- United States

- /

- Software

- /

- NasdaqCM:ZENA

ZenaTech (ZENA) Is Up 13.4% After Unveiling Quantum Hardware to Power AI Drones for Defense

Reviewed by Sasha Jovanovic

- In late September 2025, ZenaTech, Inc. announced the development of a proprietary quantum computing hardware platform designed to boost its AI drones’ real-time data processing for defense and commercial applications, including collaborations with the Department of War and NATO partners.

- This initiative signals a significant leap in the integration of quantum computing with drone technologies, promising new abilities in mission readiness, infrastructure inspection, and advanced predictive modeling across multiple industries.

- We'll explore how ZenaTech's entry into quantum-powered AI drones shapes its investment narrative through enhanced data intelligence capabilities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is ZenaTech's Investment Narrative?

To back ZenaTech as a shareholder, you have to believe in the company's long-term vision to pioneer the synergy of drones and quantum computing, despite its current lack of profits and volatile share price. The recent announcement of a proprietary quantum computing hardware platform is a meaningful shift, as it could reshape short-term catalysts. Prior to this news, revenue growth forecasts and expansion into new markets were the main near-term drivers, but ZenaTech’s entrance into quantum applications, particularly in defense and predictive analytics, introduces the possibility of faster customer adoption and new high-value contracts. At the same time, such an ambitious R&D effort intensifies the biggest existing risk: a limited cash runway and no clear profitability in the next three years. Execution will be critical, and future funding needs or delays could temper any short-term excitement brought by this new initiative. On the other hand, ZenaTech’s thin cash reserves are an important factor for investors to watch.

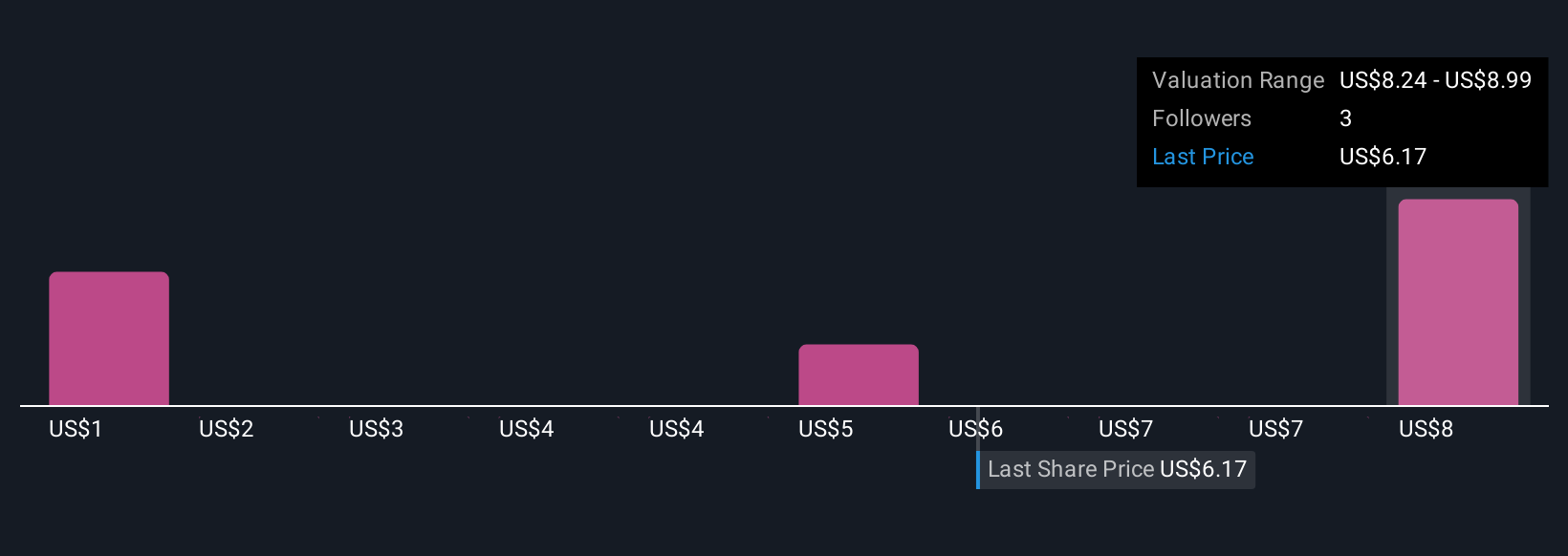

Our expertly prepared valuation report on ZenaTech implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on ZenaTech - why the stock might be worth as much as 51% more than the current price!

Build Your Own ZenaTech Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZenaTech research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free ZenaTech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZenaTech's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZenaTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ZENA

ZenaTech

An enterprise software technology company, develops cloud-based software applications in Canada.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives