- United States

- /

- Banks

- /

- NasdaqGM:KFFB

3 Promising Penny Stocks With Market Caps Under $800M

Reviewed by Simply Wall St

As the U.S. stock market faces a period of volatility, with major indices like the S&P 500 experiencing consecutive declines amid pressure on tech stocks, investors are increasingly looking for opportunities beyond well-known giants. Penny stocks, despite their old-fashioned moniker, continue to attract attention as they represent smaller or newer companies that can offer unique value propositions. By focusing on those with strong financials and potential for growth, investors may find promising opportunities in these lesser-known corners of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.68 | $362.18M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.02 | $899.94M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.96 | $666.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.1873 | $27.23M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.27 | $546.53M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.896617 | $6.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.33 | $75.9M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.01 | $9.51M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 361 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kentucky First Federal Bancorp (KFFB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kentucky First Federal Bancorp, with a market cap of $37.18 million, operates as the holding company for First Federal Savings and Loan Association of Hazard, Kentucky, and Frankfort First Bancorp, Inc.

Operations: The company generates revenue through its financial service operations, amounting to $9.47 million.

Market Cap: $37.18M

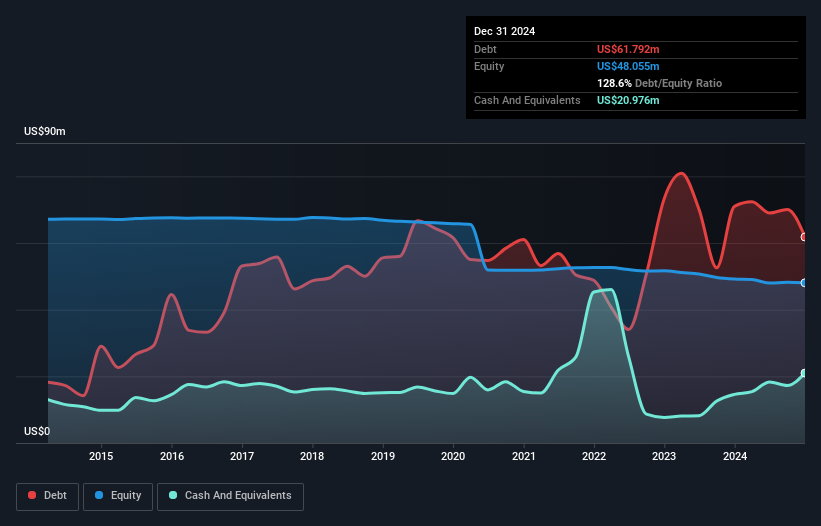

Kentucky First Federal Bancorp has demonstrated financial improvement, becoming profitable over the past year with net interest income rising to US$2.5 million for the recent quarter. The company's earnings growth outpaces the banking industry average, supported by high-quality earnings and a stable loan-to-assets ratio of 89%. Despite a low return on equity at 1.1%, its funding is primarily low-risk through customer deposits, and it maintains an appropriate level of non-performing loans at 1.2%. Recent leadership changes include appointing R. Clay Hulette as CEO, pending regulatory approval, amidst challenges like delayed SEC filings.

- Navigate through the intricacies of Kentucky First Federal Bancorp with our comprehensive balance sheet health report here.

- Understand Kentucky First Federal Bancorp's track record by examining our performance history report.

Blend Labs (BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. operates a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $776.64 million.

Operations: The company generates revenue through its Blend Platform, which accounts for $121.28 million, with an additional segment adjustment of $46.26 million.

Market Cap: $776.64M

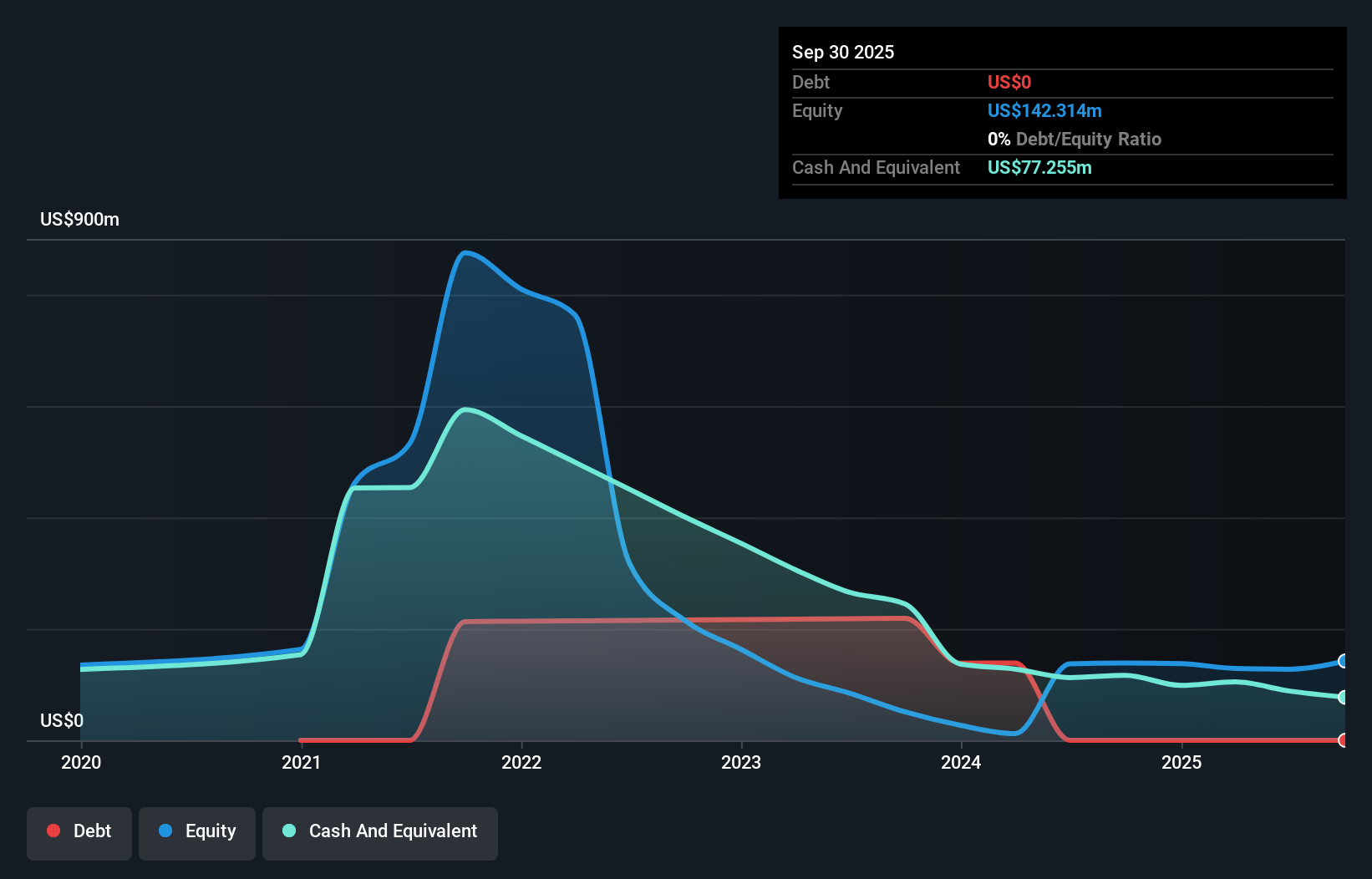

Blend Labs, Inc. has shown signs of financial improvement despite being unprofitable, with a recent quarterly net income of US$12.53 million compared to a loss the previous year. The company is debt-free and its short-term assets of US$116 million comfortably cover both short and long-term liabilities. Recent developments include the introduction of Intelligent Origination, an AI-powered system designed to streamline lending processes and reduce costs significantly. Although management is relatively inexperienced with an average tenure under two years, Blend's board is seasoned with an average tenure of 4.7 years, providing strategic oversight amidst these advancements.

- Jump into the full analysis health report here for a deeper understanding of Blend Labs.

- Assess Blend Labs' future earnings estimates with our detailed growth reports.

Voip-Pal.com (VPLM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Voip-Pal.com Inc. focuses on acquiring and developing Voice-over-Internet Protocol processes in the United States, with a market cap of $29.99 million.

Operations: Voip-Pal.com Inc. does not have any reported revenue segments.

Market Cap: $29.99M

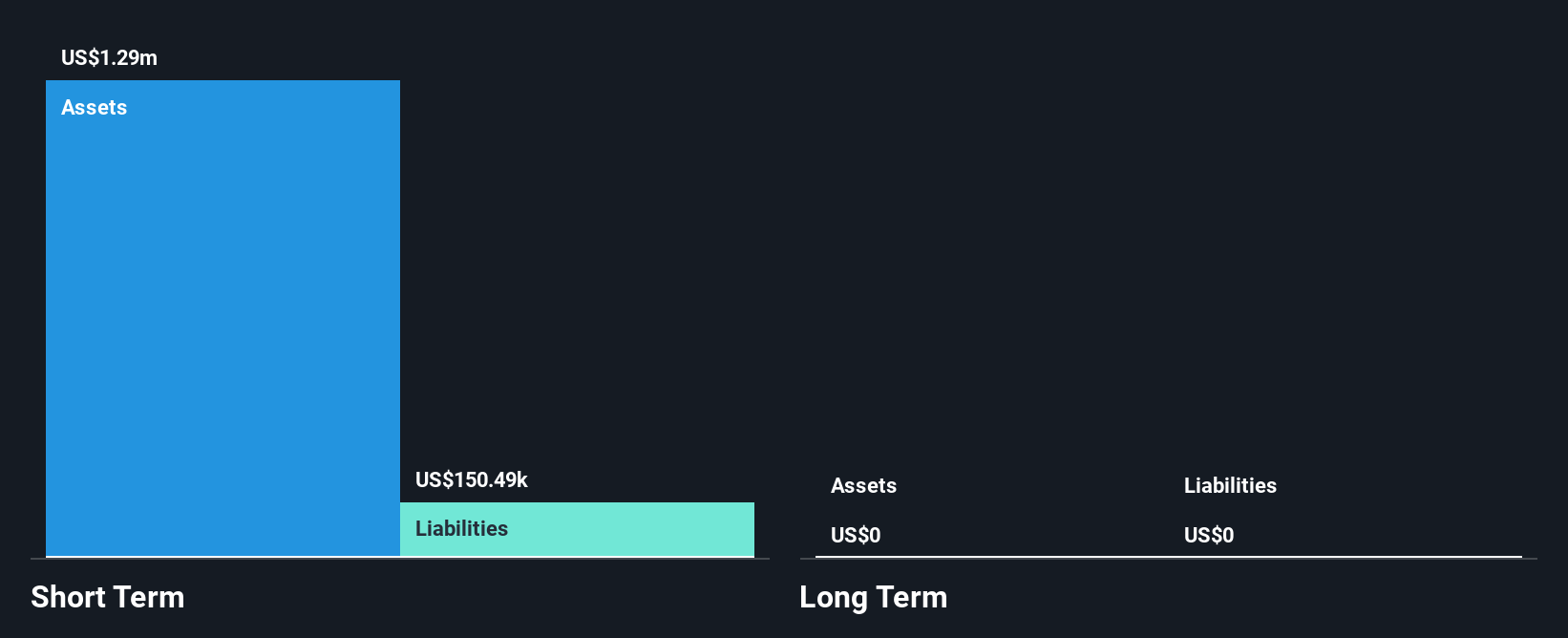

Voip-Pal.com Inc., with a market cap of US$29.99 million, is pre-revenue and unprofitable, lacking significant revenue streams. The company benefits from having no debt and short-term assets of US$1.3 million that exceed its short-term liabilities of US$150.5K, indicating a manageable financial position in the near term. However, it faces challenges with less than one year of cash runway if free cash flow continues to decline at historical rates. The management team has an average tenure of 2.3 years but lacks extensive experience on the board, which could impact strategic direction during this volatile period for the stock.

- Click to explore a detailed breakdown of our findings in Voip-Pal.com's financial health report.

- Review our historical performance report to gain insights into Voip-Pal.com's track record.

Where To Now?

- Embark on your investment journey to our 361 US Penny Stocks selection here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kentucky First Federal Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KFFB

Kentucky First Federal Bancorp

Operates as the holding company for First Federal Savings and Loan Association of Hazard, Kentucky, and Frankfort First Bancorp, Inc.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives