- United States

- /

- Building

- /

- NYSE:CARR

3 Stocks Estimated To Be Undervalued By As Much As 32%

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced a notable upswing, with major indices like the Dow Jones Industrial Average and S&P 500 posting significant gains despite some sector-specific challenges. Amidst this environment of rising optimism and potential interest rate cuts, investors are on the lookout for stocks that may be undervalued by as much as 32%, presenting opportunities for those who prioritize strong fundamentals and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.55 | $28.24 | 48.5% |

| Sotera Health (SHC) | $17.37 | $33.57 | 48.3% |

| Old National Bancorp (ONB) | $21.89 | $41.49 | 47.2% |

| Nicolet Bankshares (NIC) | $126.76 | $242.17 | 47.7% |

| Li Auto (LI) | $18.32 | $34.93 | 47.6% |

| Huntington Bancshares (HBAN) | $16.18 | $31.33 | 48.4% |

| Freshworks (FRSH) | $12.35 | $24.01 | 48.6% |

| Fifth Third Bancorp (FITB) | $43.28 | $83.54 | 48.2% |

| Elastic (ESTC) | $69.53 | $135.76 | 48.8% |

| Advanced Micro Devices (AMD) | $206.13 | $397.53 | 48.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

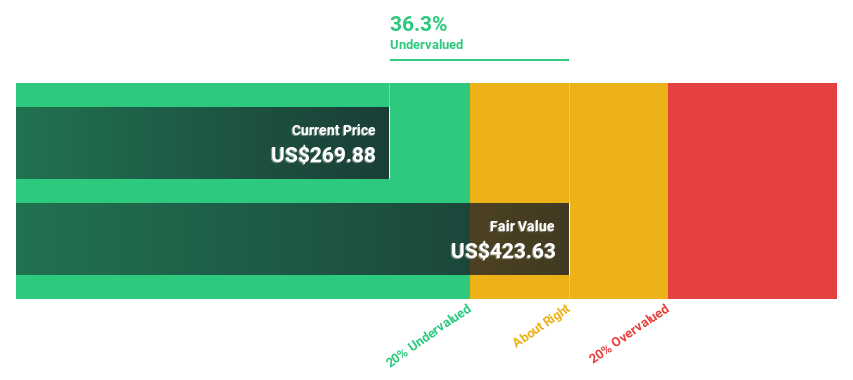

Workday (WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of $60.51 billion.

Operations: The company's revenue primarily comes from its cloud applications segment, which generated $8.96 billion.

Estimated Discount To Fair Value: 32%

Workday is trading at US$233.69, significantly below its estimated fair value of US$343.70, suggesting potential undervaluation based on cash flows. The company forecasts robust earnings growth of 32.14% annually, outpacing the broader U.S. market's growth rate. Recent partnerships with Google Cloud and Tabulera enhance operational capabilities and customer offerings, while strategic expansions like Workday GO aim to capture midsize business markets globally, bolstering revenue streams and financial performance prospects.

- Our comprehensive growth report raises the possibility that Workday is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Workday stock in this financial health report.

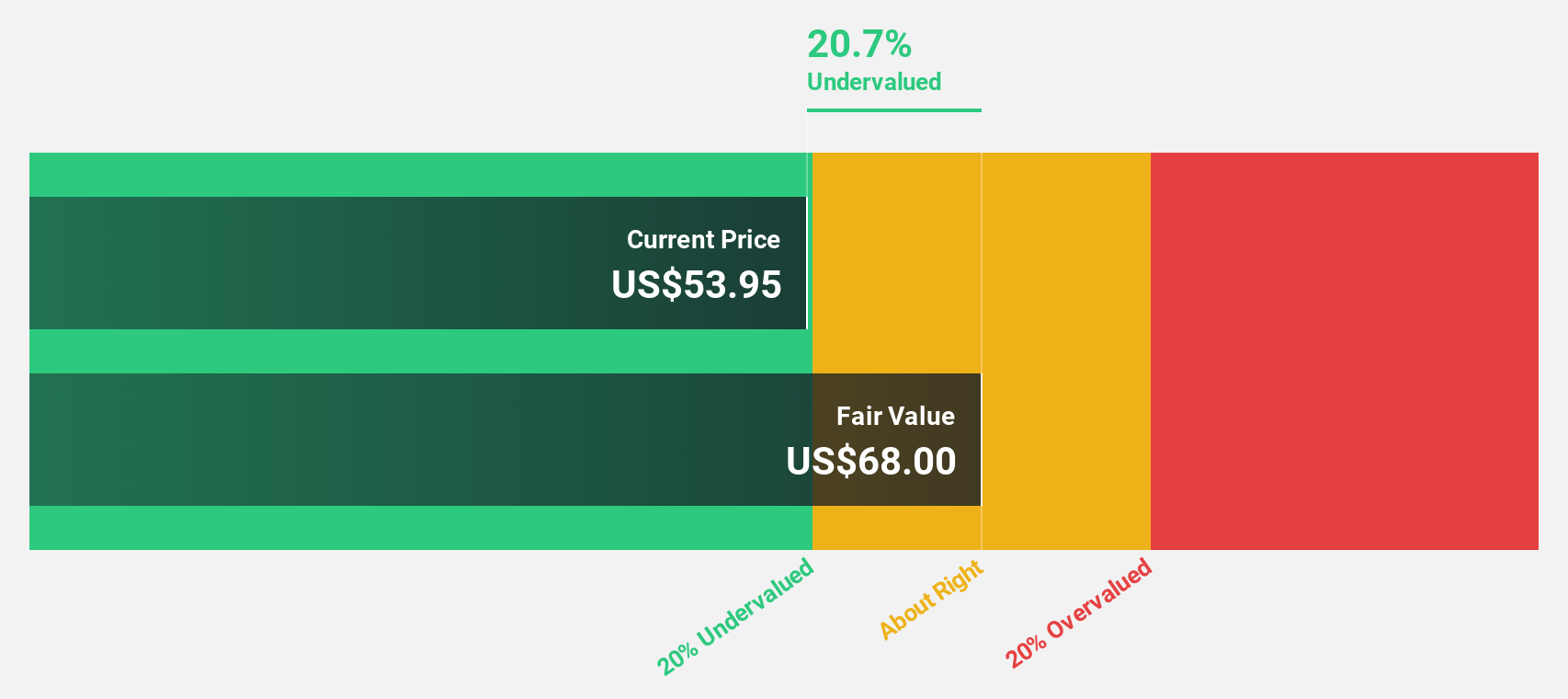

Carrier Global (CARR)

Overview: Carrier Global Corporation offers intelligent climate and energy solutions across the United States, Europe, the Asia Pacific, and internationally with a market cap of approximately $43.58 billion.

Operations: Carrier Global's revenue is derived from providing intelligent climate and energy solutions across various regions, including the United States, Europe, and the Asia Pacific.

Estimated Discount To Fair Value: 20.7%

Carrier Global, currently trading at US$53.95, is valued below its estimated fair value of US$68, highlighting potential undervaluation based on cash flows. Despite a recent reduction in 2025 sales guidance to US$22 billion and lower Q3 earnings compared to last year, the company anticipates significant annual earnings growth of 22.4%, surpassing the broader U.S. market's expectations. However, debt coverage by operating cash flow remains a concern for financial positioning.

- According our earnings growth report, there's an indication that Carrier Global might be ready to expand.

- Navigate through the intricacies of Carrier Global with our comprehensive financial health report here.

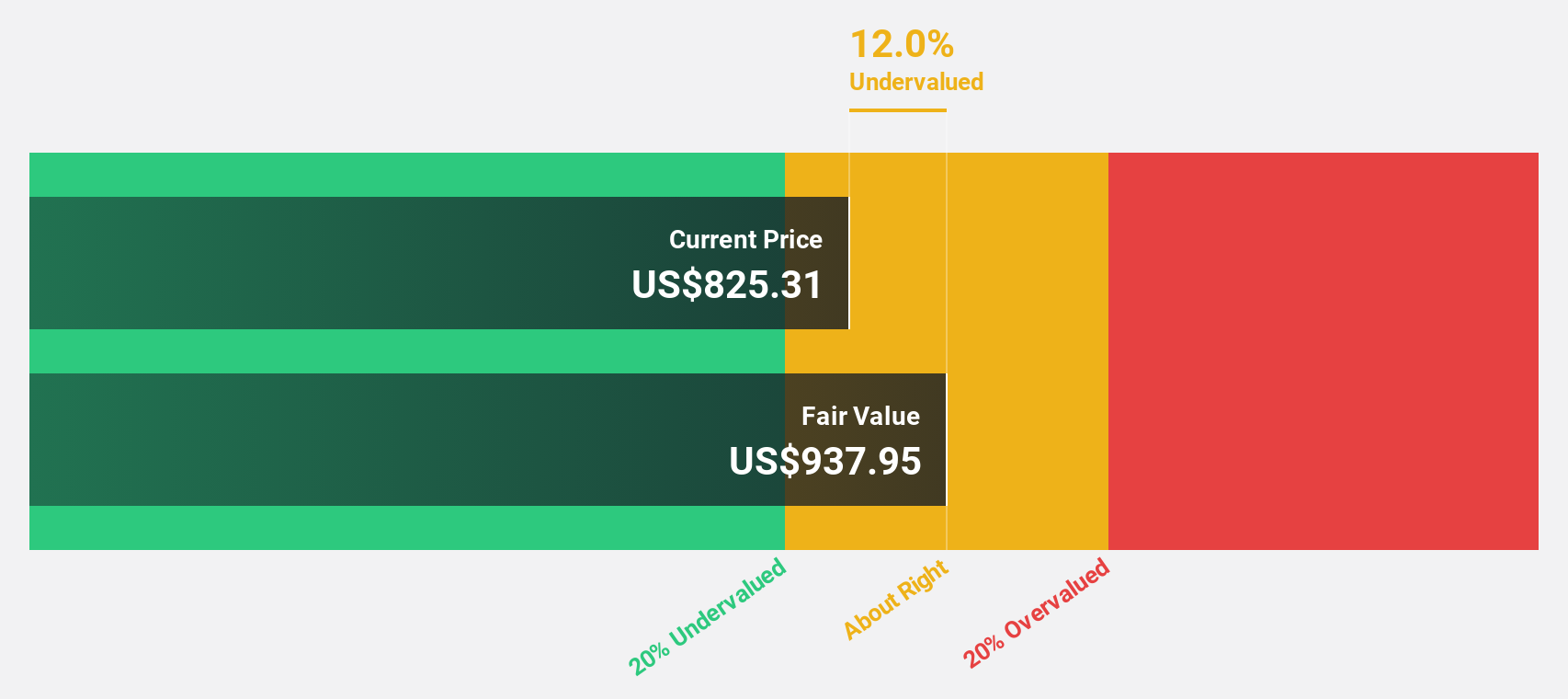

ServiceNow (NOW)

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions globally and has a market cap of approximately $169.27 billion.

Operations: ServiceNow generates revenue primarily from its Internet Software & Services segment, amounting to $12.67 billion.

Estimated Discount To Fair Value: 12%

ServiceNow, trading at US$825.31, is priced below its fair value estimate of US$937.95, suggesting it might be undervalued based on cash flows. Earnings are projected to grow significantly over the next three years, surpassing the broader U.S. market's growth rate. Recent strategic partnerships and integrations with tech giants like Microsoft and NVIDIA enhance ServiceNow's AI capabilities and enterprise solutions, potentially driving future revenue growth despite a lower return on equity forecasted in three years.

- Our expertly prepared growth report on ServiceNow implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in ServiceNow's balance sheet health report.

Key Takeaways

- Get an in-depth perspective on all 208 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success