- United States

- /

- Software

- /

- NasdaqGS:ZM

Zoom Communications (ZM) Unveils Advanced AI Concierge And New Zoom Hub Features

Reviewed by Simply Wall St

Zoom Communications (ZM) introduced product enhancements including the Zoom Virtual Agent and AI Companion, which are designed to advance customer support and scheduling, marking a significant step in automating industry-specific processes. The company's share price increased by 5.55% last week, a move that aligns with the overall positive sentiment in the market, which rose by 1.3%. While these innovations may substantiate Zoom's market presence, it is essential to note that mega-cap technology stocks saw mixed performances, indicating that the broader technological market dynamics could have also played a role in Zoom's price movement.

The recent product enhancements by Zoom Communications towards an AI-first platform may significantly influence the company's growth narrative. By potentially improving customer productivity and introducing new monetization opportunities, these advancements could drive revenue growth. However, the adoption of these new technologies remains uncertain, which may affect revenue and earnings forecasts. If successful, these innovations could strengthen Zoom's market presence, particularly with their enterprise segment initiatives.

Over the past year, Zoom's total shareholder return was 23.10%, providing a longer-term perspective on share performance. This comes with a backdrop where the company exceeded the US market's return of 15.8% over the same period, though it underperformed the US Software industry's 27.9% return. The recent share price movement from the introduction of new features reflects positive sentiment but is not indicative of guaranteed success.

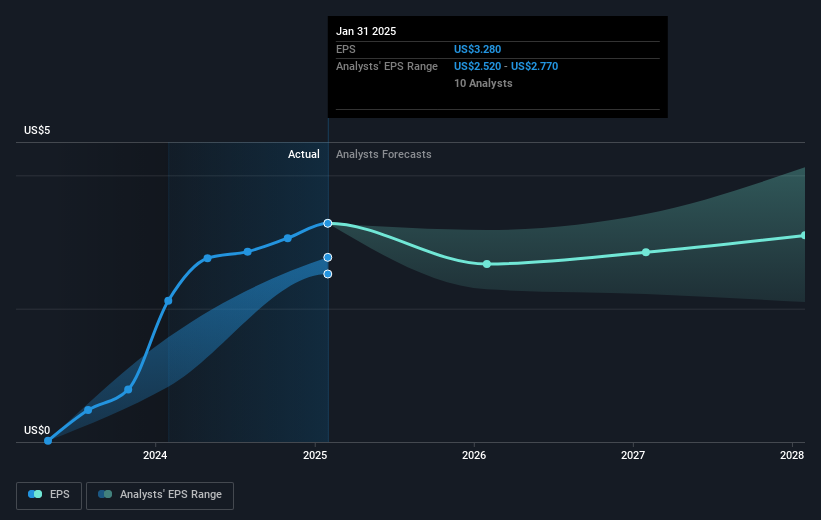

In terms of revenue and earnings forecasts, analysts expect Zoom's revenue to grow slowly at 3.1% annually with earnings increasing at a slightly higher rate of 3.52% per year. Given the current share price of US$73.64, there is a 23.7% gap to the average analyst price target of US$91.07, suggesting potential for upward movement if the market responds favorably to Zoom's AI-driven strategy. Analysts' consensus affirms a projected price increase; however, individual valuations vary, highlighting both opportunity and risk in the evolving technological landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives