- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Assessing Valuation as Investor Sentiment Shifts and Share Momentum Stalls

Reviewed by Kshitija Bhandaru

Accenture (ACN) has seen its stock move only modestly in recent sessions, remaining relatively stable as market sentiment shifts. Investors may be weighing the consulting giant’s latest performance in comparison with its longer-term track record and valuations.

See our latest analysis for Accenture.

After a relatively stable stretch, Accenture’s 1-year total shareholder return is fractionally negative. This reflects cautious sentiment despite recent market shifts and steady fundamentals. With momentum lacking, investors seem to be reassessing expectations for growth and risk.

If you’re weighing what else might be gaining traction lately, broaden your search and uncover opportunities with fast growing stocks with high insider ownership

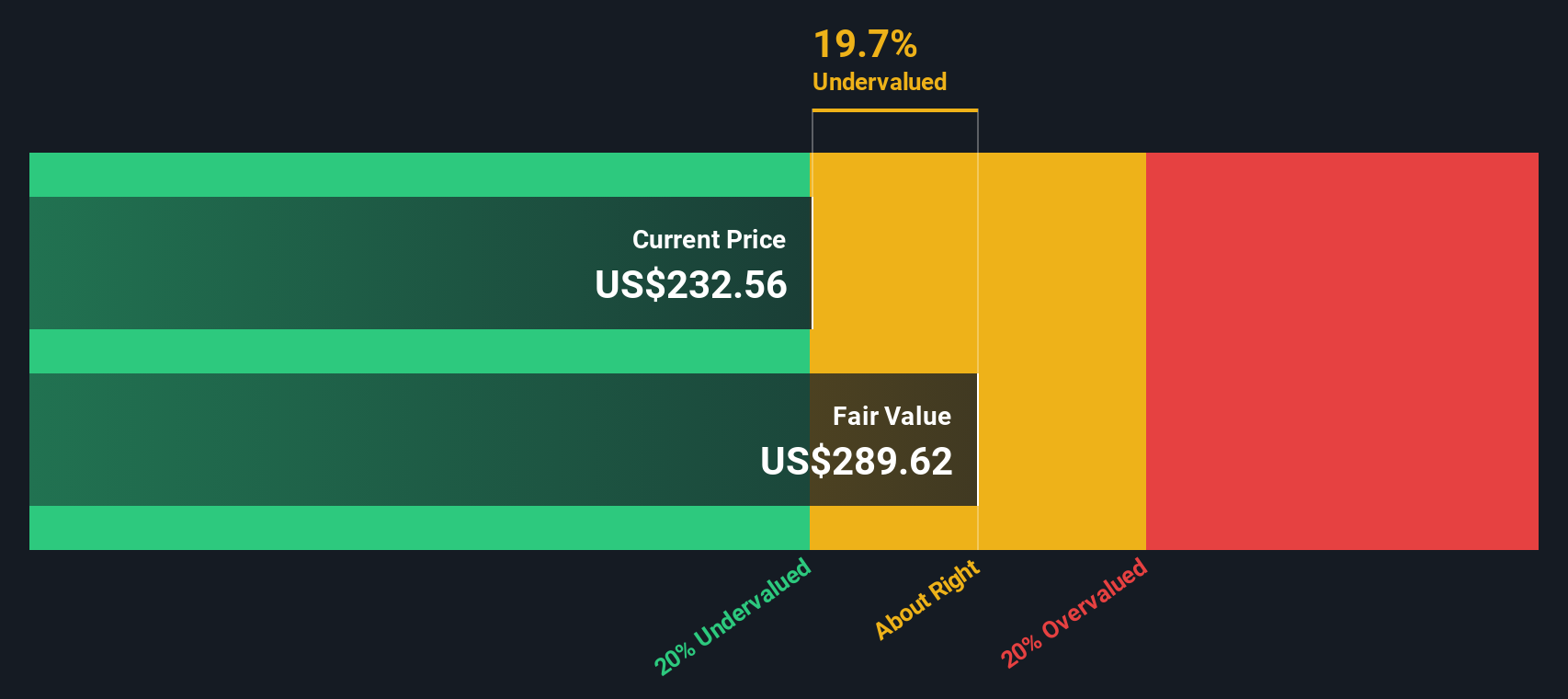

With shares hovering below analyst targets and fundamentals appearing intact, investors are left to debate whether Accenture is currently trading at a discount or if the market is already factoring in its potential for growth. Is there a buying opportunity here, or is everything already priced in?

Most Popular Narrative: 20.7% Overvalued

At $244.34, Accenture’s share price sits noticeably below the narrative fair value of $202.38, and the narrative pegs the stock as trading above its justified level based on forward-looking performance assumptions. This sets up a critical debate about whether recent momentum and business quality can live up to expectations.

Scale & Efficiency: Revenue (TTM) approximately US$68.5B, Operating margin around 16.8%, Net margin about 11.6%, ROE roughly 26.9%. Read-through: After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name.

Want to know the engine that powers this narrative’s high price? The secret hinges on a blend of robust profit margins, strong cash generation, and an operational profile that stands out from the industry pack. Curious what unique numbers underpin this valuation and why forecasts look bold? Uncover the specifics fueling this fair value by reading the full narrative.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in bookings and elongated client decision cycles could quickly challenge even the most optimistic assumptions about Accenture’s current valuation.

Find out about the key risks to this Accenture narrative.

Another View: What Does the DCF Say?

While the primary narrative points to Accenture being overvalued based on standard multiples, our DCF model tells a different story. According to this cash flow-based method, Accenture is trading about 11% below its fair value estimate, suggesting potential upside. Could the market be underestimating the company's enduring cash generation?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you have a different take or would rather rely on your own analysis, you can craft your own valuation narrative quickly and easily. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. These unique screens help you spot trends early, capture high potential, and build a smarter portfolio ahead of the crowd.

- Accelerate your portfolio’s growth by browsing these 910 undervalued stocks based on cash flows with strong fundamentals that could be flying under the radar.

- Capitalize on powerful income streams by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for investors who value consistent returns.

- Ride the AI revolution by exploring these 24 AI penny stocks positioned for long-term success in cutting-edge artificial intelligence sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives