- United States

- /

- Software

- /

- NasdaqGS:ZM

Zoom (ZM) Net Margin Surges to 33.2%—One-Off Gain Sparks Debate on Earnings Sustainability

Reviewed by Simply Wall St

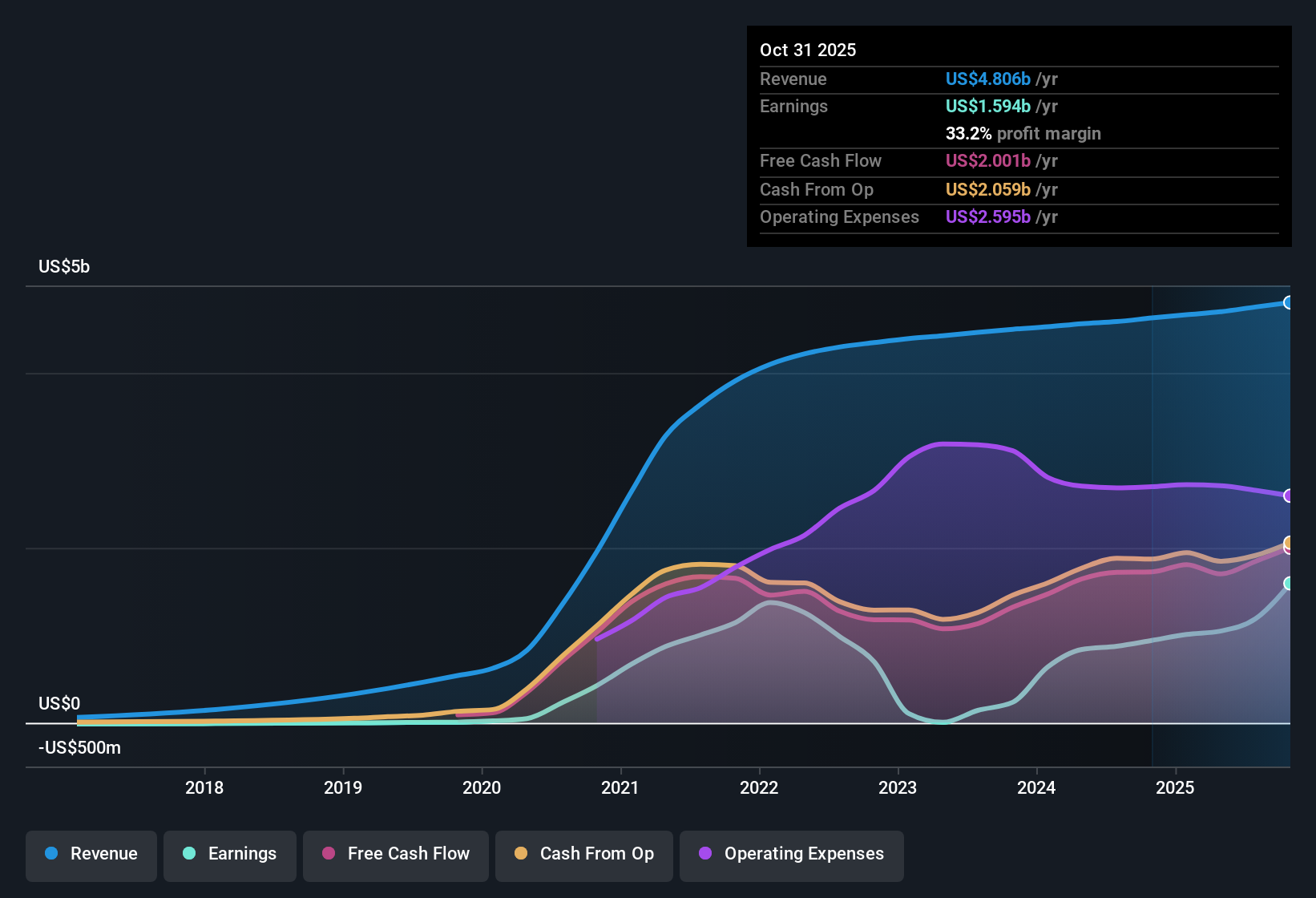

Zoom Communications (ZM) just posted its Q3 2026 results, reporting revenue of $1.2 billion and basic EPS of $2.05. Over the past year, the company has seen revenue climb from $4.6 billion to $4.8 billion, with EPS rising from $2.86 to $5.26. Margins leaned stronger this quarter, reflecting both the boost from a one-off gain and robust operational execution.

See our full analysis for Zoom Communications.Let’s see how these results compare to the popular narratives circulating in the community. Some stories will be confirmed, while others might face fresh scrutiny.

See what the community is saying about Zoom Communications

Profit Margin Surges on One-Off Gain

- Trailing twelve month net profit margins rose to 33.2%, up from 20.3% for the prior year, boosted by a $586.5 million non-recurring gain outlined in the data.

- Analysts' consensus view:

- The consensus narrative notes that Zoom’s improved margins directly support its stance as a stronger, more operationally efficient company. Rapid enterprise adoption of its AI-driven features is making the underlying business more resilient.

- This margin expansion contrasts with the consensus concern that future profits may be pressured by normalization as the one-off boost fades and new spending on innovation takes hold. This is a risk not immediately visible in this period’s bottom-line strength.

Profit Growth Far Outsized Earnings Trend

- Net income climbed 69.4% year over year to $1.59 billion, dramatically outpacing Zoom’s five-year average earnings growth rate of 6.7% per year according to the data provided.

- Analysts' consensus view:

- The consensus narrative points out that while this outsized net profit figure affirms Zoom’s ability to deliver value, it is a clear anomaly when set against the company’s longer-term growth patterns. This reinforces why both optimistic and cautious investors should treat last year’s pace as unsustainable.

- It is noteworthy that, despite the earnings surge, forward consensus forecasts still call for a 7.7% annual earnings decline over the next three years. This reflects mixed expectations among analysts about how much recent momentum can be sustained.

Valuation Remains Below Market Peers

- Zoom trades at a price-to-earnings ratio of 15.7x, a considerable discount to both peer averages and the broader US software industry (current sector PE: 35.0x), as well as its DCF fair value of $124.08.

- Analysts' consensus view:

- Consensus narrative highlights that even with modest projected revenue growth of 3.6% per year, which is below the US market at 10.5%, current valuation multiples suggest the market is baking in caution. Analysts believe there is 47% potential upside versus DCF fair value, supporting the idea that pessimism may be overdone.

- The current share price of $84.43 is also well below the analyst target of $94.58. This suggests a gap between what the market is pricing in and what analysts think is fair, given the combination of strong recent profit expansion and softer forward projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zoom Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the numbers? Take just a few minutes to share your perspective and shape your own story. Do it your way.

A great starting point for your Zoom Communications research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Zoom posted impressive short-term profits, analysts still expect annual earnings to decline over the next three years. This highlights inconsistent growth ahead.

If you prefer companies with a track record of dependable performance and fewer surprises, now is the time to focus on stable growth stocks screener (2073 results) for steadier opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)