- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (NasdaqGS:ZS) Jumps 11% On Improved Earnings Report

Reviewed by Simply Wall St

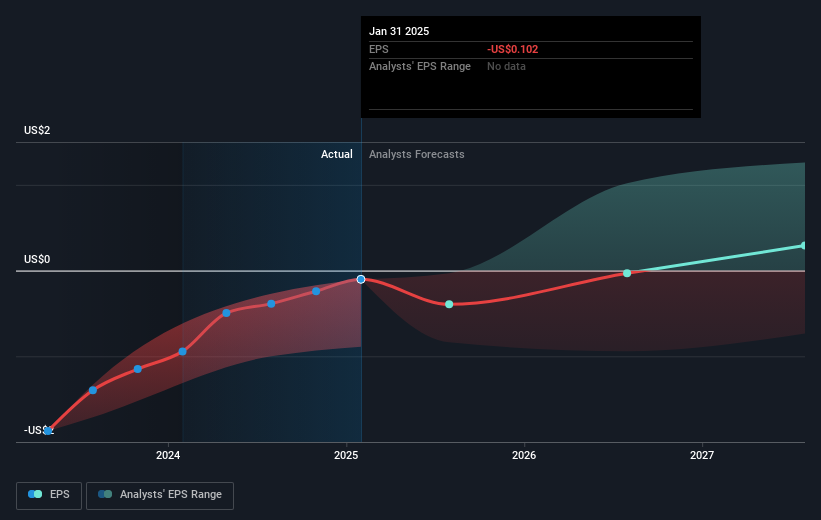

Zscaler (NasdaqGS:ZS) experienced a notable 11% increase in share price over the last week, attributed largely to the release of their second-quarter earnings report showing improved financial performance, including a reduction in net loss from the previous year. This positive financial development provided a counterpoint to broader market declines, where major indices like the S&P 500 and Nasdaq saw declines of approximately 2% and 4% respectively due to concerns over tariffs and economic forecasts. Adding to the momentum for Zscaler was the appointment of Phil Tee as Executive Vice President of AI Innovations, signaling potential growth in AI-driven offerings. Despite a challenging market environment impacting tech giants like Tesla and Apple, Zscaler's optimistic revenue guidance appears to have bolstered investor confidence. This move contrasts with the broader tech sector's performance, which saw declines amid overall market turbulence.

Navigate through the intricacies of Zscaler with our comprehensive report here.

Over the past five years, Zscaler has delivered a substantial total shareholder return of 399.19%. This impressive long-term performance underscores the company's considerable transformation and growth in the tech sector. A significant contributor has been Zscaler's consistent revenue growth, with earnings rising annually despite current profitability challenges. Key partnerships, such as the integration of Zscaler's Zero Trust Network Access with RISE with SAP in January 2025, played a crucial role in bolstering investor confidence.

Moreover, Zscaler's innovative strides in areas like Zero Trust Segmentation, announced in November 2024, further strengthened its market position. The company's expansion into AI-driven offerings, particularly following Phil Tee's appointment in March 2025, signals a commitment to leveraging emerging technologies. Nonetheless, despite outperforming its peers over the longer term, recent figures show Zscaler's one-year return in line with the software industry, which experienced a 3.7% rise amidst broader market challenges.

- Unlock the insights behind Zscaler's valuation and discover its true investment potential

- Explore the potential challenges for Zscaler in our thorough risk analysis report.

- Already own Zscaler? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

High growth potential with excellent balance sheet.