- United States

- /

- IT

- /

- NYSE:BBAI

Market Participants Recognise BigBear.ai Holdings, Inc.'s (NYSE:BBAI) Revenues Pushing Shares 28% Higher

The BigBear.ai Holdings, Inc. (NYSE:BBAI) share price has done very well over the last month, posting an excellent gain of 28%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

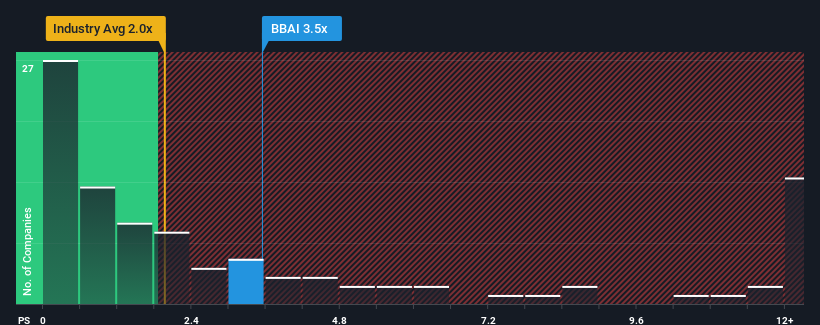

Following the firm bounce in price, when almost half of the companies in the United States' IT industry have price-to-sales ratios (or "P/S") below 2x, you may consider BigBear.ai Holdings as a stock probably not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for BigBear.ai Holdings

What Does BigBear.ai Holdings' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, BigBear.ai Holdings has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on BigBear.ai Holdings will help you uncover what's on the horizon.How Is BigBear.ai Holdings' Revenue Growth Trending?

BigBear.ai Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 21% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this information, we can see why BigBear.ai Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From BigBear.ai Holdings' P/S?

BigBear.ai Holdings' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that BigBear.ai Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the IT industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with BigBear.ai Holdings (including 1 which is a bit concerning).

If these risks are making you reconsider your opinion on BigBear.ai Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Mediocre balance sheet low.

Market Insights

Community Narratives