- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Earnings Growth Slows, Undervalued Versus Peers Challenges Bullish Narratives

Reviewed by Simply Wall St

Accenture (ACN) reported earnings growth of 5.7% over the past year, falling short of its five-year average of 7.4% per year. Looking ahead, analysts expect earnings to grow by 8.8% per year and revenue to rise by 5.3% per year. However, both rates are anticipated to trail the broader US market. With high-quality earnings and a relative value advantage compared to industry peers, investors are likely to see the current outlook as supportive of the company's valuation.

See our full analysis for Accenture.Next, we will see how these latest numbers measure up against the market's dominant narratives. Some stories are likely to hold up, while others may need to be reconsidered.

See what the community is saying about Accenture

AI Investments Fuel Future Momentum

- Accenture’s strategic commitment to Gen AI is reflected in $1.4 billion in new bookings and $600 million in Gen AI revenue this quarter. This provides a concrete foundation for future growth beyond historic averages.

- Analysts' consensus view highlights that heavy investment in Gen AI and high-growth acquisitions could accelerate revenue as clients increase adoption of digital transformations.

- This quarter’s $250 million in targeted acquisitions and double-digit cloud and security revenue growth are seen as key levers that could support both top-line expansion and improved net margins.

- Bulls point to the company’s position as a preferred partner for major tech-driven reinvention projects. This suggests Accenture is well placed to benefit as AI-driven IT spending ramps up.

Margins and Shareholder Returns Outweigh Headwinds

- Profit margins are projected to rise from 11.6% now to 12.3% within three years. The company returned $2.4 billion to shareholders via buybacks this quarter despite macroeconomic pressures and higher subcontractor costs.

- Analysts' consensus view notes that continued focus on cash flow and aggressive share repurchases could offset margin challenges, supporting steady EPS growth even as federal revenue slows and currency fluctuations impact results.

- Cloud and security businesses, both experiencing double-digit growth, are expected to drive higher margins by shifting the revenue mix toward more profitable services.

- While competitive pricing and global economic pressures remain risks, the consensus sees solid shareholder returns as a buffer against these uncertainties.

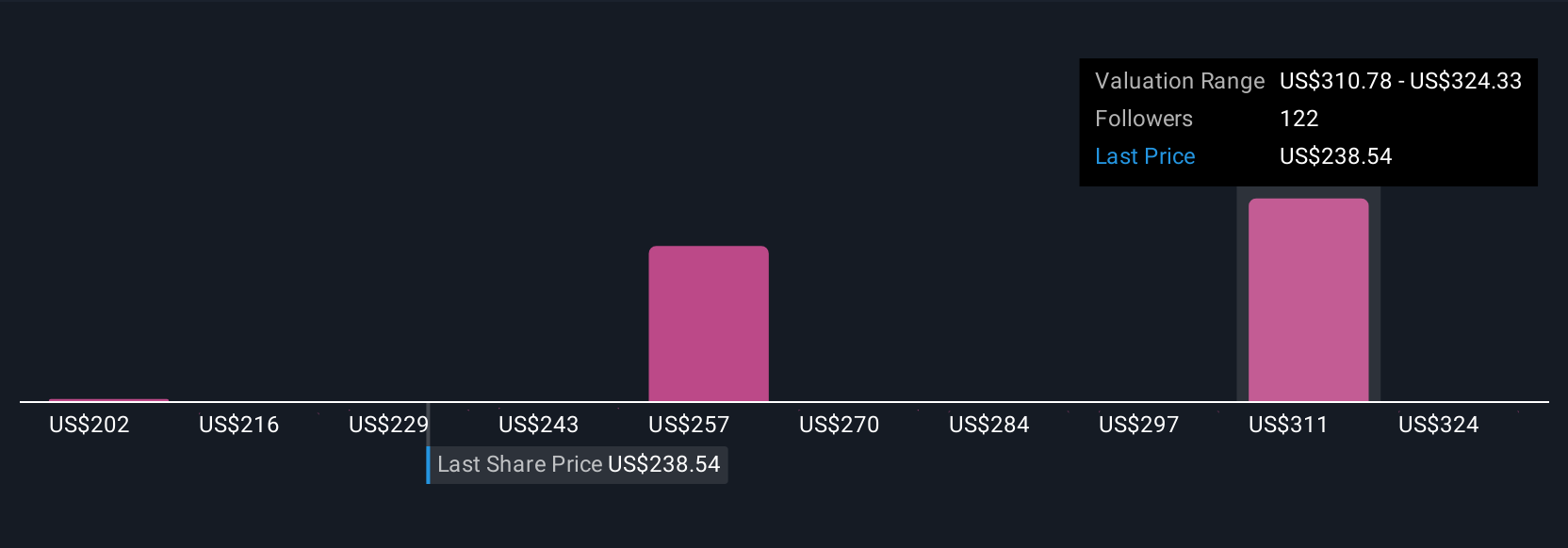

Valuation Discount Versus Industry and Fair Value

- With a current price-to-earnings ratio of 19.4x, Accenture is trading below both the IT industry average of 31.3x and its peer group at 22.7x. It is also notably below its DCF fair value estimate of $276.42 while the share price trades at $238.97.

- Analysts' consensus view underscores that for the share price to reach the consensus target of $280.55, Accenture would need to achieve $10.0 billion in earnings and trade at a forward PE of 25.7x. These figures will require both continued execution on growth initiatives and careful navigation of global challenges.

- The current discount to fair value and sector multiples gives investors room for upside if management delivers on AI and digital transformation strategies.

- However, divergent analyst price targets emphasize the role of execution risk and market dynamics in closing the valuation gap over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Accenture on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.Have your own take on the numbers? Share your perspective and craft your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

See What Else Is Out There

While Accenture’s valuation trades at a discount, near-term execution risk and slower revenue growth compared to peers present challenges to closing the gap.

If you’re looking for opportunities with more compelling upside potential, check out our undervalued stocks based on cash flows to compare companies that may offer stronger value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives