- United States

- /

- Medical Equipment

- /

- NasdaqCM:VANI

3 Promising Penny Stocks With Market Caps Under $900M

Reviewed by Simply Wall St

As the U.S. markets close higher after a volatile week, investors are keenly observing opportunities that might arise amidst fluctuating conditions and economic uncertainties. Penny stocks, often seen as relics of speculative trading, still hold potential when underpinned by solid financials and growth prospects. In this article, we explore three penny stocks that exemplify strong balance sheets and promising fundamentals, offering investors a chance to uncover hidden value in companies with significant growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.87 | $400.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| Global Self Storage (SELF) | $4.967 | $56.32M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.20 | $52.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.86 | $23.12M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.20 | $551.59M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.997 | $7.24M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.43 | $77.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.77 | $11.03M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 368 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ispire Technology (ISPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ispire Technology Inc. engages in the research, development, design, commercialization, sale, marketing, and distribution of e-cigarettes and cannabis vaping products globally under the Ispire and Aspire brands with a market cap of approximately $138.70 million.

Operations: The company's revenue primarily comes from its cigarette manufacturers segment, generating $127.49 million.

Market Cap: $138.7M

Ispire Technology Inc. faces challenges as a penny stock with its recent financial performance showing a decline in sales to US$127.49 million and an increased net loss of US$39.24 million for the year ended June 30, 2025. Despite being unprofitable, the company maintains more cash than debt and covers its short-term liabilities with assets of US$72.9 million. However, it has been dropped from the S&P Global BMI Index recently, indicating potential concerns about its market position. The management team is relatively new but experienced, while revenue is expected to grow by 31.65% annually according to forecasts.

- Click here to discover the nuances of Ispire Technology with our detailed analytical financial health report.

- Gain insights into Ispire Technology's outlook and expected performance with our report on the company's earnings estimates.

Vivani Medical (VANI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vivani Medical, Inc. is a clinical-stage biopharmaceutical company focused on developing miniaturized and subdermal drug implants for treating chronic diseases, with a market cap of approximately $100.12 million.

Operations: Vivani Medical, Inc. has not reported any specific revenue segments.

Market Cap: $100.12M

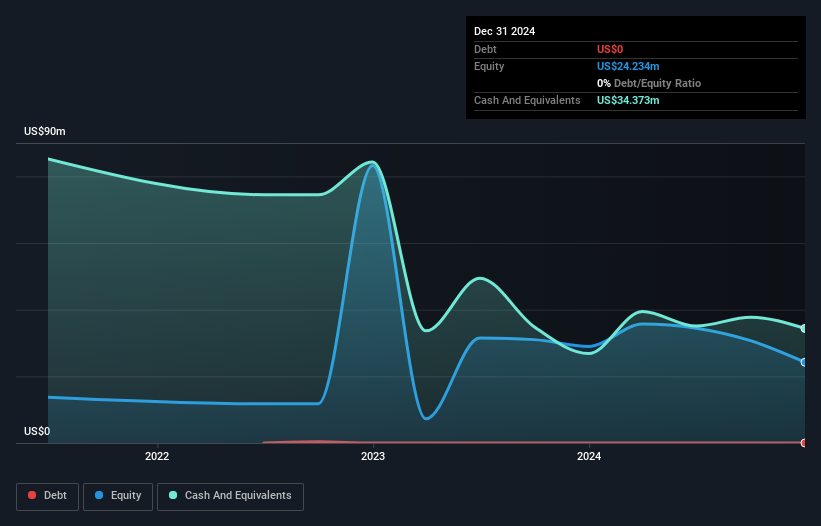

Vivani Medical, Inc. is a pre-revenue clinical-stage biopharmaceutical company focused on developing drug implants for chronic diseases. The company recently announced plans to start a Phase 1 study of its semaglutide implant program in 2026, aiming to address chronic weight management issues. Despite its unprofitable status and increased net losses of US$13.45 million for the first half of 2025, Vivani remains debt-free and has secured additional capital through a private placement worth approximately US$10 million. However, the company's short-term assets do not fully cover its long-term liabilities, posing potential financial challenges ahead.

- Dive into the specifics of Vivani Medical here with our thorough balance sheet health report.

- Assess Vivani Medical's future earnings estimates with our detailed growth reports.

Blend Labs (BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. operates a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $861 million.

Operations: The company's revenue is primarily derived from its Blend Platform, which generated $121.52 million, with an additional segment adjustment of $46.26 million.

Market Cap: $860.96M

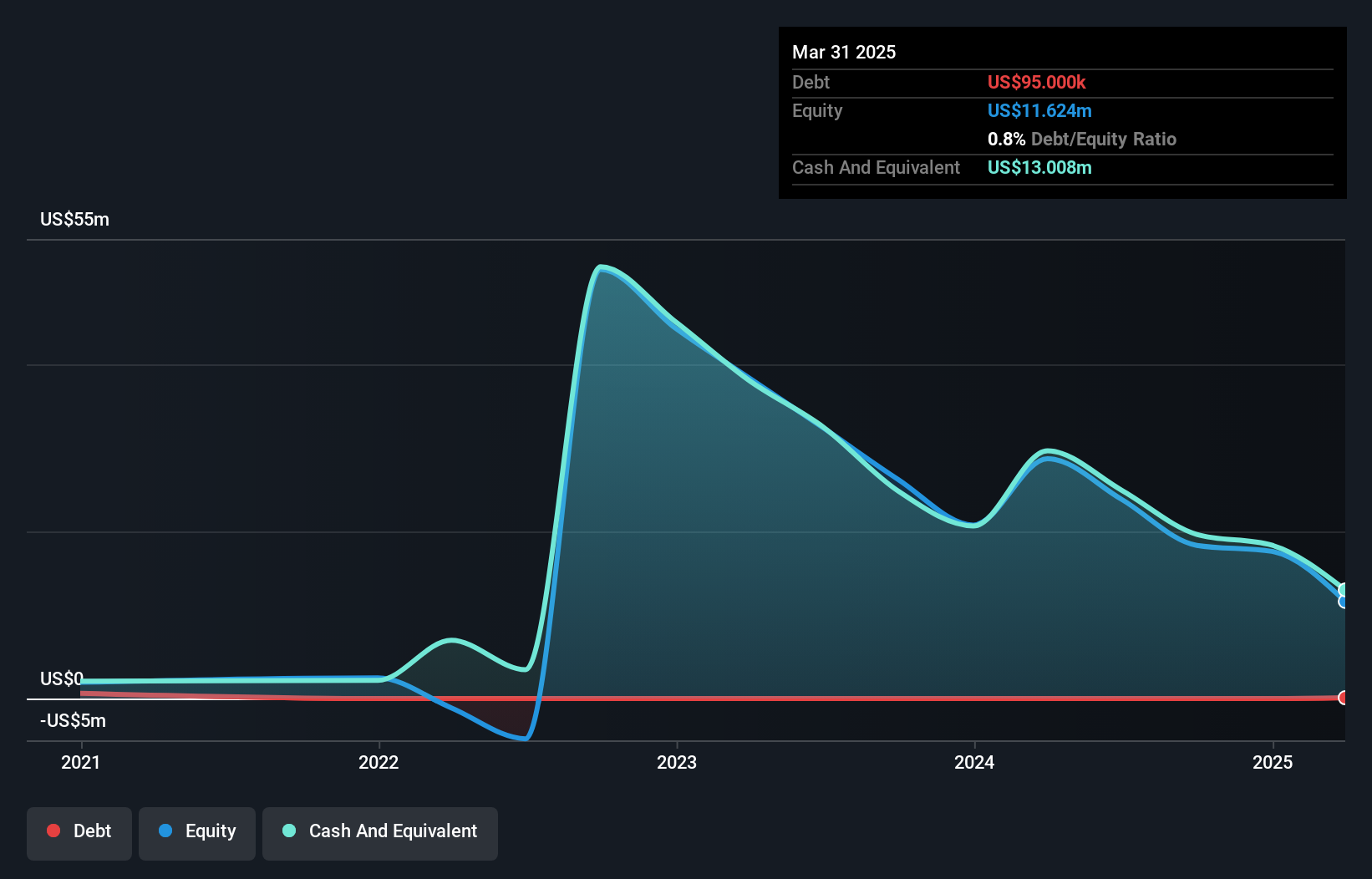

Blend Labs, Inc. is navigating the penny stock landscape with a focus on innovation in financial services through its AI-powered Intelligent Origination system, which aims to streamline lending processes and reduce operational costs. Despite being unprofitable, Blend has shown progress by reducing net losses significantly over recent periods and maintaining a debt-free balance sheet. The company's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. However, the stock's high volatility and recent insider selling could be concerns for investors. Leadership changes may influence strategic direction as new executives take key roles.

- Navigate through the intricacies of Blend Labs with our comprehensive balance sheet health report here.

- Learn about Blend Labs' future growth trajectory here.

Summing It All Up

- Jump into our full catalog of 368 US Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VANI

Vivani Medical

A clinical-stage biopharmaceutical company, engages in the development of miniaturized and subdermal drug implants that treat chronic diseases.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)