- United States

- /

- Software

- /

- NYSE:ASAN

How New AI Initiatives and Leadership Changes at Asana (ASAN) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, Asana presented at the 17th Annual Silicon Valley C-Level Technology Leadership Summit, featuring Head of Enterprise Technology Saket Srivastava, and announced Arnab Bose from Okta as its new Chief Product Officer.

- Recent developments, including insider share transactions and renewed emphasis on AI features like AI Teammates, have sparked discussion around Asana’s ongoing pivot toward profitability and product innovation in an increasingly competitive SaaS landscape.

- We'll examine how Asana's new AI initiatives and leadership changes could influence its long-term investment thesis and competitive positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Asana Investment Narrative Recap

Belief in Asana as a shareholder rests on the expectation that its AI-driven workflow automation, product innovation, and focus on large enterprise clients will help grow market share despite mounting competition and operating losses. The recent summit presentation and executive appointment highlight an intent to accelerate product improvements, but these developments do not materially shift the short-term catalyst, which remains traction for AI Teammates among enterprise customers. The primary risk continues to be potential pressure on net revenue retention from enterprise renewals.

Among recent company announcements, the rollout of AI Teammates stands out as most relevant. This effort is central to Asana’s ambition to create stickier, higher-value use cases in enterprise accounts, which is directly tied to winning customer expansions and boosting retention rates, the key catalyst that could underpin a reversal in its current share price performance.

However, against these advancements, upcoming enterprise contract renewals pose a risk investors should be keenly aware of if net retention…

Read the full narrative on Asana (it's free!)

Asana's outlook anticipates $966.9 million in revenue and $126.6 million in earnings by 2028. This scenario assumes a 9.4% annual revenue growth rate and a $358.4 million increase in earnings from the current -$231.8 million.

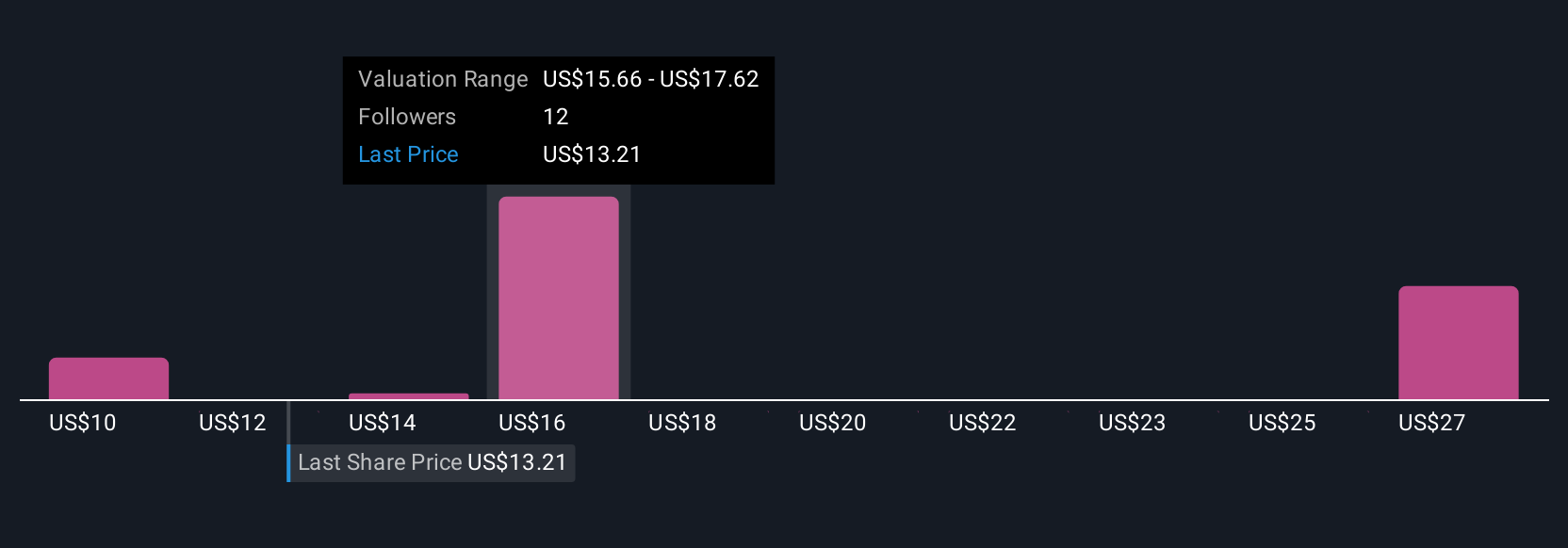

Uncover how Asana's forecasts yield a $16.38 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors provided 7 fair value estimates for Asana, ranging from US$9.79 to US$29.33 per share. While most see upside, many remain focused on whether product innovation in AI will be enough to offset retention risks, so consider these perspectives before making assumptions about the company’s future.

Explore 7 other fair value estimates on Asana - why the stock might be worth 28% less than the current price!

Build Your Own Asana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asana's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives