- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf (NasdaqCM:WULF) Sees 15% Drop Last Week As 2024 Financials Show Narrowed Net Loss

Reviewed by Simply Wall St

TeraWulf (NasdaqCM:WULF) saw its share price decrease by 15% last week. The decline followed the company's announcement on February 28, detailing its financial results for 2024, where it reported a narrowed net loss compared to the previous year, alongside the completion of a significant share buyback program. While these developments occurred, broader market sentiment was impacted by President Trump's announcement of a 25% tariff on auto imports, contributing to a general downturn in markets, evidenced by a 1.7% decline over the past week. Such an environment can weigh on investment sentiment, influencing price movements like those experienced by WULF.

We've identified 3 possible red flags for TeraWulf that you should be aware of.

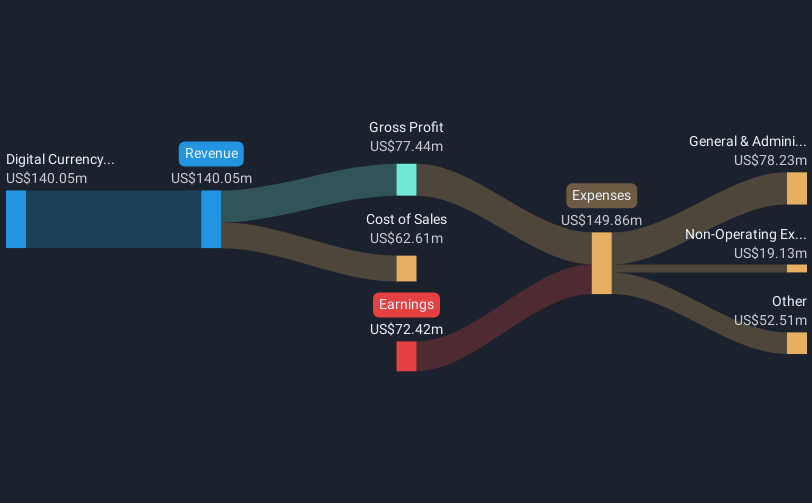

Over the past year, TeraWulf's total shareholder return was 3.42%. This performance exceeded the US Software industry's return of a 2.7% decline but fell short of the US market's return of 5.6%. Key events include the completion of a US$150 million share buyback program, significantly reducing outstanding shares by 6.27%, potentially supporting shares by providing a return of capital to shareholders. TeraWulf's revenue saw marked growth, doubling from US$69.23 million in FY 2023 to US$140.05 million in FY 2024, which may indicate positive operational progress despite ongoing unprofitability.

Operations expanded with the signing of long-term leases for data center infrastructure, enhancing future capacity. Early debt repayment of US$77.5 million also occurred, eliminating outstanding debt and potentially improving financial flexibility, though profitability remains a future goal. The promotion of Sean Farrell to Chief Operating Officer suggests ongoing internal restructuring to bolster management effectiveness as the company navigates its growth trajectory and profitability ambitions.

Understand TeraWulf's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

Slight with limited growth.

Similar Companies

Market Insights

Community Narratives