- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS) Valuation Check After New Peraton Zero Trust Multicloud Partnership Announcement

Reviewed by Simply Wall St

Peraton’s new strategic partnership with Zscaler (ZS) focuses on integrating hybrid multicloud infrastructure with cloud native Zero Trust security, targeting mission critical government and enterprise environments.

See our latest analysis for Zscaler.

For Zscaler, the Peraton deal lands during a choppy spell, with a 30 day share price return of minus 22.26 percent but a still solid year to date share price return of 28.14 percent and a resilient 3 year total shareholder return of 105.02 percent. This suggests that momentum has cooled in the short term while the longer term growth story remains intact.

If this kind of security driven growth story interests you, it could be worth exploring other high growth tech and AI names through high growth tech and AI stocks to see what else fits your watchlist.

With shares down sharply from recent highs but still boasting robust multi year returns, is Zscaler now trading at a discount to its long term cloud security potential, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 29.1% Undervalued

With Zscaler last closing at 232.78 dollars versus a narrative fair value of 328.22 dollars, the prevailing view leans toward meaningful upside if its growth thesis plays out.

The transition away from legacy security appliances (firewalls, SD WAN), in favor of unified cloud delivered security architectures, is gaining momentum across key verticals like retail and manufacturing. This is supporting a multi year replacement cycle that will boost platform adoption, revenue, and margins. Strategic platform innovation and programs like Z Flex are driving broader product adoption within existing accounts and enabling larger, multi year deals. This is increasing total contract value and supporting higher future operating margins through scale.

Curious how double digit growth, rising margins, and a premium future earnings multiple can still point to upside from here? The full narrative unpacks the aggressive revenue ramp, profit inflection, and valuation math behind that fair value call, including the debate between the most bullish and most cautious earnings paths.

Result: Fair Value of $328.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from cloud providers and ongoing cybersecurity talent shortages could constrain margins and challenge the long term Zero Trust growth story.

Find out about the key risks to this Zscaler narrative.

Another Lens on Valuation

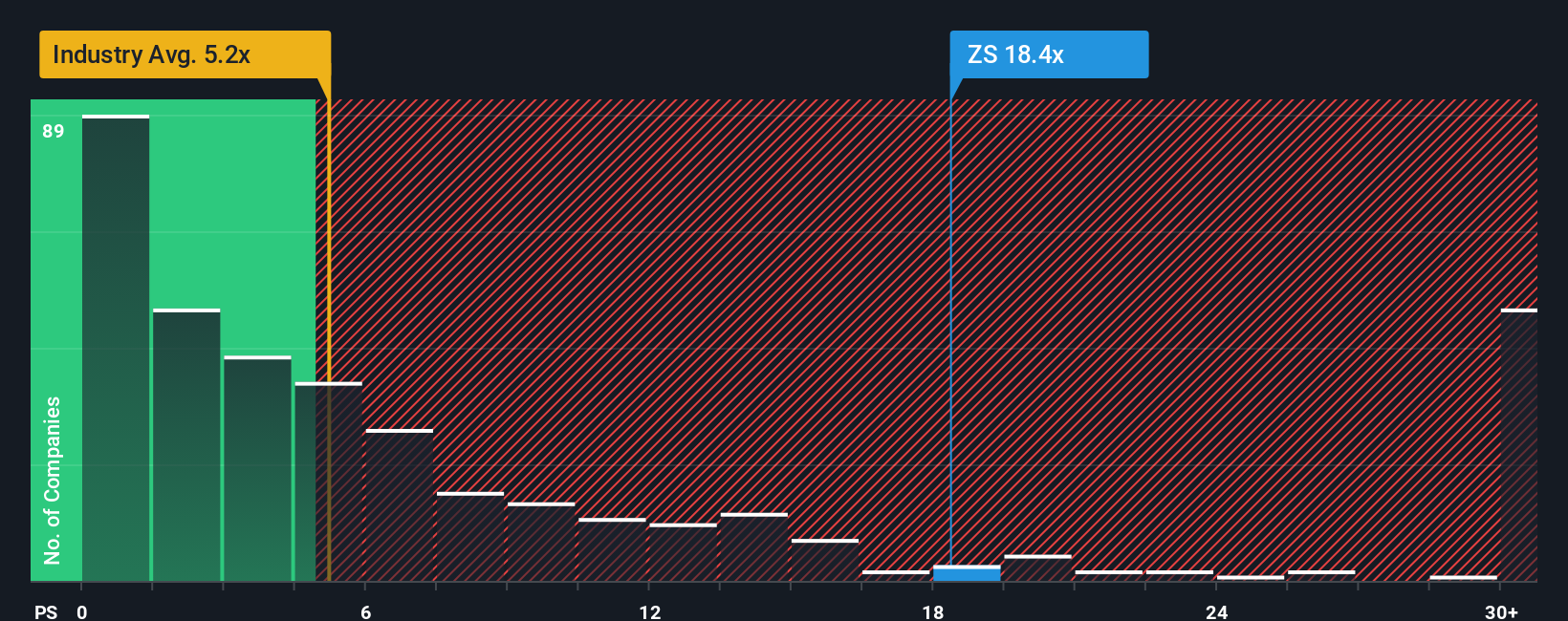

While the narrative model points to upside, a simple sales multiple tells a tougher story. Zscaler trades at 13.1 times sales, well above the US Software average of 4.8 times, peers at 11.9 times, and even its own fair ratio of 10.8 times. This raises clear valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zscaler Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a personalized Zscaler thesis in just a few minutes, Do it your way.

A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning these focused stock ideas so you do not miss the opportunities other investors are watching.

- Capitalize on potential mispricings by targeting quality companies trading at attractive valuations through these 909 undervalued stocks based on cash flows that may offer a margin of safety.

- Explore structural growth trends in automation and intelligent software by focusing on innovators in digital transformation via these 25 AI penny stocks.

- Strengthen your income strategy by tapping into established businesses offering cash payouts with these 13 dividend stocks with yields > 3% that can help anchor long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)