- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian (TEAM): Assessing Valuation After Insider Sales and New Analyst Caution

Reviewed by Kshitija Bhandaru

Atlassian (TEAM) has caught investors’ attention after insider share sales by key executives and a new, cautious view from a major bank. Both factors are stirring up conversation about the company’s future trajectory.

See our latest analysis for Atlassian.

Coming off the back of insider share sales and some skepticism from Wall Street, Atlassian’s share price has drifted lower. This reflects ebbing confidence in the near-term. Over the past year, the company has posted a -0.06% total shareholder return, highlighting fading momentum despite high-profile acquisitions and boardroom changes.

If you’re curious where opportunity might be building elsewhere, consider taking the next step and explore fast growing stocks with high insider ownership.

With shares under pressure and sentiment muted, the question for investors is clear: is Atlassian now trading at a bargain compared to its future potential, or is the market already accounting for all risks and upside ahead?

Most Popular Narrative: 41.1% Undervalued

Based on the prevailing narrative, Atlassian’s fair value estimate stands notably higher than the latest close, hinting at possible mispricing that diverges from recent market caution. This perspective invites a closer look into the high-expectation catalysts that underlie such an optimistic outlook.

Accelerating adoption of AI-powered features and investments in integrating AI deeply into Atlassian's core cloud platform are expanding differentiated use cases. This is leading to higher user engagement, greater value per customer, and increased opportunities for premium upsells, supporting future revenue growth and margin expansion.

What exactly is the engine behind this bullish forecast? The model is betting on explosive growth tied to new technology wins, margin upside, and product expansion. Just how aggressive are those targets? Find out what numbers are setting the tone for Atlassian’s future runway.

Result: Fair Value of $256.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as delayed enterprise cloud migrations or slower-than-expected returns from new AI features could disrupt Atlassian's projected growth and valuation narrative.

Find out about the key risks to this Atlassian narrative.

Another View: What Do the Market Multiples Say?

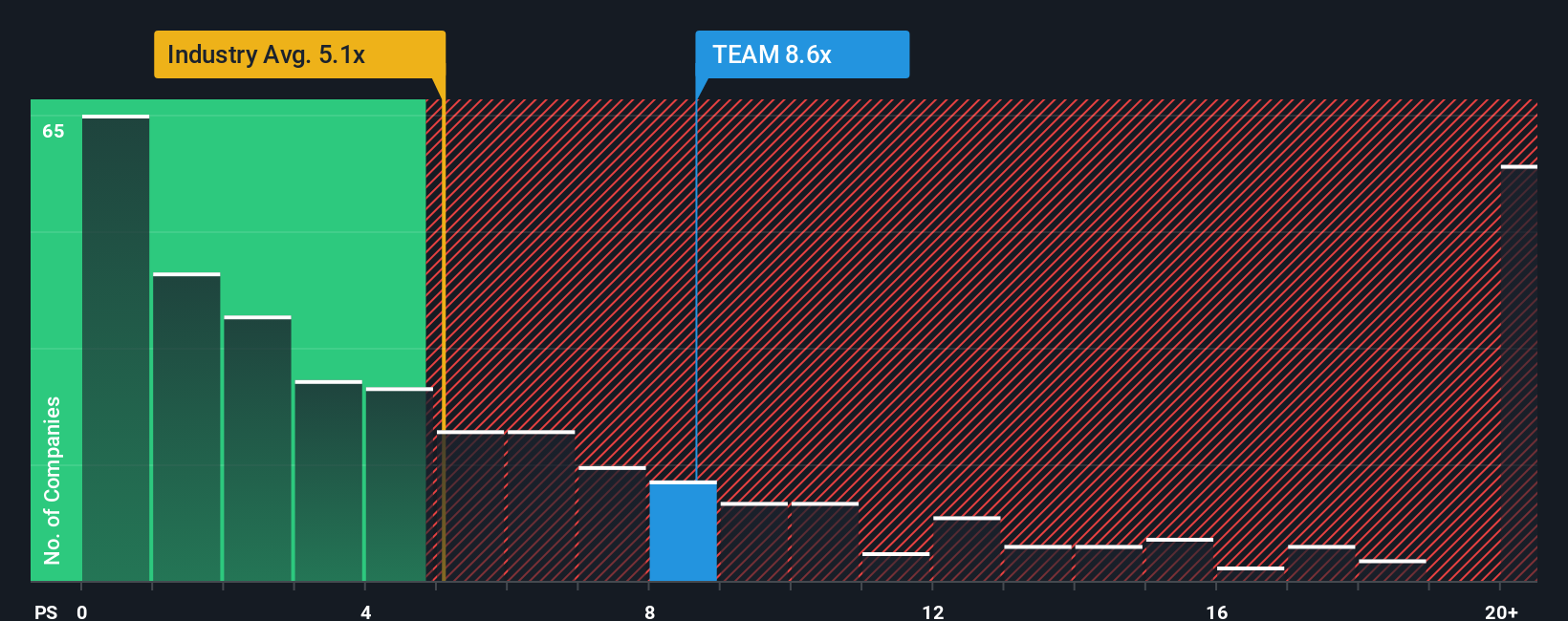

Looking through the lens of price-to-sales, Atlassian trades at 7.6x, which is well above the US Software industry average of 5.3x but notably lower than its peer average of 13.8x. Compared to its fair ratio of 13.6x, this places Atlassian in a valuation middle ground. Does this premium reflect lasting growth, or is there more room for skepticism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlassian Narrative

If this outlook doesn’t align with your perspective or you’d rather dig into the numbers your own way, you can build a complete Atlassian view in just minutes. Do it your way.

A great starting point for your Atlassian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart opportunities are closer than you think. Move beyond Atlassian and give your portfolio an edge with investment themes designed to highlight potential market movers.

- Discover value with these 910 undervalued stocks based on cash flows and identify companies the market might be underestimating right now.

- Enhance your growth potential by exploring these 24 AI penny stocks that are transforming industries with artificial intelligence.

- Pursue yield with these 19 dividend stocks with yields > 3% which offers attractive returns for investors focused on reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)