Wix.com (NASDAQ:WIX) Full Year 2024 Results

Key Financial Results

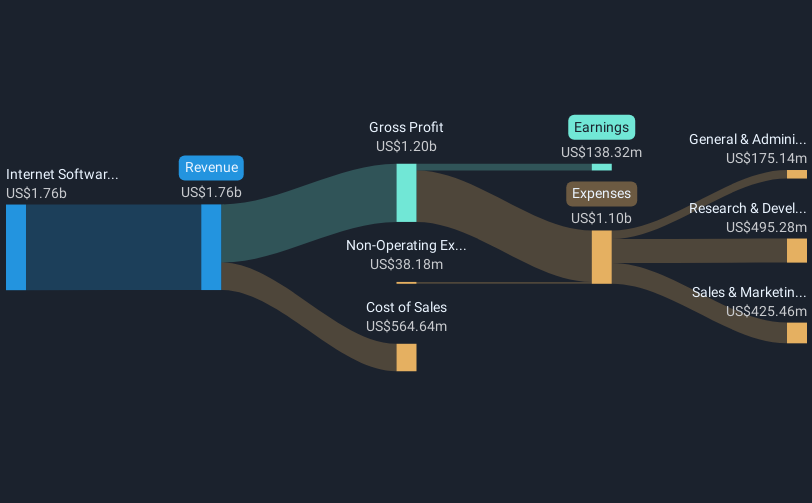

- Revenue: US$1.76b (up 13% from FY 2023).

- Net income: US$138.3m (up 317% from FY 2023).

- Profit margin: 7.9% (up from 2.1% in FY 2023). The increase in margin was driven by higher revenue.

- EPS: US$2.49 (up from US$0.58 in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Wix.com EPS Beats Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 9.6%.

In the last 12 months, the only revenue segment was Internet Software & Services contributing US$1.76b. The largest operating expense was Research & Development (R&D) costs, amounting to US$495.3m (45% of total expenses). Over the last 12 months, the company's earnings were enhanced by non-operating gains of US$38.2m. Explore how WIX's revenue and expenses shape its earnings.

Looking ahead, revenue is forecast to grow 11% p.a. on average during the next 3 years, compared to a 9.6% growth forecast for the IT industry in the US.

Performance of the American IT industry.

The company's shares are down 6.0% from a week ago.

Risk Analysis

What about risks? Every company has them, and we've spotted 2 warning signs for Wix.com you should know about.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion