- United States

- /

- Software

- /

- NYSE:BLND

3 Promising Penny Stocks With Market Caps Above $90M

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape shaped by trade talks and economic data, investors are keenly watching for opportunities amid the shifting dynamics. Penny stocks, a term rooted in past market eras, continue to represent smaller or less-established companies that might offer significant value. By identifying those with strong financials and potential for growth, investors can uncover promising opportunities within this niche sector.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8956 | $150.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.40 | $234.25M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.70 | $465.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $97.69M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.45 | $37.51M | ✅ 4 ⚠️ 4 View Analysis > |

| Flexible Solutions International (FSI) | $4.91 | $61.34M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84 | $6.15M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.95 | $46.04M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.37 | $448.46M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 430 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Stitch Fix (SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stitch Fix, Inc. operates an online platform offering a personalized shopping experience for apparel, shoes, and accessories across various categories in the United States with a market cap of approximately $482.80 million.

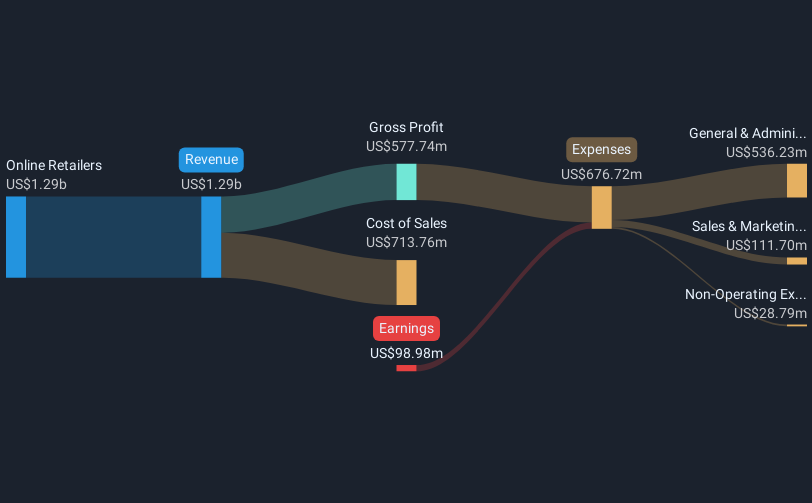

Operations: The company's revenue primarily stems from its online retail operations, which generated $1.28 billion.

Market Cap: $482.8M

Stitch Fix, with a market cap of US$482.80 million, recently joined several Russell Growth Indices, highlighting its visibility in the market. Despite being unprofitable and having a negative return on equity of -27.95%, it maintains a robust cash runway exceeding three years due to positive free cash flow. The company reported third-quarter revenue of US$325.02 million and reduced its net loss significantly from the previous year. While trading at 79.7% below estimated fair value, Stitch Fix remains debt-free with strong short-term asset coverage over liabilities and stable weekly volatility at 11%.

- Take a closer look at Stitch Fix's potential here in our financial health report.

- Review our growth performance report to gain insights into Stitch Fix's future.

XBiotech (XBIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XBiotech Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing true human monoclonal antibodies for treating various diseases, with a market cap of $90.55 million.

Operations: XBiotech Inc. has not reported any specific revenue segments.

Market Cap: $90.55M

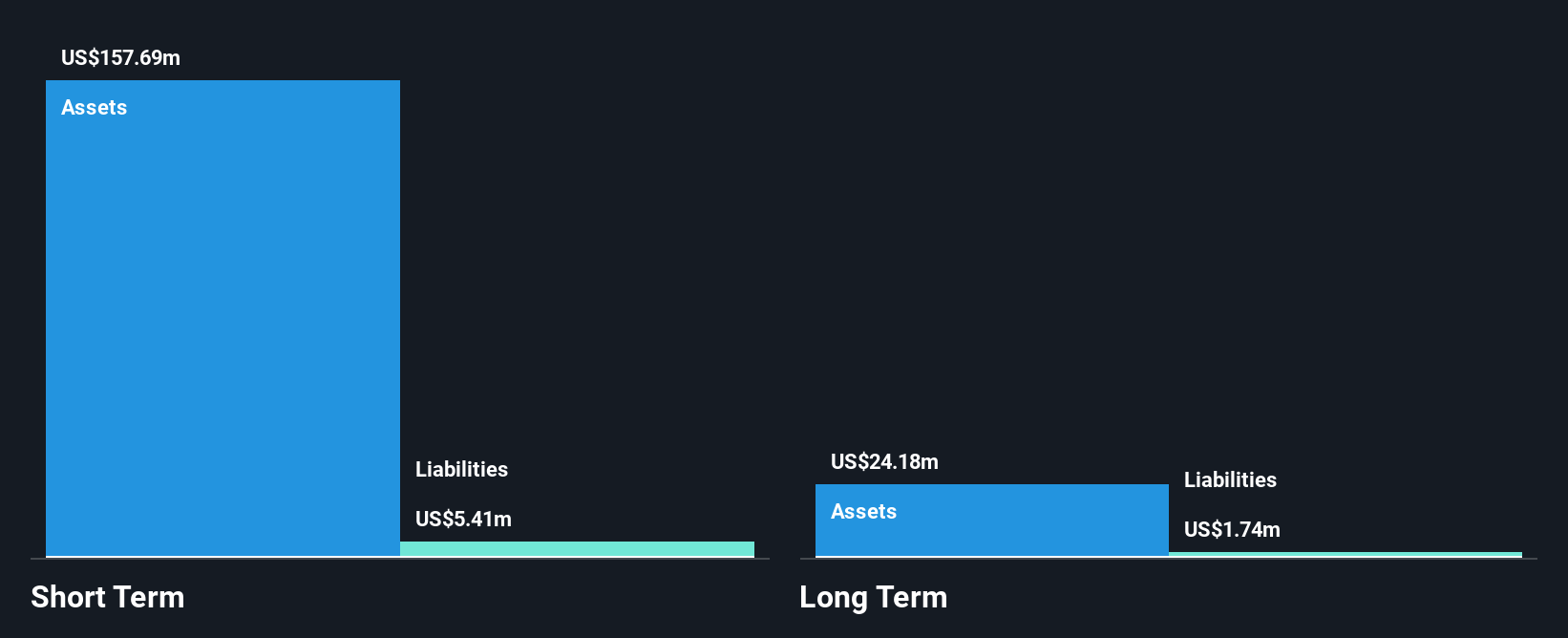

XBiotech Inc., with a market cap of US$90.55 million, is pre-revenue and unprofitable, having reported a net loss of US$10.88 million for the first quarter of 2025. Despite its financial challenges, the company benefits from experienced management and board members with an average tenure exceeding seven years. Recently dropped from several Russell indices, XBiotech remains debt-free with short-term assets significantly surpassing both short- and long-term liabilities. The recent board appointments of Dr. Thomas Kündig and Craig Rademaker bring valuable expertise in dermatology research and capital markets to support strategic growth initiatives amidst ongoing financial volatility.

- Navigate through the intricacies of XBiotech with our comprehensive balance sheet health report here.

- Explore historical data to track XBiotech's performance over time in our past results report.

Blend Labs (BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. offers a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $853.13 million.

Operations: The company's revenue is derived from its Blend Platform, which generated $118.69 million, with an additional segment adjustment of $46.26 million.

Market Cap: $853.13M

Blend Labs, Inc., with a market cap of US$853.13 million, is unprofitable but has shown progress by reducing its net loss from US$20.67 million to US$9.23 million year-over-year in Q1 2025. The company maintains a strong cash position with short-term assets of US$139.9 million exceeding liabilities and operates debt-free, providing a stable financial runway for over three years based on current free cash flow. Recent partnerships and product launches, such as the Rapid Refi solution with PHH Mortgage and integration with Glia's AI tools, enhance its platform's capabilities to streamline lending processes and improve borrower experiences despite insider selling concerns.

- Jump into the full analysis health report here for a deeper understanding of Blend Labs.

- Explore Blend Labs' analyst forecasts in our growth report.

Make It Happen

- Investigate our full lineup of 430 US Penny Stocks right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blend Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLND

Blend Labs

Provides a cloud-based software platform for financial services firms in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives