- United States

- /

- Software

- /

- NasdaqGS:TEAM

High Growth Tech Stocks in US Market for October 2025

Reviewed by Simply Wall St

The U.S. stock market has recently seen a resurgence, with the S&P 500 and Nasdaq reaching record highs amid a rebound in tech stocks, while the Federal Reserve's interest rate cuts have added an extra layer of complexity to investor decision-making. In this environment, identifying high-growth tech stocks involves evaluating companies that are well-positioned to capitalize on emerging technologies and trends such as artificial intelligence and data streaming, which are currently driving market enthusiasm.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Circle Internet Group | 27.85% | 82.08% | ★★★★★☆ |

| Aldeyra Therapeutics | 41.75% | 73.80% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Palantir Technologies (PLTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Palantir Technologies Inc. develops software platforms for intelligence communities to aid in counterterrorism efforts globally, with a market cap of $432.17 billion.

Operations: The company generates revenue through two primary segments: Commercial, contributing $1.54 billion, and Government, with $1.90 billion in revenue. The focus is on providing software solutions that support intelligence operations across various regions.

Palantir Technologies has demonstrated impressive growth, with a notable 25.1% annual revenue increase and an even more striking 88.7% earnings surge over the past year, outpacing the software industry average of 16.3%. This growth trajectory is supported by strategic partnerships, such as the recent collaboration with OneMedNet to leverage AI in healthcare analytics, potentially tapping into a $868 billion market by 2030. Palantir's commitment to R&D is evident from its significant investment in developing robust AI platforms that enhance data interoperability and security across various sectors including defense and healthcare, positioning it well for sustained innovation and market expansion.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation develops collaboration software designed to enhance productivity for organizations globally, with a market cap of $39.38 billion.

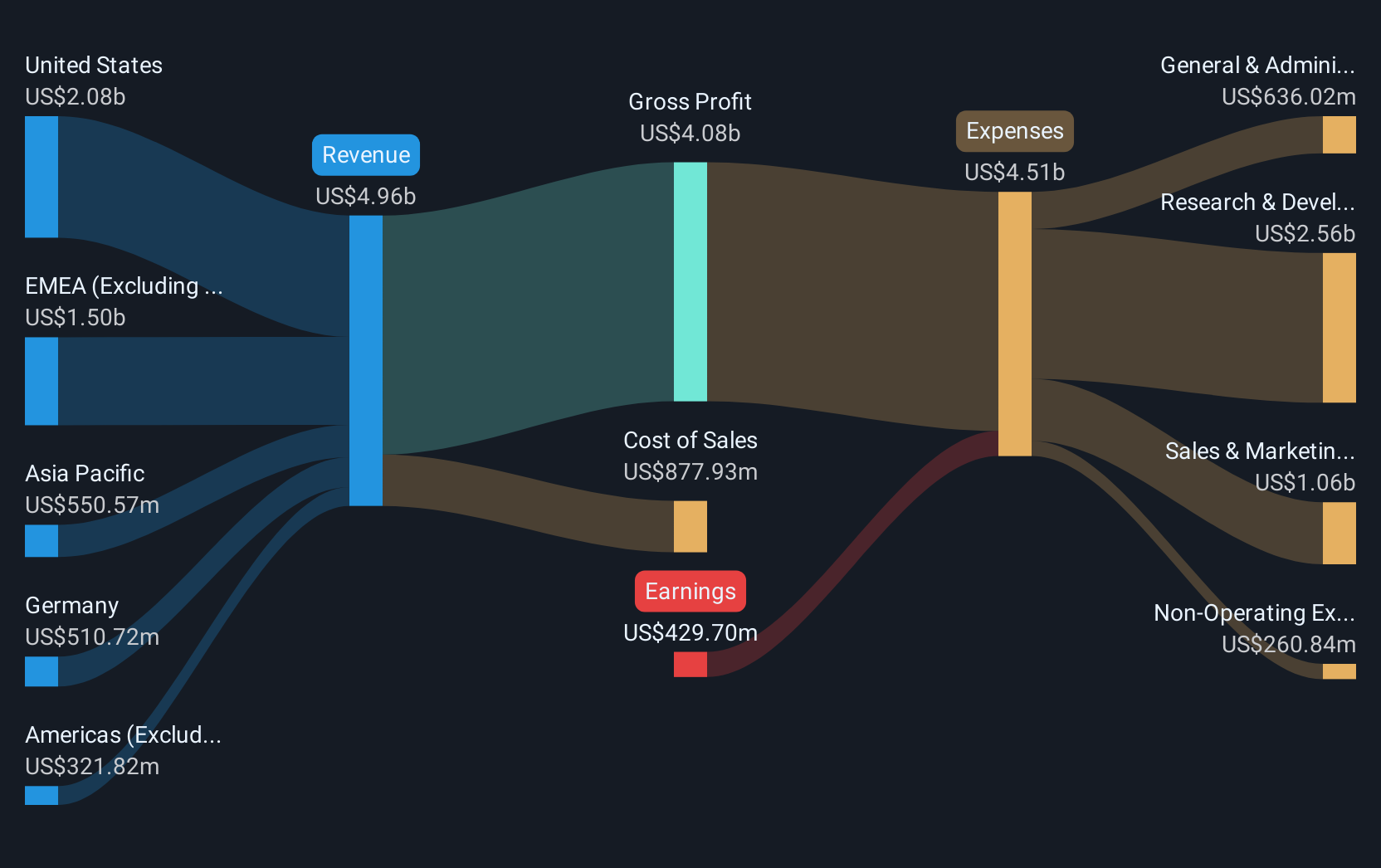

Operations: The company generates revenue primarily from its software and programming segment, amounting to $5.22 billion. Its business model focuses on providing collaboration tools that enhance organizational productivity on a global scale.

