- United States

- /

- Software

- /

- NYSE:AI

C3.ai (NYSE:AI) Secures US$350M USAF Contract Extension & Expands Baker Hughes Partnership

Reviewed by Simply Wall St

C3.ai (NYSE:AI) experienced a 5% price increase over the past week, driven by several key developments. The company announced a $350 million expansion of its contract with the United States Air Force, boosting the total to $450 million through 2029. Additionally, C3.ai renewed its joint venture with Baker Hughes, focusing on Enterprise AI solutions for the oil and gas sector. Although the broader market remained relatively flat, these announcements likely added weight to the overall positive sentiment around the stock, contrasting with other companies impacted by regulatory and trade news.

You should learn about the 2 risks we've spotted with C3.ai (including 1 which can't be ignored).

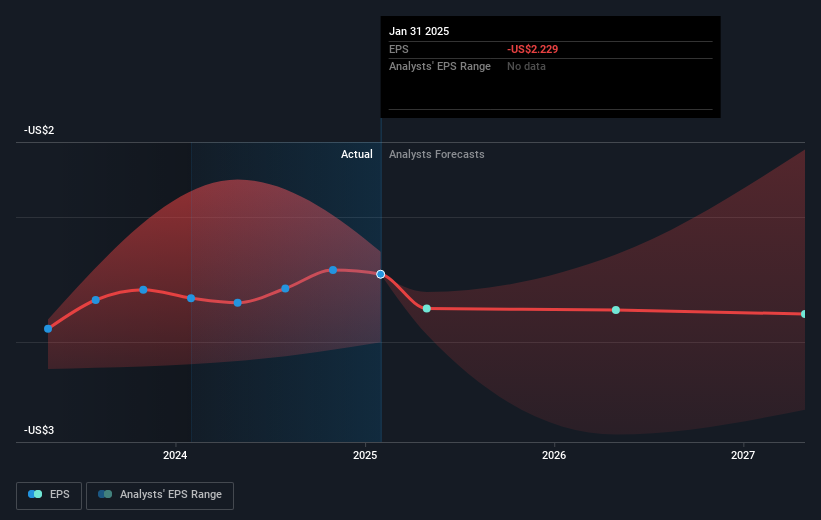

The recent developments at C3.ai, including significant contract expansions with the U.S. Air Force and renewed collaboration with Baker Hughes, are poised to substantially influence the company's narrative. These partnerships are expected to bolster C3.ai's market position and potentially accelerate revenue growth through strategic alliances. The focus on advanced AI solutions could further align with the company's expansion goals, enhancing product offerings in the enterprise AI sector. These factors may contribute to a stronger forecasted revenue and improved earnings outlook despite ongoing challenges related to financial losses.

Over a three-year span, C3.ai's total shareholder return was 24.10%, offering a broader perspective on its longer-term performance. However, in comparison to recent market trends, C3.ai underperformed relative to the US Software industry and the broader US Market over the past year, where the latter reported a 11.5% increase.

With the current share price at US$22.51, it remains below the consensus analyst price target of US$30.21, indicating potential upside. Nevertheless, the company's continued focus on expanding strategic partnerships and efficient expense management remains crucial to achieving the revenue growth and margin improvements necessary to reach favorable earnings forecasts. These elements reflect both opportunities and risks that stakeholders should consider in light of financial and geopolitical uncertainties.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence (AI) software company in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives