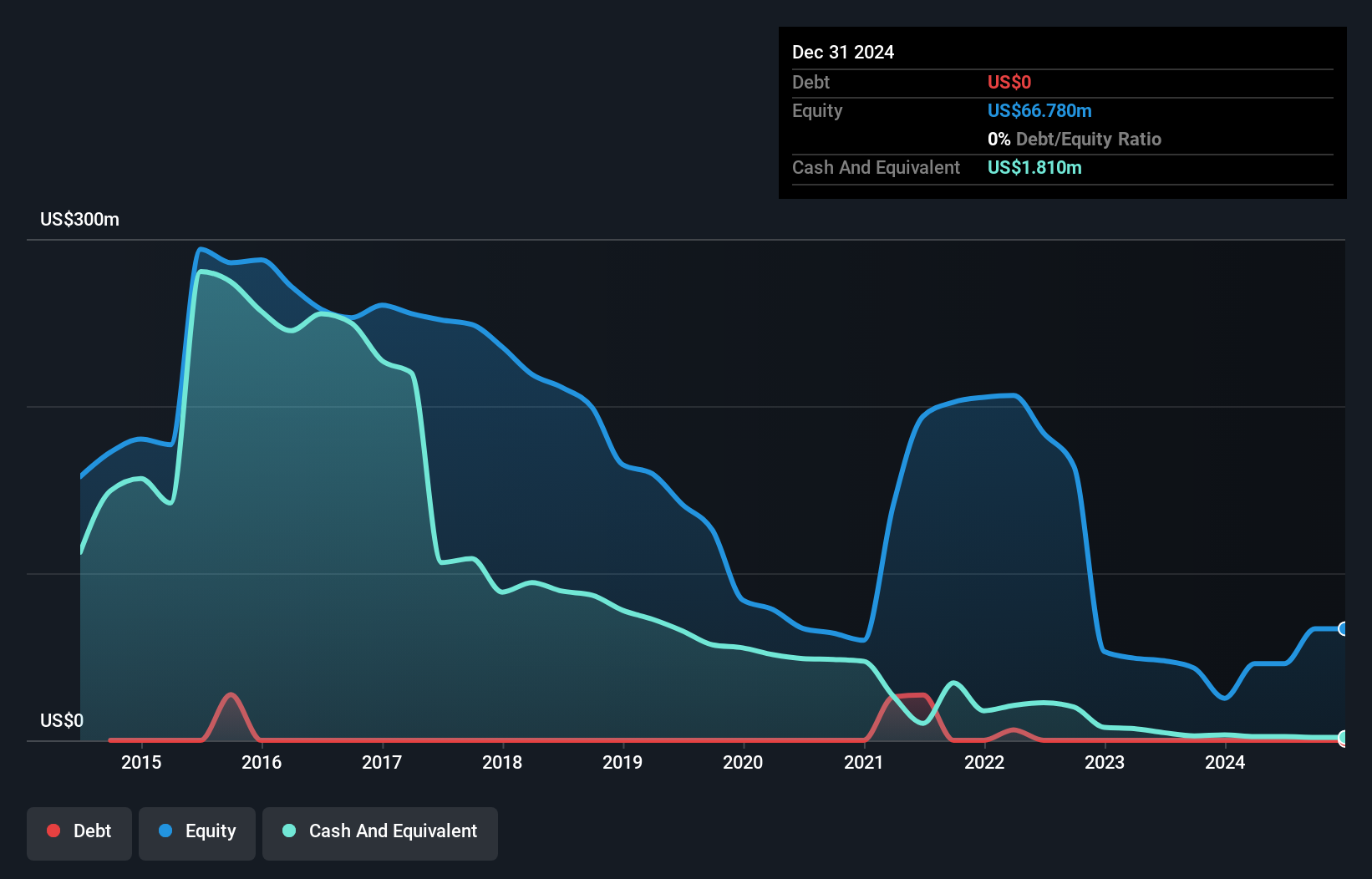

BIT Mining Limited, with a market cap of US$42.71 million, is navigating challenges in the cryptocurrency sector. Despite being unprofitable and having a negative return on equity of -44.21%, it reported net income of US$18.95 million for the first half of 2024, reversing from a previous loss. The company faces regulatory scrutiny, entering into agreements with U.S. authorities to resolve past investigations with penalties totaling US$10 million. Recent capital raising efforts include a follow-on equity offering worth US$9.6 million to bolster its cash position amid high share price volatility and shareholder dilution concerns.

- Get an in-depth perspective on BIT Mining's performance by reading our balance sheet health report here.

- Explore BIT Mining's analyst forecasts in our growth report.

Summing It All Up

- Embark on your investment journey to our 707 US Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FTCI

FTC Solar

Engages in the manufacture and service of solar tracker systems in the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success