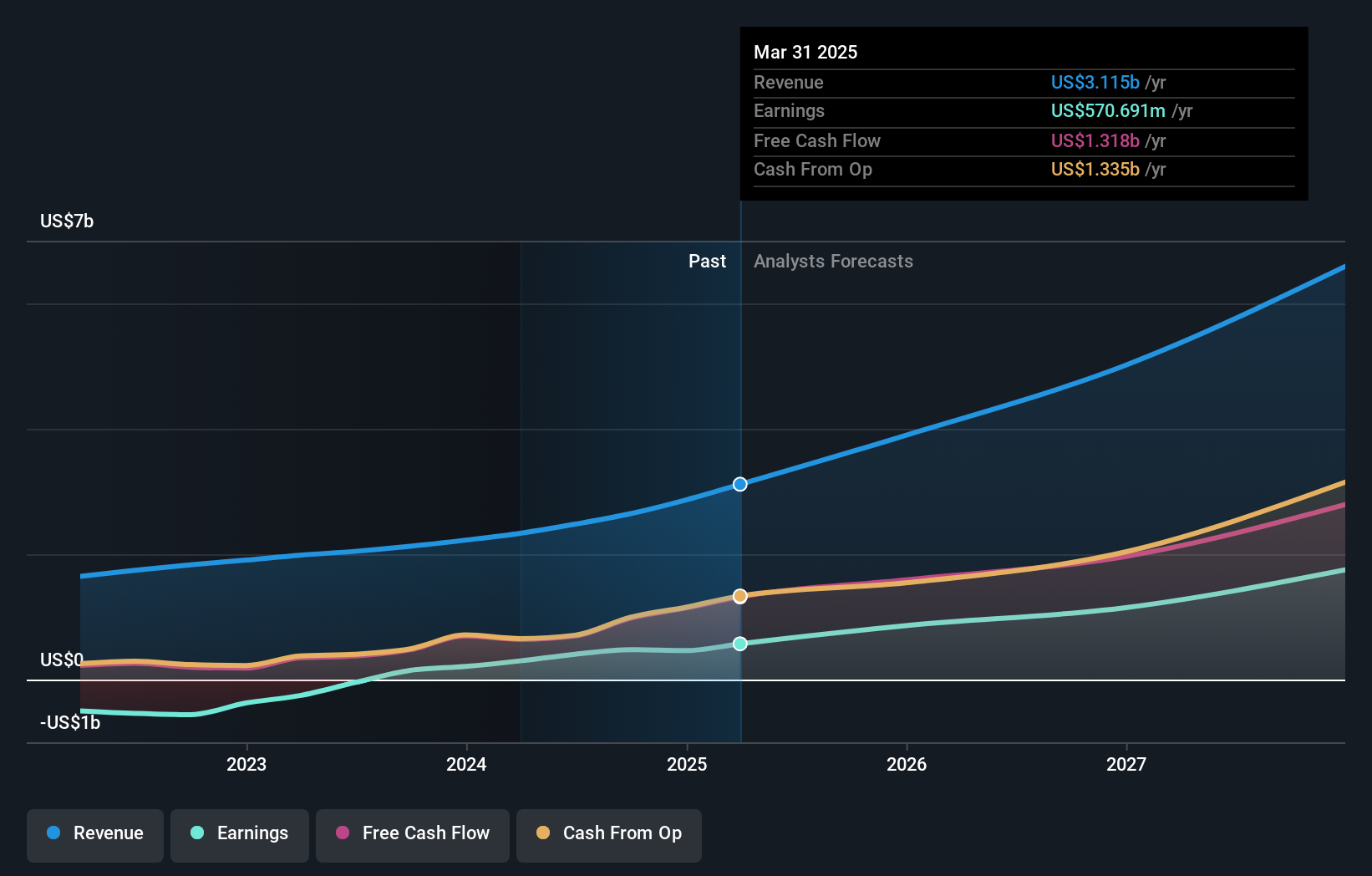

Atlassian's trajectory in the tech sector is marked by a robust focus on innovation and strategic partnerships, notably its recent collaboration with Google Cloud. This alliance enhances Atlassian's AI capabilities, integrating its popular tools like Jira and Confluence with Google’s AI-optimized infrastructure, which could significantly streamline cloud transformations for clients globally. Financially, Atlassian has demonstrated resilience despite being unprofitable, with a promising revenue growth forecast of 14.6% annually and an expected shift to profitability within three years. The company also actively invests in R&D to fuel these advancements, evidenced by substantial annual increases in R&D spending aimed at refining its software solutions for enhanced enterprise productivity and collaboration.

- Take a closer look at Atlassian's potential here in our health report.

Understand Atlassian's track record by examining our Past report.

ServiceNow (NOW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across multiple regions worldwide, with a market cap of $187.65 billion.

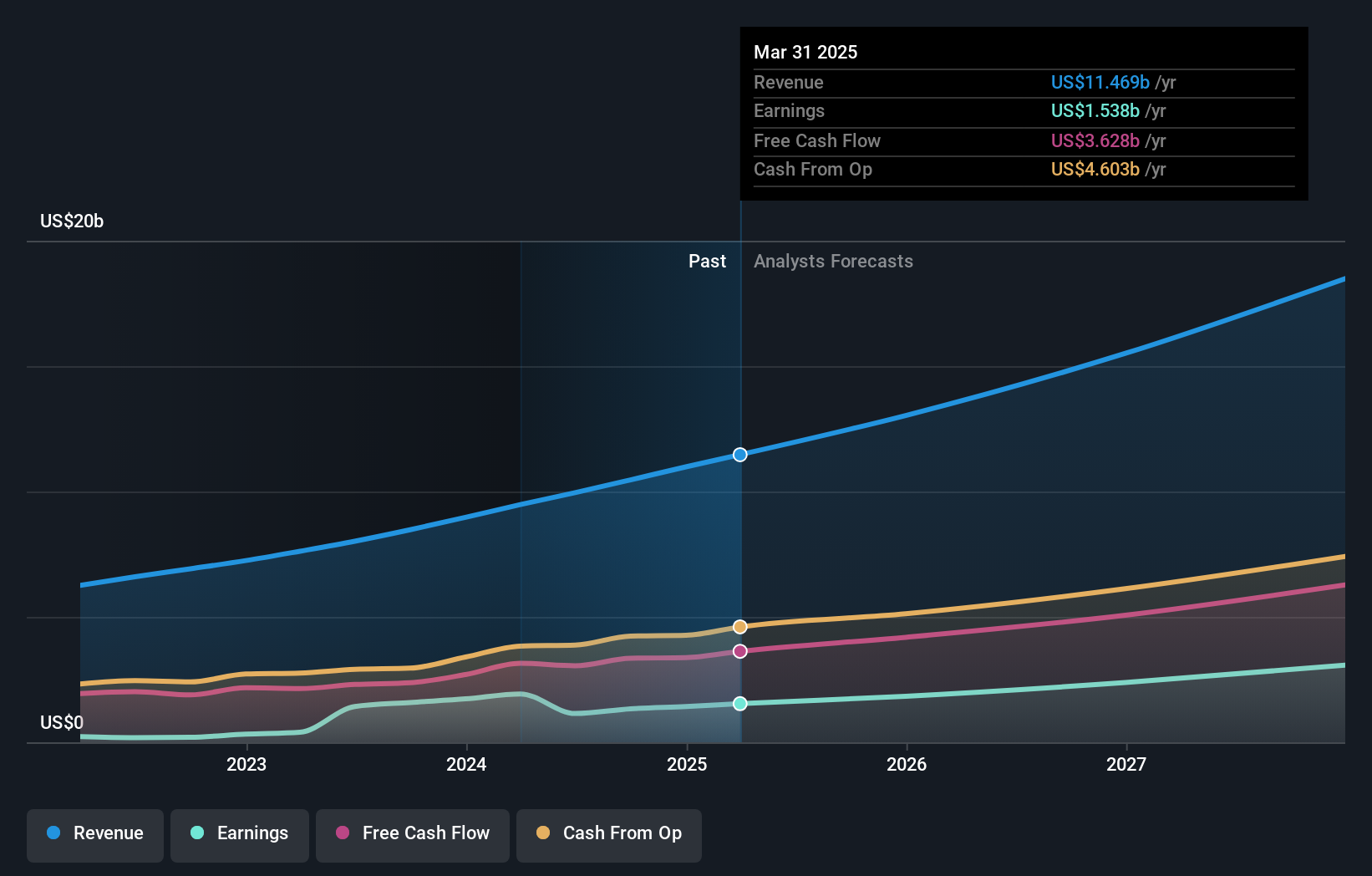

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $12.06 billion. Its solutions cater to various regions, including North America, Europe, the Middle East and Africa, and Asia Pacific.

ServiceNow's recent advancements underscore its robust position in the high-growth tech sector, particularly through its innovative AI Experience platform and strategic expansions. The company's R&D spending has strategically fueled these technological enhancements, ensuring ServiceNow stays at the forefront of enterprise AI solutions. Notably, their latest product announcements and partnerships, such as with Cloudera and Vectice, demonstrate a clear focus on integrating AI across diverse workflows to enhance operational efficiencies and customer engagement. This approach not only drives significant revenue growth—projected at 15.4% annually—but also positions ServiceNow as a pivotal player in transforming how businesses leverage technology for competitive advantage.

- Dive into the specifics of ServiceNow here with our thorough health report.

Examine ServiceNow's past performance report to understand how it has performed in the past.

Where To Now?

- Click here to access our complete index of 71 US High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives