- United States

- /

- Software

- /

- NasdaqGS:VRNT

Does the Thoma Bravo Deal Mean Verint Shares Offer More Value in 2025?

Reviewed by Bailey Pemberton

Figuring out what to do with Verint Systems stock right now is more complicated than ever, but also more interesting. If you have been watching the ticker lately, you might have noticed little movement in the past week, but a rollercoaster across the longer term. Verint is down just 0.2% for the past month, but a steeper 24.1% year-to-date and 13.5% over the last year. And that is not the whole story. For three and five year periods, the stock is down more than 40% and 24% respectively. Something fundamental is shifting.

The main driver behind this sudden change in perception has come from the news that Thoma Bravo has agreed to acquire Verint for $20.50 per share in cash. That figure has now set a clear ceiling and a floor for short-term price action, which explains why there has not been much volatility as traders focus on the takeover price. Alongside that, two high-profile analyst downgrades have rolled in over the last week, both citing the purchase deal as a reason for their more neutral outlooks. While that would normally spook investors, in this case, it simply reflects the reality that big upside or downside is now dictated by the buyout terms, not by unpredictable business shifts.

But here is where it gets interesting: even with all these headlines, Verint still scores an impressive 5 out of 6 on our valuation scorecard (where each check means the stock is undervalued in a different way). Is this suggesting untapped value, even with a takeover in the works? To answer this, let us walk through the key valuation approaches and hint at a more holistic way to think about valuation, which we will dive into at the end of the article.

Why Verint Systems is lagging behind its peers

Approach 1: Verint Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today's dollars. This approach is often favored by analysts because it focuses on the business's ability to generate actual cash over time, instead of relying solely on earnings or book value.

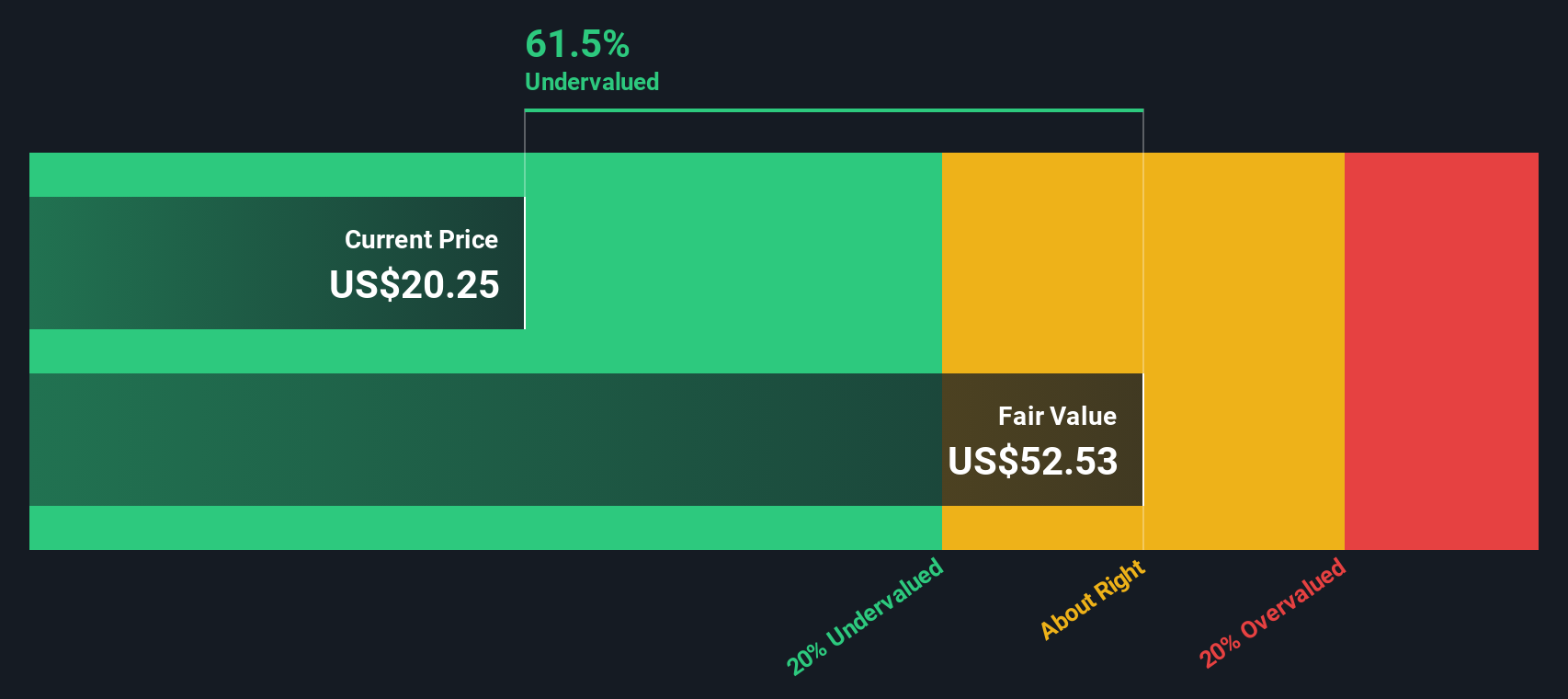

For Verint Systems, the DCF model projects cash flows using recent numbers and analyst estimates for the next five years and then extrapolates further based on reasonable long-term assumptions. The company reported Last Twelve Months (LTM) Free Cash Flow (FCF) of $109.6 million. Analyst projections see FCF growing steadily, reaching $218.8 million by 2030 as part of the two-stage calculation method.

All projections and estimated values are denominated in US dollars. According to this model, Verint’s intrinsic value per share is $52.71. This figure is notably higher than the current buyout price of $20.50, indicating the stock trades at a 61.5% discount relative to its underlying cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verint Systems is undervalued by 61.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Verint Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true yardstick for valuing profitable companies like Verint Systems. This metric is popular because it offers a simple way to compare how much investors are willing to pay for each dollar of earnings, making it easier to spot bargains or overpriced stocks within the same sector.

However, not all PE ratios are created equal. Expectations around a company’s future growth and the riskiness of its business both impact what is considered a reasonable or “fair” PE multiple. Fast-growing or highly profitable companies tend to command higher ratios, while companies facing more uncertainty generally see lower ones.

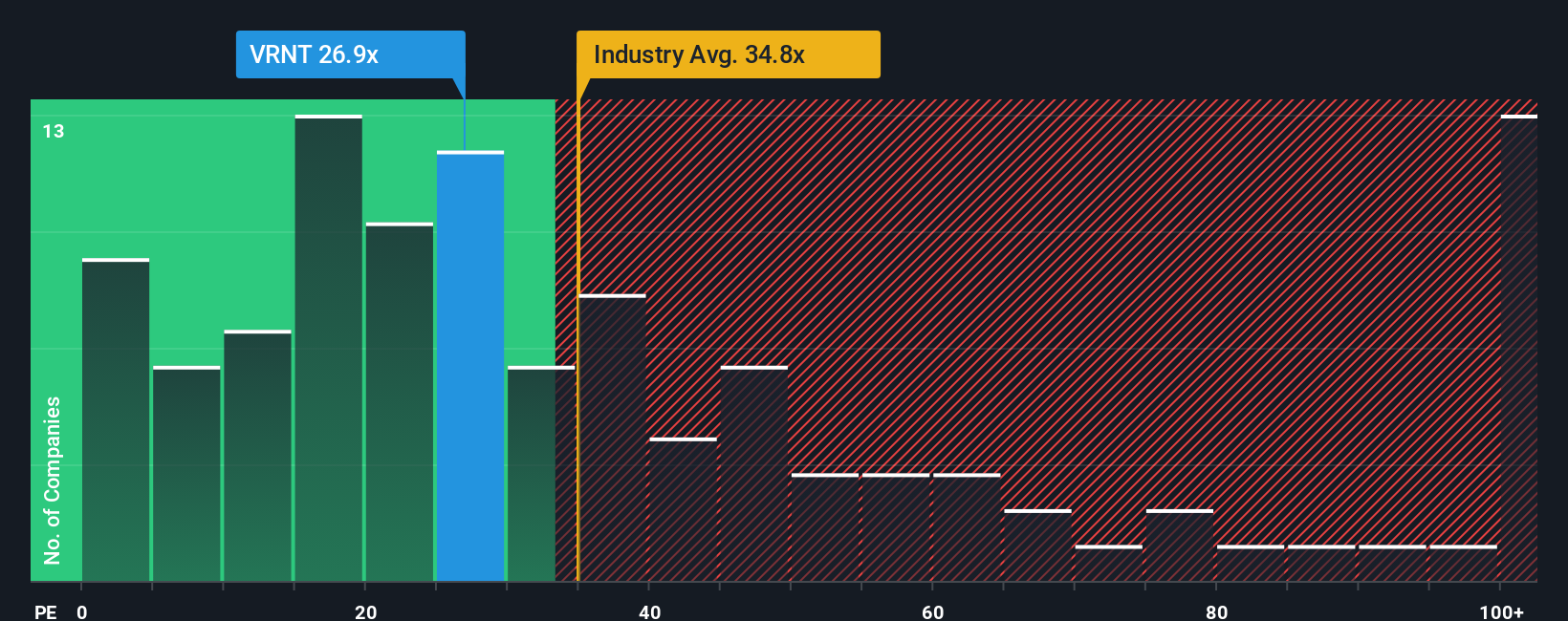

For Verint Systems, the current PE ratio sits at 26.9x. That is well below the Software industry average of 35.4x, as well as the peer group average of 101.5x. On the surface, this could indicate relative undervaluation, but context is crucial.

This is where Simply Wall St’s “Fair Ratio” comes in. Rather than relying strictly on industry or peers, the Fair Ratio combines earnings growth, profit margins, market cap, and company-specific risks into a single, balanced number. For Verint, the Fair Ratio stands at 45.3x, notably higher than its current 26.9x multiple. This suggests that the market is underappreciating Verint based on its fundamentals and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verint Systems Narrative

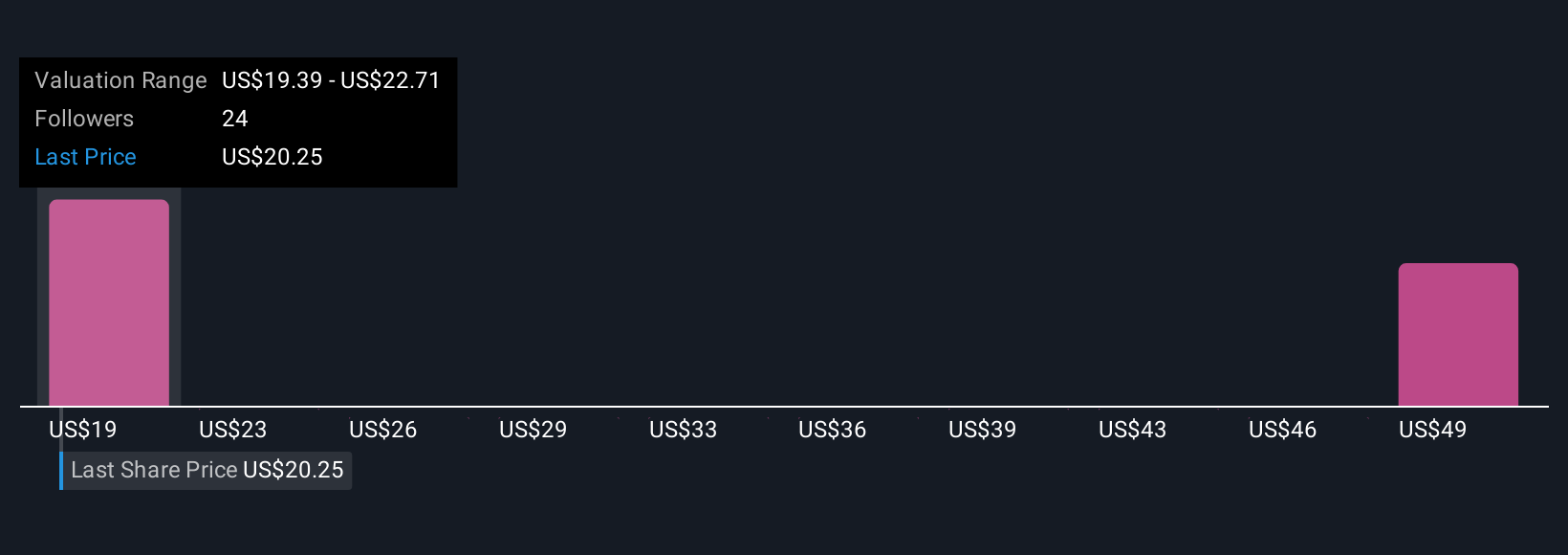

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your investment story for a company, connecting numbers such as fair value, future revenue, earnings, and margins with your unique perspective about what will drive Verint Systems forward. Instead of just crunching ratios, Narratives link Verint’s business developments, such as its AI momentum or its exposure to competitive risks, to your own forecast and estimate of fair value.

Using Narratives on Simply Wall St’s Community page (trusted by millions of investors) makes investing far more personal and intuitive. Narratives let you compare your fair value calculation to the current share price so you can decide for yourself if it is the right time to buy, hold, or sell. Best of all, Narratives update automatically whenever material news or earnings drop, keeping your thesis fresh with every key event.

For example, one investor could believe that Verint’s widespread AI adoption and margin expansion will lift fair value well above $52, while another might focus on uncertain earnings and industry competition and set theirs at $20.50. Your Narrative empowers you to make decisions confidently as you track the story, the numbers, and your investment all in one view.

Do you think there's more to the story for Verint Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNT

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives