- United States

- /

- Software

- /

- NasdaqGS:VRNS

Varonis Systems, Inc.'s (NASDAQ:VRNS) Share Price Not Quite Adding Up

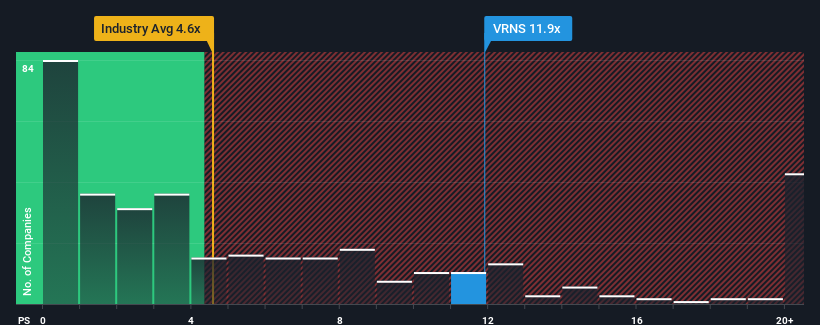

You may think that with a price-to-sales (or "P/S") ratio of 11.9x Varonis Systems, Inc. (NASDAQ:VRNS) is a stock to avoid completely, seeing as almost half of all the Software companies in the United States have P/S ratios under 4.6x and even P/S lower than 1.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Varonis Systems

What Does Varonis Systems' P/S Mean For Shareholders?

Recent times haven't been great for Varonis Systems as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Varonis Systems.Is There Enough Revenue Growth Forecasted For Varonis Systems?

The only time you'd be truly comfortable seeing a P/S as steep as Varonis Systems' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.6% last year. Pleasingly, revenue has also lifted 55% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 19% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Varonis Systems' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Varonis Systems' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Varonis Systems trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Varonis Systems that you should be aware of.

If you're unsure about the strength of Varonis Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.