- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler's (NASDAQ:ZS) investors will be pleased with their fantastic 327% return over the last five years

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the Zscaler, Inc. (NASDAQ:ZS) share price is up a whopping 327% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 11% in thirty days.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Zscaler

Zscaler isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Zscaler can boast revenue growth at a rate of 38% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 34% per year in that time. Despite the strong run, top performers like Zscaler have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

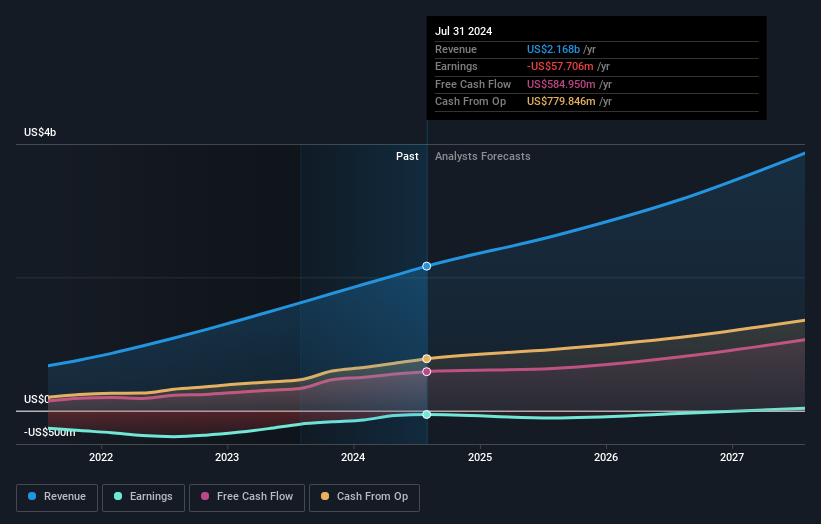

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Zscaler is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Zscaler in this interactive graph of future profit estimates.

A Different Perspective

Zscaler provided a TSR of 20% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 34% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Zscaler that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZS

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives