- United States

- /

- IT

- /

- NYSE:ACN

Is Now the Right Moment to Revisit Accenture After Its 5% Weekly Drop?

Reviewed by Bailey Pemberton

If you are looking at your portfolio and wondering what to do with Accenture stock, you are definitely not alone. With shares closing at $239.71 recently, Accenture has been a hot topic among investors, especially after its noticeable ups and downs over the past year. The stock has dipped by 5.2% just in the past week, while the past month shows a modest 0.8% uptick. Zoom out further and you will notice a year-to-date drop of 31.3% and a one-year slide of 34.3%. These are not exactly confidence-inspiring numbers at first glance. Yet, looking back over the past five years, Accenture has still managed a total return of 11.2%, which hints at its longer-term resilience.

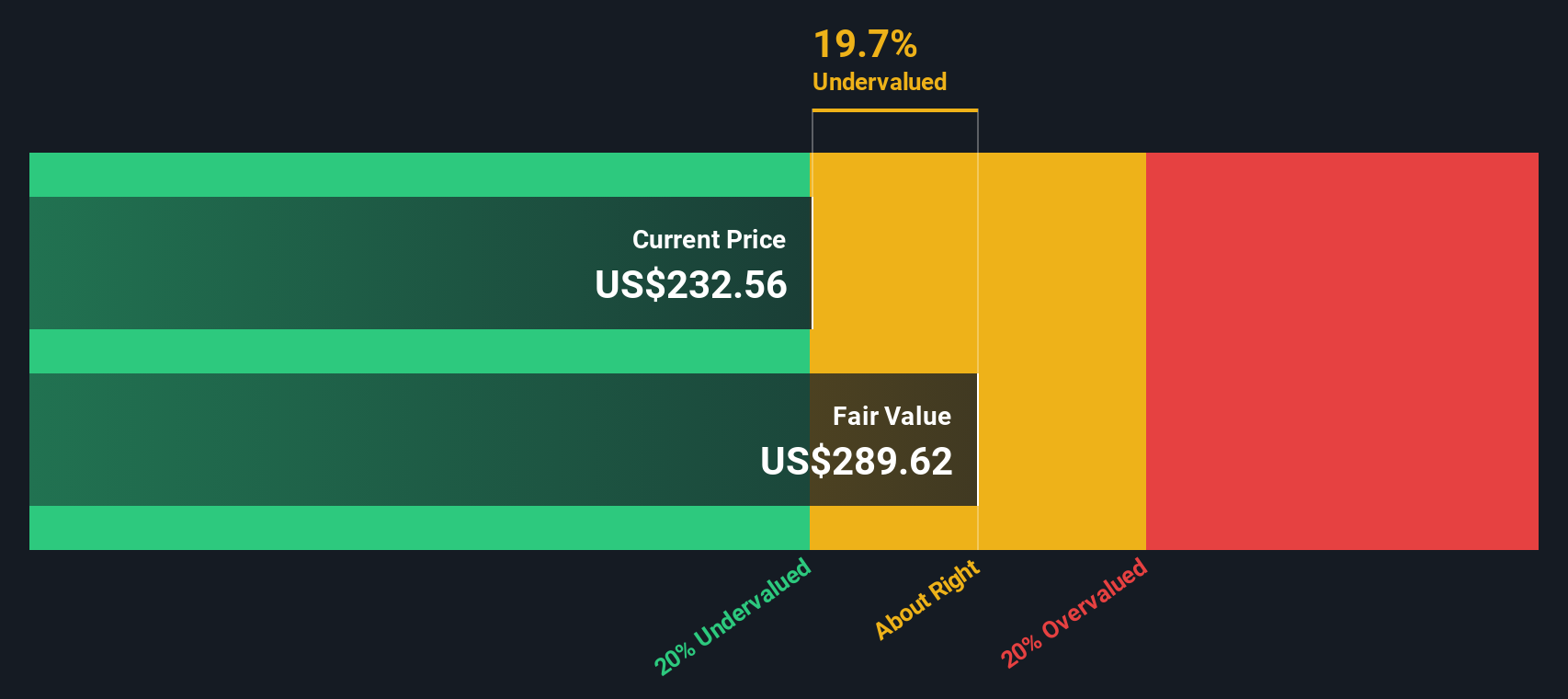

These moves have come against a backdrop of shifting investor sentiment across the broader technology and consulting sector, as markets have become more mindful of risk and future growth prospects amid macroeconomic headwinds. Even so, what is really catching analysts’ attention is Accenture’s valuation. On a scale that rewards undervaluation in six key areas, Accenture scores a 4. That means it is considered undervalued according to four out of six standard checks, giving you a reason to take a deeper look before deciding whether to buy, hold, or sell.

So how is Accenture’s stock really valued by different methods, and which approach makes the most sense for investors right now? Let's break down the main ways analysts put a price tag on companies like Accenture, and then discuss one often-overlooked angle that can help you see the bigger picture.

Why Accenture is lagging behind its peers

Approach 1: Accenture Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting how much cash it will generate in the future and then discounting those cash flows back to today’s dollars, accounting for time and risk. This helps investors get a sense of what a business is intrinsically worth, based on its ability to generate cash.

For Accenture, the DCF model uses current Free Cash Flow (FCF) of $10.90 billion and incorporates growth estimates provided by analysts for the next five years. Further cash flow projections are extrapolated for the following years. By the end of this ten-year window, Accenture’s forecast FCF is $14.66 billion for 2035, showing a steady, moderate growth trajectory.

Based on these cash flow projections and discounting them back to their present value, the DCF model arrives at an intrinsic share price estimate of $276.62. Compared to the current share price of $239.71, this signals that Accenture shares are trading at a 13.3% discount to their estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Accenture is undervalued by 13.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Accenture Price vs Earnings

For profitable companies like Accenture, the price-to-earnings (PE) ratio is a widely used valuation tool. This metric lets investors quickly gauge how much they are paying for each dollar of a company’s earnings, making it especially useful for established businesses with consistent profits.

The “right” PE ratio is not the same for every company. It depends on growth expectations, future risks, and market sentiment. Higher anticipated earnings growth or lower risk can justify a higher PE, while slower growth or extra risk may result in a lower multiple being appropriate for investors.

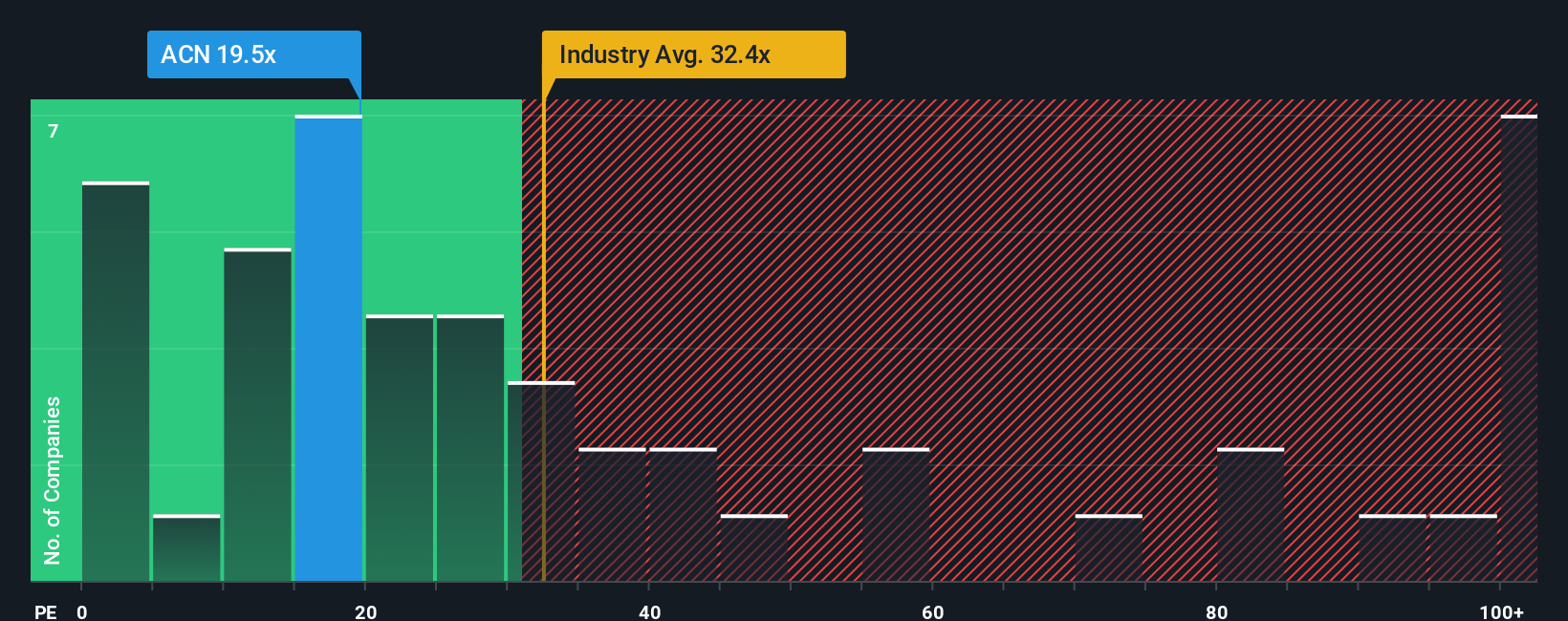

Accenture currently trades at a PE ratio of 19.4x. For context, the IT industry average stands at 32.7x, and Accenture’s peer group’s average is about 27.0x. At a glance, this might make Accenture look attractively valued compared to its sector.

However, rather than relying only on industry or peer averages, Simply Wall St’s “Fair Ratio” uses a proprietary formula that factors in Accenture’s earnings growth, profit margins, market cap, and the specific risks and opportunities the company faces. This provides a much more tailored benchmark for what Accenture’s PE should be.

For Accenture, this Fair Ratio is calculated at 38.2x. Since the company’s actual PE of 19.4x is well below this level, the numbers suggest the stock is currently undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Accenture Narrative

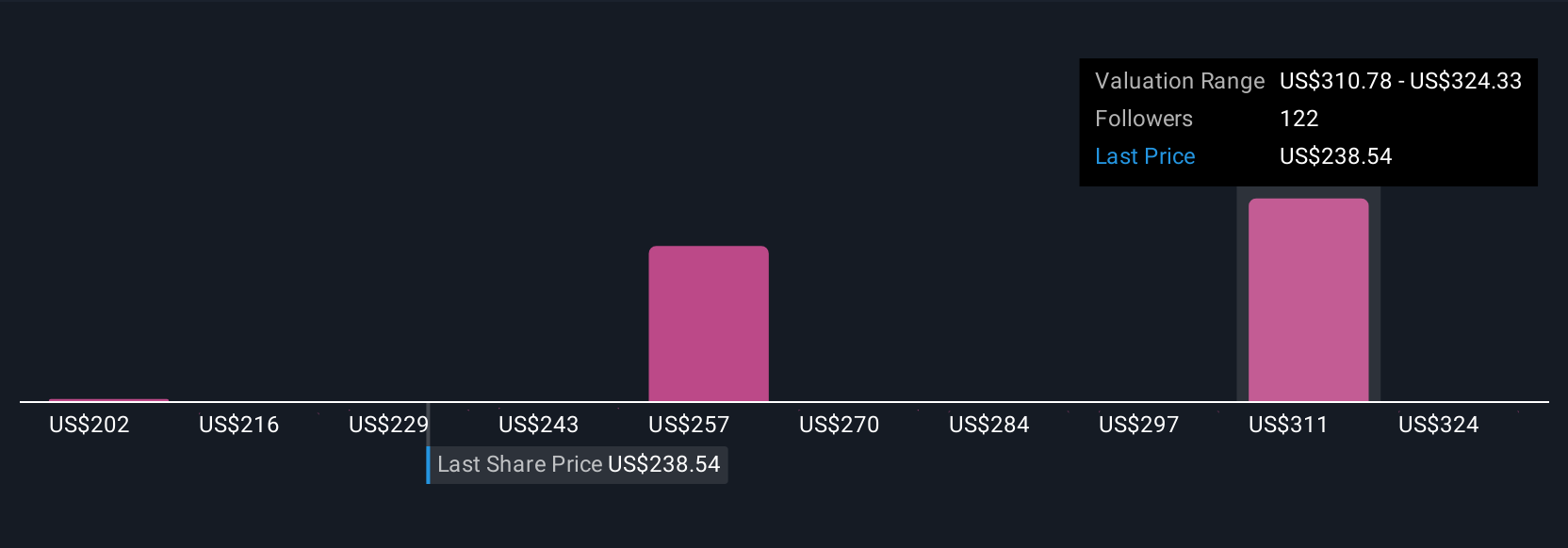

Earlier we mentioned that there's an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your story behind the numbers. It combines your view of Accenture’s future with your own assumptions for things like revenue growth, margins, and fair value.

Unlike traditional models that only crunch numbers, Narratives bring those numbers to life by linking Accenture’s story to a financial forecast and a personalized fair value. Narratives are designed to be easy and accessible, and you can create them directly on the Simply Wall St Community page, a tool already trusted by millions of investors.

By using Narratives, you can make smarter buy or sell decisions since you can directly compare your calculated Fair Value against the current Price and see how your logic compares with others. Narratives update dynamically as new news, results, or forecasts come in, helping you keep your view relevant as circumstances change.

For example, on Simply Wall St, you might see one investor’s “bullish” Accenture Narrative with a fair value of $278, based on strong AI growth expectations and improving margins. Another “bearish” Narrative values the stock at $202, reflecting concerns about industry headwinds and more modest assumptions.

For Accenture however we'll make it really easy for you with previews of two leading Accenture Narratives:

Fair Value: $278.32

Undervalued by 13.9%

Revenue Growth: 5.9%

- Strategic focus on Gen AI and Industry X investments, along with high-growth acquisitions, is expected to drive long-term digital transformation and boost future revenue.

- Analysts project annual revenue growth of 5.9% and margin improvements, supporting an analyst consensus price target of $278 to $316, which is well above the current share price.

- Key risks include slowing federal revenue, margin pressure, industry competition, and currency fluctuations that could challenge profitability, but the bullish case expects industry leadership to prevail.

Fair Value: $202.38

Overvalued by 18.4%

Revenue Growth: 5.4%

- Despite AI-driven bookings momentum and solid free cash flow, Accenture trades near historical valuation multiples, and recent sector re-rating has reduced its upside potential.

- EPS growth and margin expansion remain visible, but declining total bookings and elongated sales cycles are flagged as risks to sustained growth and profitability.

- Fundamental stance is moderately constructive, but upside depends on a rebound in bookings and further clarity on macroeconomic and industry-specific trends.

Do you think there's more to the story for Accenture? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives