- United States

- /

- Software

- /

- NYSE:ASAN

Does the Recent Share Slide Make Asana a Bargain in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Asana stock? You are not alone. Whether you already own shares or are eyeing this work management platform as a new addition, recent market moves have likely caught your attention. The stock dropped 6.9% over the last week, even after gaining 5.4% during the past month. It is hard to ignore that Asana is down more than 28% year-to-date, and over the last three years, the stock sits 24.6% below its previous levels. However, zooming further out, anyone who has been in for the long haul has endured a tough ride, with the five-year return down 41.6%. Yet, looking at just the last year, there is a bright spot: Asana managed a 16.5% gain, hinting that growth and sentiment could be shifting in its favor as the market's risk appetite evolves.

Whenever a company’s share price moves around this much, the obvious question is: Does the current valuation actually make sense? Here is an eye-opener for you: by our count, Asana is undervalued in five out of six major valuation checks, receiving a valuation score of 5. That sets it well apart from many of its peers and kicks off a compelling conversation about what the market might be missing. Up next, we will break down the standard ways analysts judge a stock’s value, but stick around because there is an even smarter approach we will share at the end, one that could change the way you think about whether Asana is a buy or a pass.

Why Asana is lagging behind its peers

Approach 1: Asana Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used tool for estimating the fair value of a company. It projects the business’s future cash flows and then discounts those amounts back to today’s dollars. This allows investors to assess what the company’s future profit streams are worth in present terms.

For Asana, the current Free Cash Flow stands at $33.53 Million. Analysts forecast steady growth ahead, projecting that Asana’s annual Free Cash Flow could reach $610.17 Million over the next decade. Keep in mind that these projections extend beyond the five years of typical analyst forecasts. The additional years are extrapolated using historical growth trends and industry assumptions.

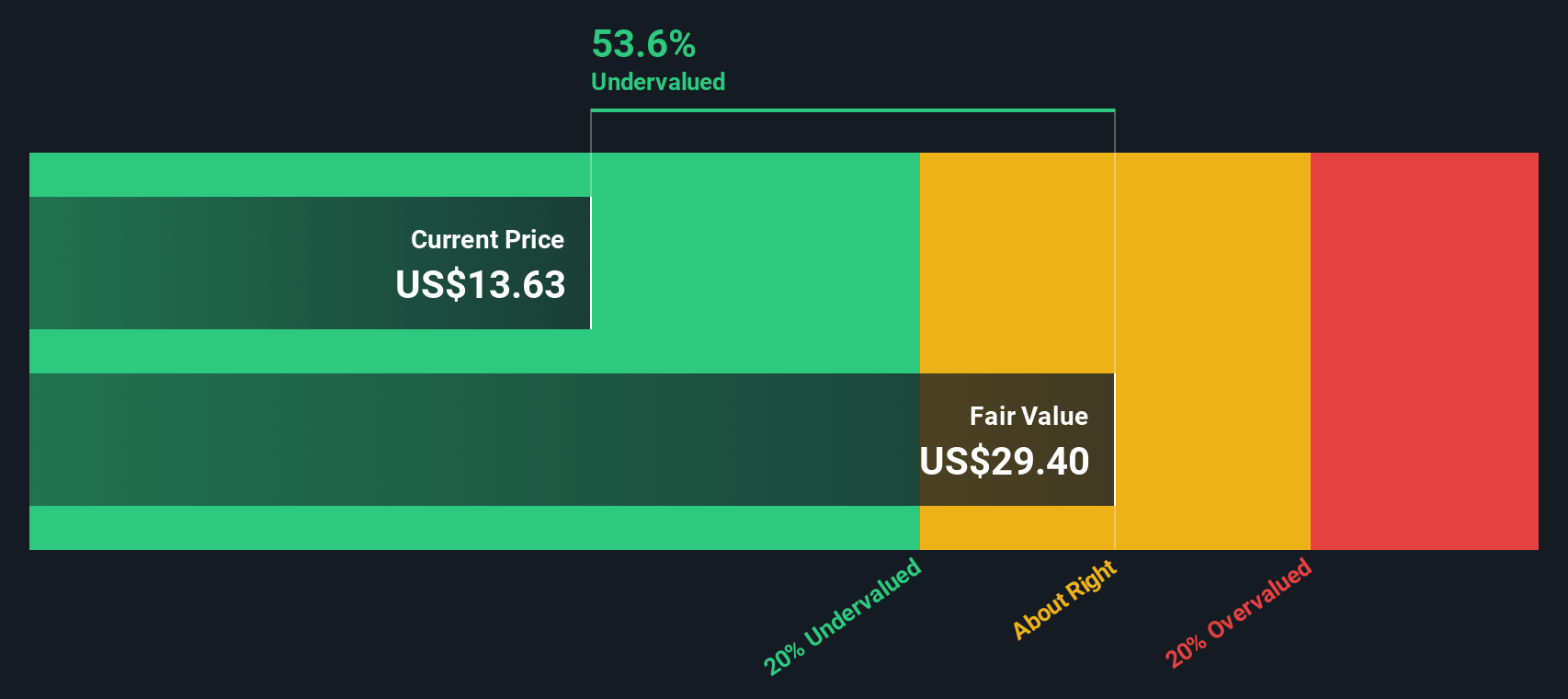

Based on these projected cash flows, Asana’s intrinsic value is estimated at $29.37 per share according to the DCF model. Compared to its recent market price, this analysis suggests that the stock is currently trading at a 51.9% discount to its fair value. This could mean it is significantly undervalued if these assumptions are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Asana is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Asana Price vs Sales

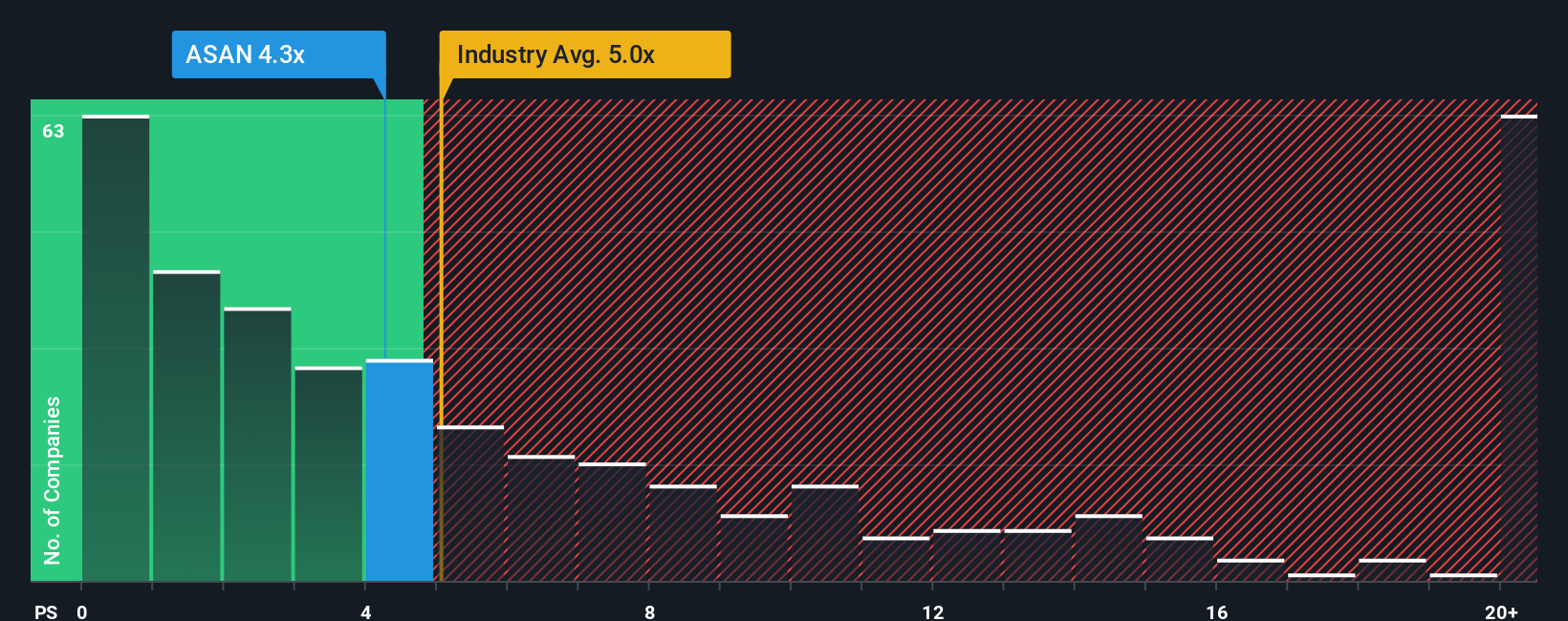

The Price-to-Sales (P/S) ratio is often preferred when valuing technology companies like Asana, especially if profitability is limited or inconsistent. Unlike earnings-based multiples, the P/S offers investors a way to gauge how the market is valuing each dollar of revenue generated. This makes it a practical metric in high-growth sectors where reinvestment can temporarily depress profits.

What constitutes a "normal" or "fair" P/S ratio generally depends on a company’s anticipated sales growth, risk profile, and the prevailing trends in its industry. A high-growth company typically commands a higher multiple, while increased risks or slowing growth expectations can pull the ratio down.

For Asana, the current P/S multiple stands at 4.41x. This compares favorably to the Software industry average of 5.07x and also comes in well below its peer group average of 6.07x. While these benchmarks provide some context, they can sometimes miss the nuances that set a company apart.

That is where Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio, calculated here at 6.68x, sets itself apart by considering factors like Asana’s revenue growth, industry positioning, profit margins, company size, and specific business risks. This approach aims to identify a valuation that is tailor-made for Asana rather than relying solely on broad averages.

Comparing Asana’s current P/S of 4.41x to its Fair Ratio of 6.68x suggests the stock may be significantly undervalued from a revenue-based perspective. This could offer a potentially attractive entry point for long-term investors who believe in its growth story.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Asana Narrative

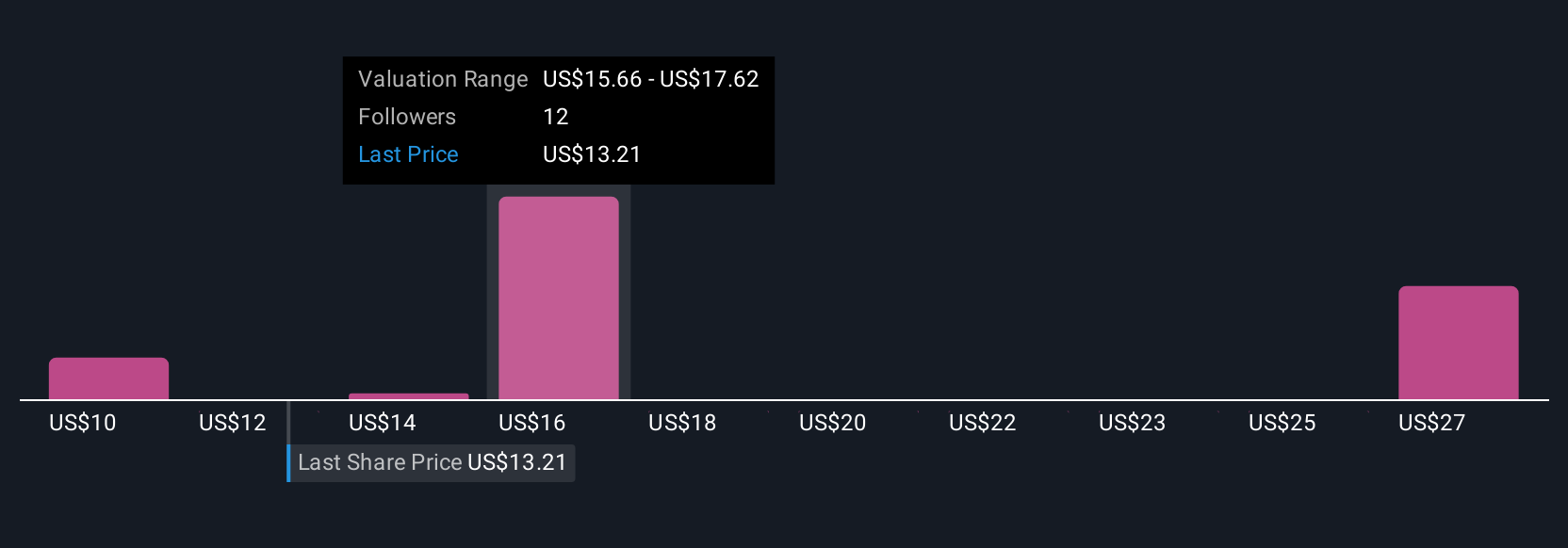

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an investor’s personal story or thesis about a company, connecting the company’s business outlook with their own assumptions around future revenue, earnings, margins, and what that means for fair value. Rather than just crunching numbers, Narratives allow you to tie the story behind the numbers to your investment decisions, bridging the gap between qualitative beliefs and a financial forecast.

On Simply Wall St's Community page, Narratives make this easy. Millions of investors use them to share perspectives and visualize how their storyline for a company translates into an updated fair value. Narratives help you decide whether to buy or sell by letting you compare your own fair value estimate directly with the latest market price, and because they update automatically as new news or earnings come in, your view stays relevant without extra work.

For example, with Asana you could see one Narrative suggesting a fair value of $22.00, fueled by optimism around AI-driven growth, or another calling for $10.00 due to worries over profitability and competition. This lets you pick the story and plan that best matches your outlook, instantly.

Do you think there's more to the story for Asana? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives