- United States

- /

- Software

- /

- NasdaqGM:FIVN

US High Growth Tech Stocks to Watch Now

Reviewed by Simply Wall St

As the U.S. market grapples with trade uncertainties and fluctuating indices, particularly the Dow Jones hovering near unchanged levels amid tariff discussions, investors are closely watching how these broader economic factors impact high-growth tech stocks. In such a volatile environment, identifying promising tech stocks involves looking at companies that demonstrate resilience and adaptability to navigate shifting trade policies and economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.83% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Five9 (FIVN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five9, Inc. offers intelligent cloud software solutions for contact centers globally and has a market capitalization of approximately $2.11 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.07 billion. The business focuses on providing cloud-based solutions for contact centers, serving both domestic and international markets.

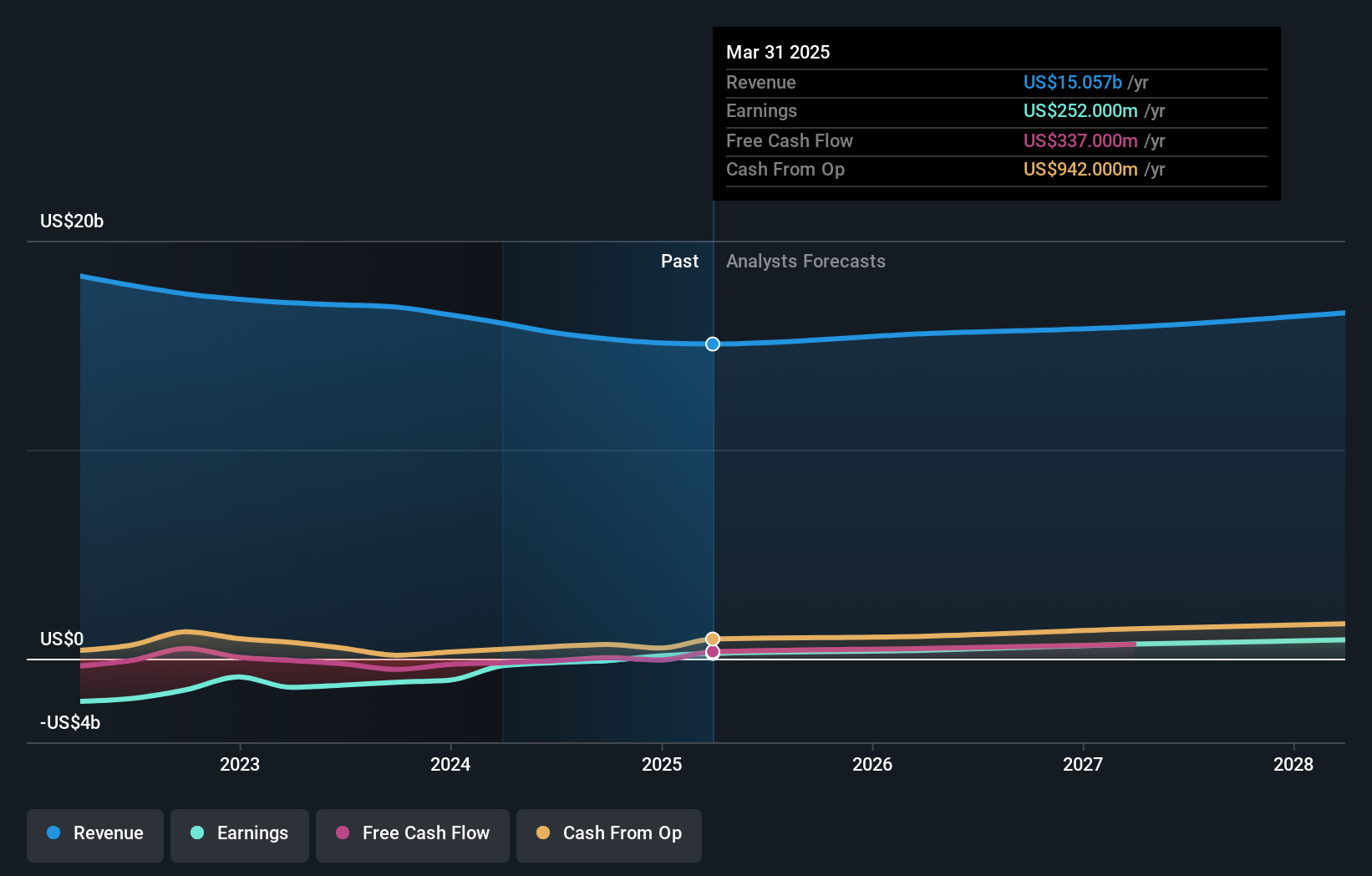

Despite recent turbulence, evidenced by its removal from several Russell indexes, Five9 demonstrates resilience and potential in the high-growth tech sector. With a forecasted annual earnings growth of 47.3% and revenue growth at 8.6%, the company is strategically positioning itself for profitability within three years. Notably, Five9's commitment to innovation is underscored by its R&D spending which remains robust, supporting initiatives like the newly launched AI Agents and AI Trust & Governance tools under its Agentic Experience Engine—aiming to revolutionize customer experience through advanced AI integration. This focus on developing cutting-edge technology not only enhances its service offerings but also aligns with industry shifts towards more dynamic, AI-driven business solutions.

- Click here to discover the nuances of Five9 with our detailed analytical health report.

Gain insights into Five9's historical performance by reviewing our past performance report.

BILL Holdings (BILL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BILL Holdings, Inc. offers a financial operations platform designed for small and midsize businesses globally, with a market capitalization of $4.97 billion.

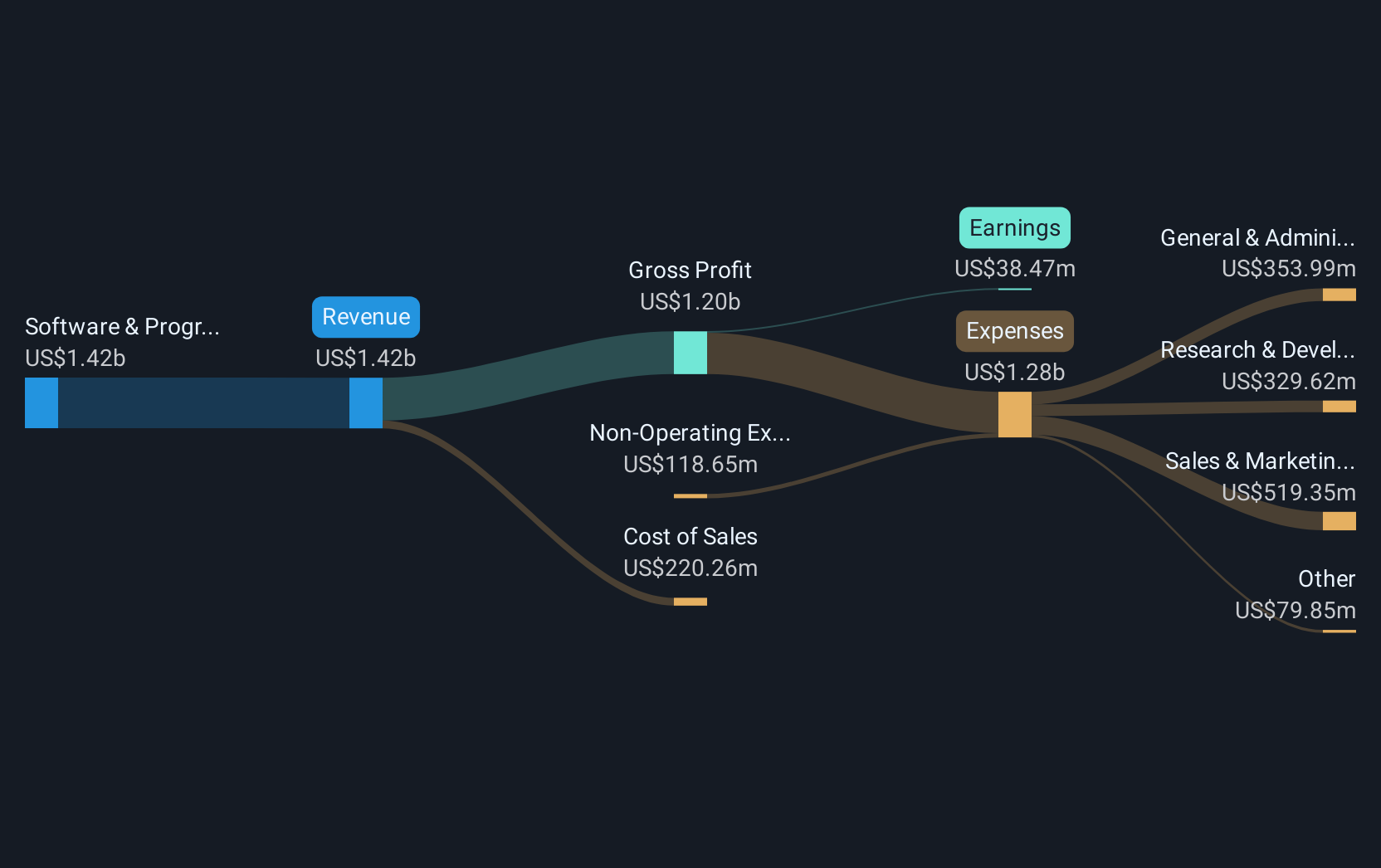

Operations: The company generates revenue primarily from its Software & Programming segment, which contributed $1.42 billion. The platform is tailored for small and midsize businesses worldwide, focusing on enhancing financial operations.

Amidst a series of index drops, BILL Holdings has demonstrated resilience and adaptability in the high-growth tech landscape. The company recently unveiled its Supplier Payments Plus service, enhancing transaction efficiency for large suppliers—a move that underscores its commitment to innovation and streamlined B2B commerce. This strategic pivot not only addresses critical market needs but also complements BILL's robust annual revenue growth of 12.6% and earnings expansion at an impressive rate of 20.8% per year. Furthermore, with R&D expenditures consistently fueling advancements in payment solutions, BILL is well-positioned to maintain its competitive edge in the evolving digital payment sphere.

- Dive into the specifics of BILL Holdings here with our thorough health report.

Understand BILL Holdings' track record by examining our Past report.

Kyndryl Holdings (KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a technology services company specializing in IT infrastructure services across the United States, Japan, and other international markets, with a market capitalization of approximately $10.05 billion.

Operations: Kyndryl Holdings generates revenue primarily from its IT infrastructure services, with significant contributions from the United States ($3.88 billion) and Japan ($2.36 billion). The company also serves Principal Markets and Strategic Markets, contributing $5.21 billion and $3.62 billion respectively to its revenue streams.

Kyndryl Holdings has recently been integrated into various Russell growth benchmarks, signaling its burgeoning presence in the tech sector. Despite a modest annual revenue growth of 2.9%, Kyndryl's earnings are expected to surge by 40.8% annually, outpacing the U.S. market average of 14.7%. This financial trajectory is bolstered by strategic alliances and innovations, such as its recent partnership with Commvault aimed at enhancing cyber resilience and regulatory compliance services for businesses globally. Moreover, Kyndryl's focus on integrating AI capabilities through collaborations with industry giants like AWS and Databricks exemplifies its commitment to driving digital transformation across diverse sectors.

- Click to explore a detailed breakdown of our findings in Kyndryl Holdings' health report.

Assess Kyndryl Holdings' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 226 companies within our US High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives