- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai (BBAI): Assessing Valuation Following Biometric Rollout at Nashville Airport and New Strategic Alliances

Reviewed by Simply Wall St

If you’ve been following BigBear.ai Holdings (BBAI), the latest news about its veriScan biometric deployment at Nashville International Airport is tough to miss. Improving passenger flow and security in such a busy transportation hub, along with forming new partnerships in government and defense, adds a layer of credibility to the company’s AI ambitions. As headlines tout these operational wins, investors are left weighing how much of this momentum is already reflected in the stock’s price, especially given ongoing concerns about near-term financial challenges.

Looking back over the year, BigBear.ai Holdings has seen both surges and setbacks. The announcement of the airport deployment helped drive a 2% after-hours pop, but that excitement faded somewhat with a steep drop last month, underscoring the mixed mood around recent earnings expectations. Despite this, shares are up an impressive 220% over the year, with a quarter of that gain coming in just the past three months. This hints that optimism about the company’s trajectory still has some believers. New strategic collaborations have sparked attention, even as worries about revenue and net income persist.

With BigBear.ai’s market value swinging between promise and uncertainty, investors continue to weigh whether this represents an opportunity for forward-looking strategies or if the market is already anticipating future growth in the share price.

Most Popular Narrative: 13.3% Undervalued

Based on the latest and most widely followed valuation narrative, BigBear.ai Holdings is considered undervalued by 13.3% relative to its estimated fair value.

BigBear.ai plans to expand internationally by converting successful pilots into enduring programs and building regional partnerships with leading companies. This could potentially increase revenue and global market presence. The company is focused on business alliances and strategic acquisitions, which could drive faster innovation and open new revenue streams by accessing additional markets and technologies.

What is really driving that double-digit upside prediction? The narrative is anchored in a mix of ambitious international growth, fresh alliances, and bold forecasts for future earnings. Want to know the numeric assumptions and surprise variable that just might make or break this story? The full narrative provides insight into what is fueling BigBear.ai’s undervalued call.

Result: Fair Value of $5.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, inconsistent government funding and the company’s history of lumpy revenues could quickly change the outlook if delays or setbacks continue.

Find out about the key risks to this BigBear.ai Holdings narrative.Another View: Price Tags That Challenge the Story

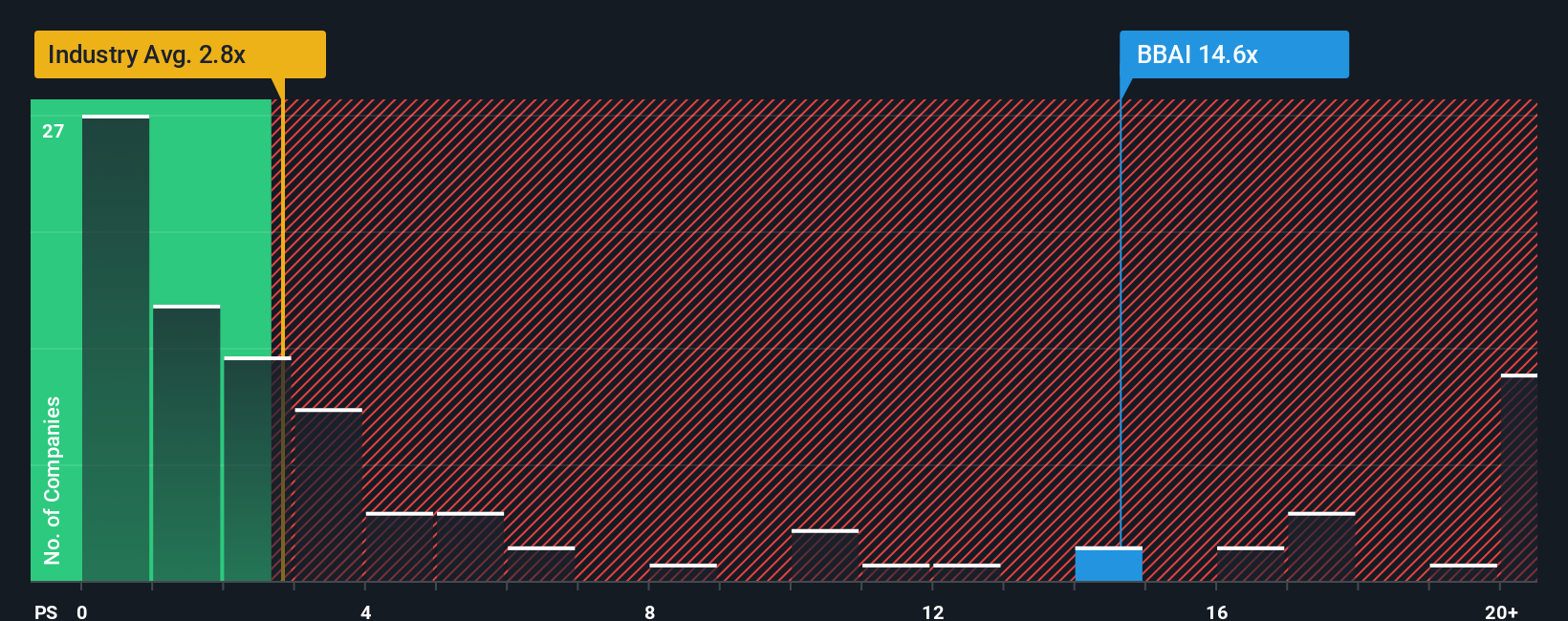

While analyst forecasts call BigBear.ai undervalued, our alternative valuation based on industry sales ratios suggests the shares look expensive compared to sector norms. Could this price be factoring in a little too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BigBear.ai Holdings Narrative

If you see the numbers differently or want to dig into the details for yourself, you can build your own perspective in just a few minutes with our tools: Do it your way.

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missed opportunities are just a click away. Harness Simply Wall Street's powerful tools to tap into unique stocks that could elevate your portfolio to new heights.

- Uncover hidden bargains in sectors other investors overlook when you check out undervalued stocks based on cash flows.

- Jump ahead of the curve by spotting early leaders who are shaping tomorrow’s digital breakthroughs with AI penny stocks.

- Capture reliable payouts and strengthen your returns by pursuing dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives