- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN) Margin Dip Reinforces Cautious Narrative as Earnings Growth Trails Historical Pace

Reviewed by Simply Wall St

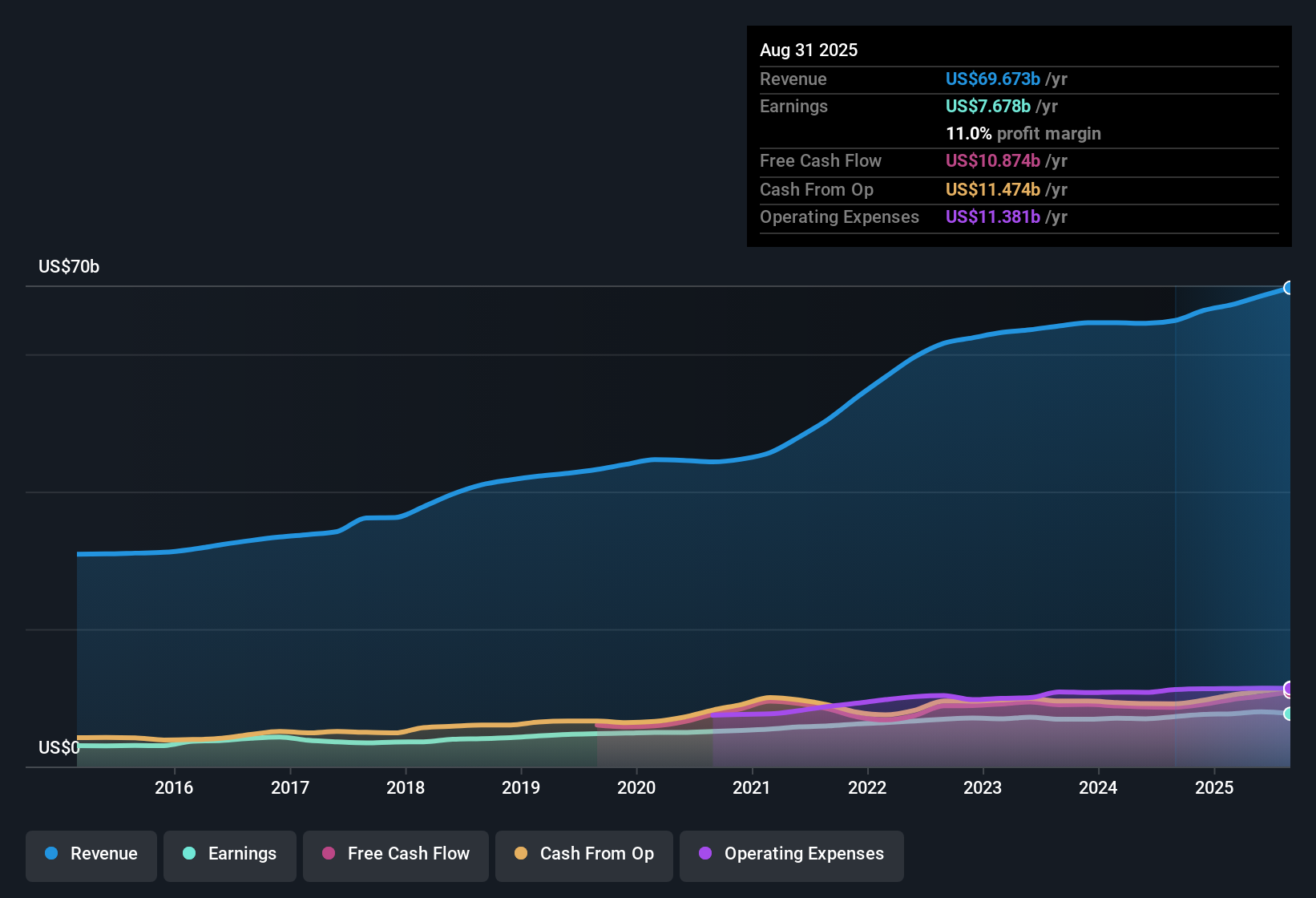

Accenture (ACN) reported earnings growth of 5.7% year-over-year, trailing its own 5-year average annual earnings growth of 7.4%. The company’s net profit margin dipped slightly to 11% from 11.2% a year earlier, and while revenue is forecast to rise by 5.3% per year going forward, this is below the broader US market’s 9.9% projected growth rate. For investors, the results point to a balance of predictability and quality in earnings, with the current share price of $240.94 remaining below estimated fair value and attractive relative valuation metrics potentially signaling opportunity.

See our full analysis for Accenture.Now let’s see how these latest numbers match up against the market narratives for Accenture. This is where prevailing views either get reinforced or put under the spotlight.

See what the community is saying about Accenture

Cloud and Security Deliver Double-Digit Growth

- The consensus narrative notes that Accenture’s cloud and security offerings expanded at a double-digit pace this quarter, standing out against the company’s overall 5.7% annual earnings growth.

- Analysts' consensus view is that these higher-margin segments are likely to support robust revenue growth and potentially improve net margins going forward.

- Strategic focus on digital transformation and high-growth areas like Industry X and Gen AI could continue driving demand, as seen in $600 million in Gen AI-related revenue this quarter.

- This momentum may help offset slower growth in Accenture’s core businesses and cushion future margin pressures.

- What is most notable is how the firm's targeted investments are already translating into stronger top-line contributions from new technology verticals.

Consensus narrative expects innovation in growth areas will keep Accenture ahead of broader industry shifts. 📈 Read the full Accenture Consensus Narrative.

Relative Value: PE Ratio Under Industry and Peer Average

- Investors are paying 19.5x trailing earnings for Accenture, a discount to both the US IT industry average of 30.7x and peer average of 25.8x. This suggests there could be room for re-rating if growth stabilizes.

- Analysts' consensus view highlights that Accenture's current share price of $240.94 remains below the DCF fair value of $277.07. The analyst price target of 278.32 reflects a 15.5% upside from current levels.

- This valuation gap is surprising given Accenture’s high-quality earnings and ongoing share repurchase program, which returned $2.4 billion to shareholders this quarter.

- Consensus sees current pricing as potentially undervaluing the company’s predictable profit streams and strategic positioning in technology-led transformation.

Margin Moves: Modest Dip, Brighter Long-Term Outlook

- Net profit margin edged down to 11% from 11.2% a year earlier, yet analysts expect margins to rise to 12.3% in the next three years thanks to the growth of higher-margin services.

- According to the consensus narrative, Accenture’s operating margin has faced headwinds from higher subcontractor costs and optimization actions.

- With future profit margins forecasted to improve and strategic reinvestment in new business lines, analysts highlight confidence in regaining profitability momentum.

- This supports the idea that recent compression is likely temporary rather than a structural decline, especially with ongoing efficiency drives and market share wins.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Accenture on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest figures? Build your own perspective into a narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

See What Else Is Out There

While Accenture demonstrates strategic growth in cloud and AI, its overall earnings growth and margin expansion have lagged industry averages and analyst expectations.

If you're looking for companies forecast to deliver stronger earnings growth and outpace sluggish results, discover fresh opportunities via our high growth potential stocks screener to stay ahead of market trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)