- United States

- /

- IT

- /

- NasdaqGS:VNET

Can VNET Group’s Stock Momentum Continue After Recent Buyout Proposal?

Reviewed by Bailey Pemberton

Thinking about what to do with VNET Group stock? You are definitely not alone. It has been a roller coaster for shareholders, with the price jumping a whopping 33.9% in the last month and up an eye-popping 109.1% since the start of the year. If you have been holding on for the long-term, you have enjoyed a 151.3% return over the past year, but maybe you are also feeling the sting from further back when the stock was down 54.1% over five years. Those big swings have a way of making every decision feel weighty, whether you are evaluating new risks or wondering if rapid gains can keep coming.

Part of this recent momentum reflects shifting market sentiment about data center operators and new optimism around Chinese tech infrastructure, which suddenly brought VNET Group into much sharper focus for investors. Even as the company rides this wave, the real question is about value. Is the current price still attractive or already stretched? To answer that, we will dig into how VNET Group stacks up against key valuation yardsticks. Out of six classic checks we use to spot undervalued stocks, VNET passes three, so it earns a value score of 3. It is not the cheapest name out there, but it is far from the most expensive.

Let us walk through those valuation methods together. But do not worry, at the end we will also look at a smarter, more holistic approach for truly understanding what this stock might be worth right now.

Approach 1: VNET Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting those amounts back to today’s value. This helps investors gauge what the business may truly be worth, beyond short-term market swings.

For VNET Group, the DCF model uses a 2 Stage Free Cash Flow to Equity approach, with all cash flows calculated in CN¥. The company’s latest twelve months Free Cash Flow is negative, at nearly CN¥2.12 billion. Analyst forecasts suggest cash flows will stay in the red through at least 2027, but are expected to turn positive in 2028. By 2029, Free Cash Flow is projected to reach about CN¥1.05 billion, with Simply Wall St estimating further annual increases for another five years.

After crunching the numbers, the DCF model calculates an intrinsic value of $8.94 per share. However, compared to the current market price, this figure represents an 18.4% premium and suggests VNET Group stock is trading above what its cash flows justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VNET Group may be overvalued by 18.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: VNET Group Price vs Sales

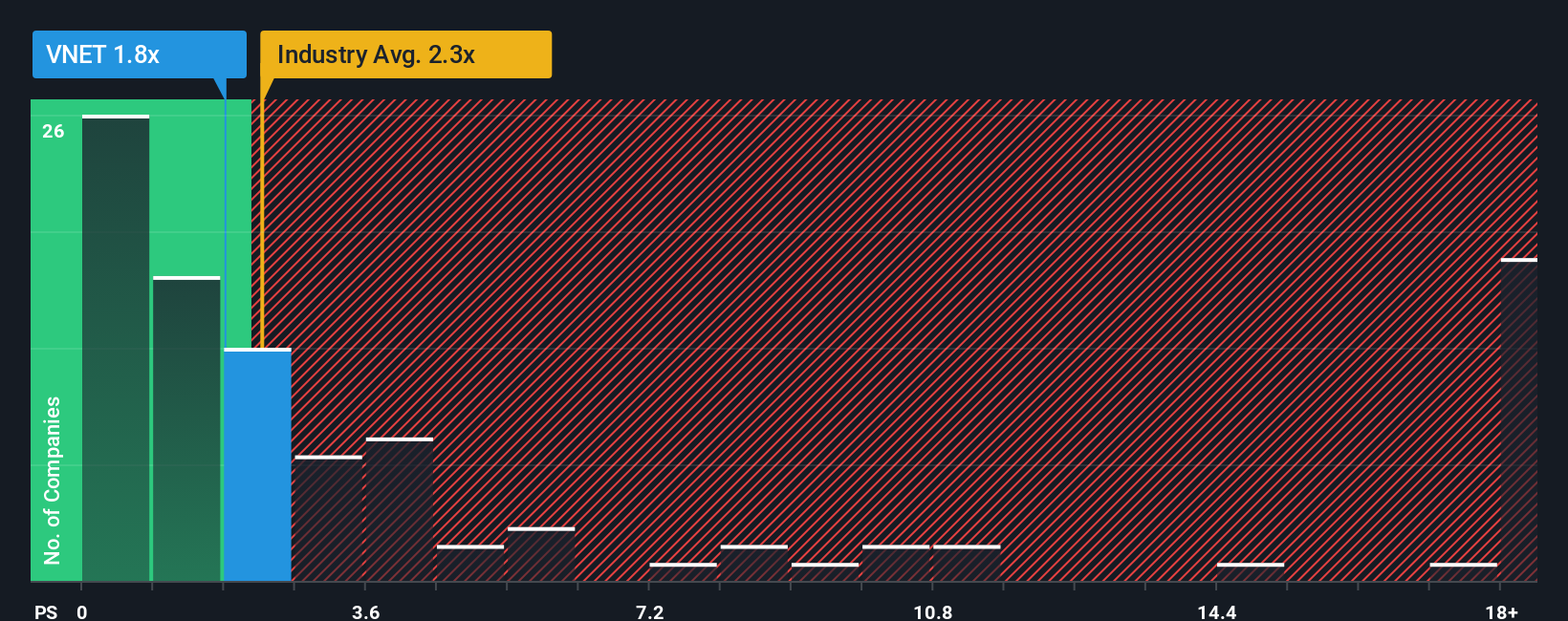

For companies like VNET Group, the price-to-sales (P/S) ratio is particularly insightful, especially when the business may not yet be consistently profitable or is in a high-growth industry. The P/S multiple focuses on how much investors are willing to pay for each dollar of revenue. This makes it a practical gauge when earnings are volatile or negative.

What counts as a “normal” or “fair” P/S ratio depends on growth prospects and risk. Rapidly growing companies or those with strong industry tailwinds often warrant higher multiples, while those facing more uncertainty tend to have lower ones.

VNET Group currently trades at a P/S ratio of 2.24x. That is just below the IT industry average of 2.38x and also under the peer group average of 3.78x. To provide more context, Simply Wall St’s proprietary Fair Ratio is used, reflecting the unique blend of VNET’s revenue growth, industry, profit margins, market cap, and specific risk factors. For VNET Group, the Fair Ratio is calculated at 2.85x. This offers a more tailored benchmark than a simple industry or peer comparison, as it is designed to reflect the company’s actual growth, risks, and financial profile.

Comparing VNET Group’s actual P/S to its Fair Ratio shows the stock is currently trading below what would be considered fair value based on its fundamentals. The difference between 2.24x and 2.85x is significant enough to suggest that the market may be underestimating the company’s potential.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your VNET Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, structured story where you lay out your view on a company, combining your assumptions about future revenue, earnings, and margins with your fair value estimate. This means your perspective includes not just numbers, but also the thinking behind them.

With Narratives, you connect the facts, such as recent earnings or business strategy, directly to a forecast and then translate that into a fair value for the company. This approach powers smarter decisions by making it simple to compare your fair value against the current market price, helping you judge if it is a time to buy, sell, or hold.

Simply Wall St’s Community page, trusted by millions of investors, lets you create or explore Narratives for VNET Group and see how other investors are thinking. As news or results come in, Narratives update automatically so your view always reflects the latest information.

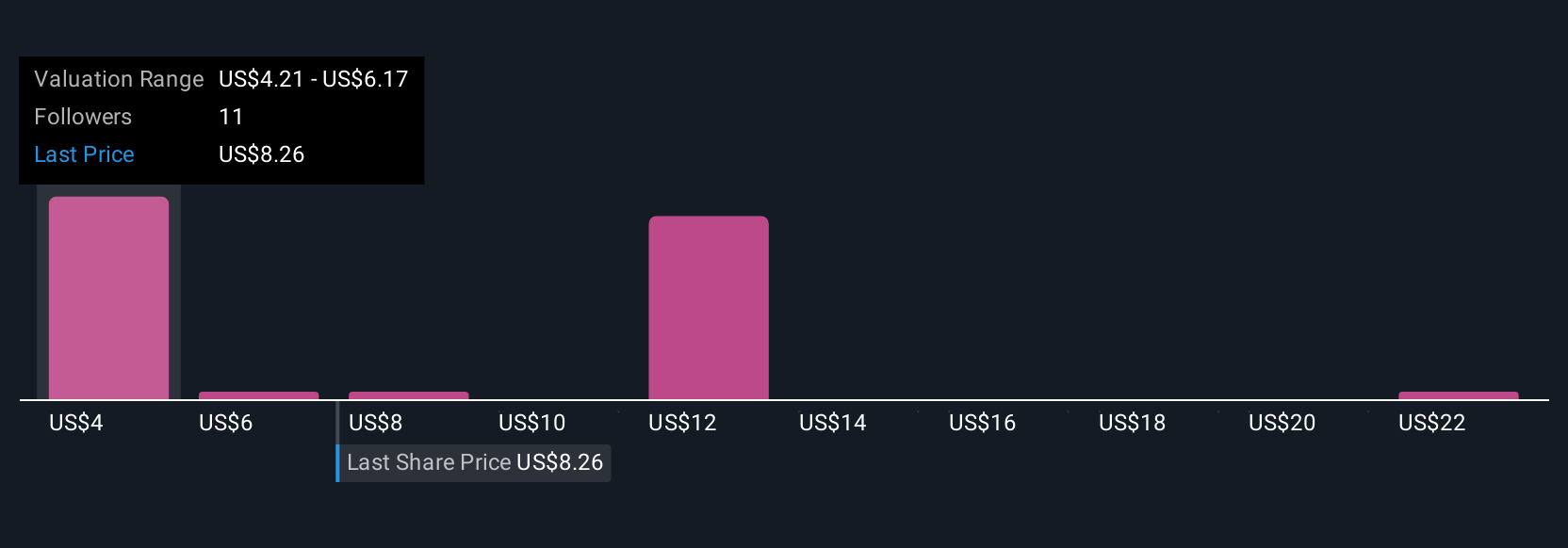

For example, some investors in the community see VNET Group’s growth prospects as so strong they assign a fair value as high as $25.31, while others warn of debt risks and set their target as low as $5.74.

Do you think there's more to the story for VNET Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)