- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian (TEAM) valuation check as core cloud apps reach a key milestone with AWS Marketplace launch

Reviewed by Simply Wall St

Atlassian (TEAM) just hit a key milestone in its cloud strategy, with Jira, Confluence, and Jira Service Management now available directly through AWS Marketplace. This tightens its tie up with Amazon and streamlines enterprise procurement.

See our latest analysis for Atlassian.

The AWS Marketplace listing lands after a choppy stretch for investors, with the share price at $162.04 and a year to date share price return of minus 33.15 percent. The one month share price return of 6.75 percent hints at stabilising, but not yet renewing, momentum. That sits alongside a difficult one year total shareholder return of minus 41.85 percent versus a still positive three year total shareholder return of 10.04 percent, suggesting the recent selloff reflects shifting sentiment on growth and risk rather than a completely broken long term story.

If this kind of cloud driven story has your attention, it could be worth scanning high growth tech and AI stocks to spot other software names where growth, AI adoption, and sentiment are lining up more convincingly.

With revenue still growing at a double-digit pace, losses narrowing, and the stock trading more than 30 percent below some valuation markers, is Atlassian quietly setting up a buying opportunity, or is the market already pricing in its next leg of cloud growth?

Most Popular Narrative Narrative: 33.9% Undervalued

With Atlassian last closing at $162.04 versus a narrative fair value around $245.24, the spread suggests markets are far from consensus on its long term trajectory.

Accelerating adoption of AI powered features and investments in integrating AI deeply into Atlassian's core cloud platform are expanding differentiated use cases, leading to higher user engagement, greater value per customer, and increased opportunities for premium upsells supporting future revenue growth and margin expansion.

Want to see what kind of revenue climb and margin shift that vision assumes? The narrative leans on bold growth curves and a striking future earnings multiple. Curious how those moving parts combine into today’s fair value call? Read on and unpack the full framework behind that gap.

Result: Fair Value of $245.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, complex cloud migrations and uncertain AI monetization could delay revenue and margin gains, which could quickly undermine the current undervaluation case.

Find out about the key risks to this Atlassian narrative.

Another View: Rich on Sales Despite Fair Value Upside

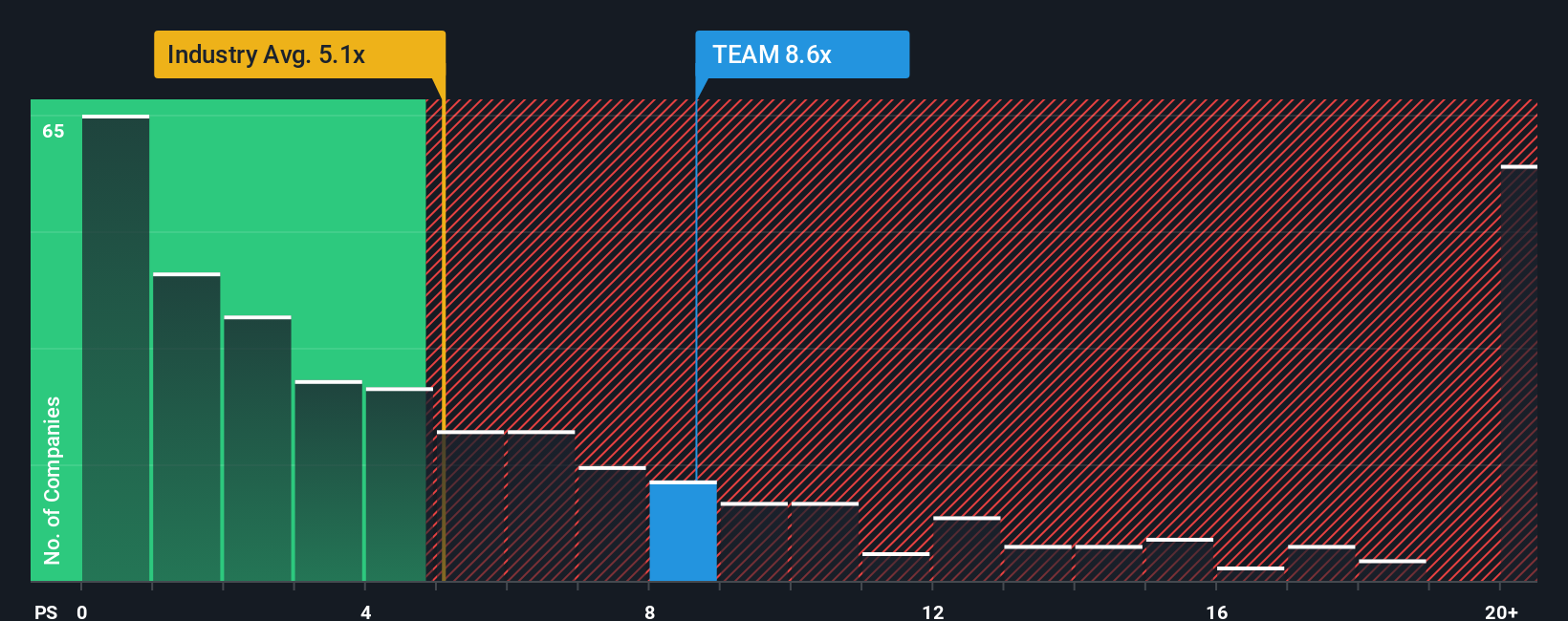

While our fair value work suggests Atlassian is about 34.7 percent undervalued, the market is still paying 7.8 times sales versus 4.9 times for the broader US software sector, even though this remains below a fair ratio of 12.5 times. Is that a sensible premium or a valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlassian Narrative

If this take does not quite fit your view, or you would rather lean on your own work, you can spin up a custom narrative in under three minutes, Do it your way.

A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before markets move on without you, put your research to work by scanning fresh stock ideas in minutes using the Simply Wall Street Screener’s focused shortlists.

- Capture high-upside potential by hunting through these 3612 penny stocks with strong financials where solid fundamentals meet low share prices and overlooked market attention.

- Position your portfolio for the next wave of innovation by targeting these 26 AI penny stocks poised to benefit from rapid advances in artificial intelligence.

- Explore potential value opportunities by filtering for these 908 undervalued stocks based on cash flows where strong cash flow analysis suggests the market may still be mispricing certain companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)