- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Evaluating Valuation After Institutional Exit Flags Growth and Outsourcing Concerns

Reviewed by Kshitija Bhandaru

Accenture (NYSE:ACN) has caught investor attention after a major institutional holder sold its stake, citing concerns around slowing consulting growth and weaker demand for outsourcing. At the same time, Accenture is doubling down on its AI investments through a deepening partnership with Google Cloud.

See our latest analysis for Accenture.

Accenture’s share price has slipped to $252.04 after losing nearly 28% on a total return basis over the past year, as the market weighs softer consulting demand and muted outsourcing activity against the company’s expanding AI partnerships and fresh leadership moves. While buybacks, innovation initiatives, and a recent dividend boost signal long-term confidence, momentum in the share price has faded compared to previous years. This has made investors increasingly attentive to evidence of an inflection in growth or profitability.

If you’re watching how technology leaders adapt amid changing market sentiment, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

But with the stock now trading at a notable discount to analyst targets and key metrics still trending positively, the real question is whether Accenture is undervalued at current levels or if the market is simply bracing for more subdued growth ahead.

Most Popular Narrative: 24.5% Overvalued

Looking at the fair value set out in the most popular narrative, Accenture’s recent close of $252.04 is materially higher than the projected intrinsic value of $202.38. This gap highlights a disconnect between current sentiment and the detailed case made by retail investor FCruz.

*"After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name. EPS growth and margin expansion are intact; execution is visible despite a more selective demand environment."*

Key financial levers behind this valuation may surprise you. The narrative is driven by specific profit margin assumptions and the expectation of resilience through changing sector cycles. Curious which numbers push the price target so much lower than where shares trade now? Find out what could shift the narrative and the fair value by reading more.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing bookings growth and delayed consulting decisions may quickly shift sentiment if this is not countered by accelerating AI deal conversions in coming quarters.

Find out about the key risks to this Accenture narrative.

Another View: Market Ratios Paint a Different Picture

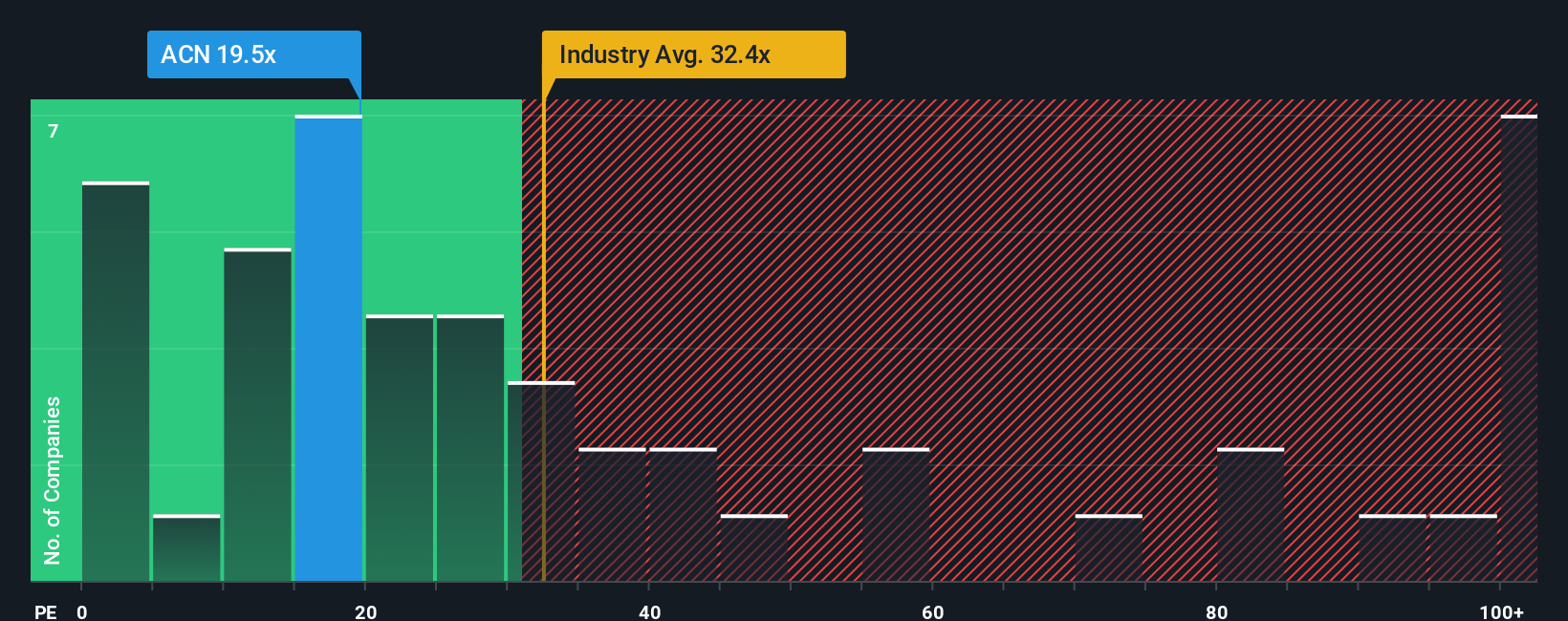

While one narrative points to overvaluation, Accenture’s price-to-earnings ratio of 20.4x stands out as significantly lower than both the US IT industry average of 32.4x and the peer average of 27.3x. Even more notably, it sits well below the fair ratio estimate of 38.4x. This suggests the market has either discounted future growth too harshly or is anticipating ongoing headwinds. Could the next catalyst shift sentiment, or will caution continue to weigh on Accenture’s stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Accenture Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can craft a unique narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready for More Investment Ideas?

Confidently uncover hidden opportunities. Don’t just stop at Accenture when there are other fast-moving stocks and innovative trends worth your attention. Let’s make your portfolio stand out from the rest!

- Boost your search for financial strength by scanning these 18 dividend stocks with yields > 3%, which consistently deliver impressive income streams above 3% yield.

- Seize the excitement in tech by tapping into these 25 AI penny stocks, companies poised to shape the future with real-world artificial intelligence advancements.

- Capitalize on market mispricing by targeting these 893 undervalued stocks based on cash flows before others spot these value-buy opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives