- United States

- /

- Software

- /

- NasdaqGS:TRMB

Trimble (TRMB) Valuation Check As Analyst Optimism Grows Around Recurring Revenue And Growth Targets

Reviewed by Simply Wall St

Recent analyst actions around Trimble (TRMB), including an upgrade from KeyBanc and an outperform reiteration from Oppenheimer, have drawn fresh attention to the stock and its growth focus.

See our latest analysis for Trimble.

At a latest share price of $80.61, Trimble’s recent 1-day and 7-day share price returns of 1.38% and 2.91% sit alongside a 90-day share price return of 6.58% and a 1-year total shareholder return of 14.78%. Investors are weighing its Lucid Gravity partnership and recurring revenue plans as they evaluate this recent performance.

If Trimble’s recent interest in advanced positioning for EVs has caught your eye, this could be a good moment to look across auto manufacturers as you think about where technology and mobility intersect next.

With Trimble trading at $80.61, showing a 1-year total return of 14.78% and sitting around 24% below the average analyst price target, you have to ask: is there real upside here, or is future growth already priced in?

Most Popular Narrative: 18.2% Undervalued

With Trimble last closing at $80.61 and the most followed narrative pointing to fair value of $98.50, the gap hinges on confidence in its long term earnings power.

The targeted "3-4-30" framework, calling for $3B in annualized recurring revenue, $4B in sales and a 30 percent EBITDA margin by 2027, is described as a credible roadmap that could drive sustained double digit earnings growth and multiple expansion if achieved or exceeded.

Curious what ties that 3-4-30 roadmap to a near $100 fair value tag? Revenue mix, margin lift and a future earnings multiple all quietly do the heavy lifting.

Result: Fair Value of $98.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that near $100 fair value view still leans on Trimble hitting its 3-4-30 goals while avoiding setbacks related to softer government spending or tougher competition in AI software.

Find out about the key risks to this Trimble narrative.

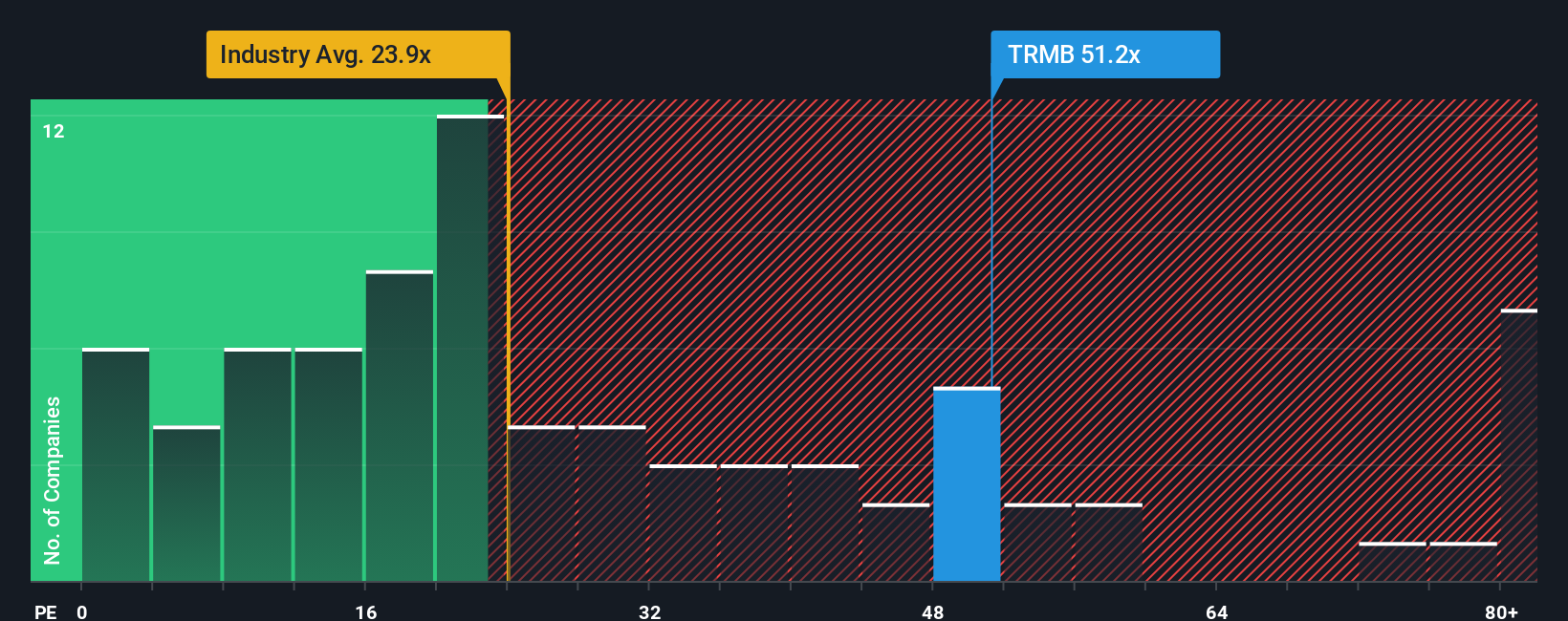

Another View: Multiples Paint a Tougher Picture

That 18.2% undervalued narrative leans on future earnings power, but today’s market multiples tell a different story. Trimble trades on a P/E of 53.6x, compared with 32.2x for the US Software industry, 38.8x for peers, and a fair ratio of 36.8x. That premium suggests less margin for error if growth or margins fall short. Which story do you think holds up best?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trimble Narrative

If you see the numbers differently or simply prefer to test your own view, you can build a Trimble story from the ground up in a few minutes: Do it your way.

A great starting point for your Trimble research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Trimble has sparked your interest, do not stop here. The next step is lining up a few more ideas so you are not relying on a single story.

- Spot potential value with strong cash flow support by checking out these 879 undervalued stocks based on cash flows that could fit a more disciplined price tag.

- Target growth at the edge of new technology by scanning these 28 AI penny stocks that are working on real world AI applications.

- Lock in income focused opportunities by reviewing these 12 dividend stocks with yields > 3% that may offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026