- United States

- /

- Building

- /

- NasdaqGS:AAON

AAON And 2 Other Insider Picks For Growth Potential

Reviewed by Simply Wall St

The market in the United States has shown positive momentum, climbing by 1.7% over the past week and rising 18% over the last year, with earnings projected to grow by 15% annually. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company in its growth potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 10.5% | 47% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Chemung Financial (CHMG) | 19.6% | 78.3% |

| Atour Lifestyle Holdings (ATAT) | 22.2% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.4% |

Here we highlight a subset of our preferred stocks from the screener.

AAON (AAON)

Simply Wall St Growth Rating: ★★★★☆☆

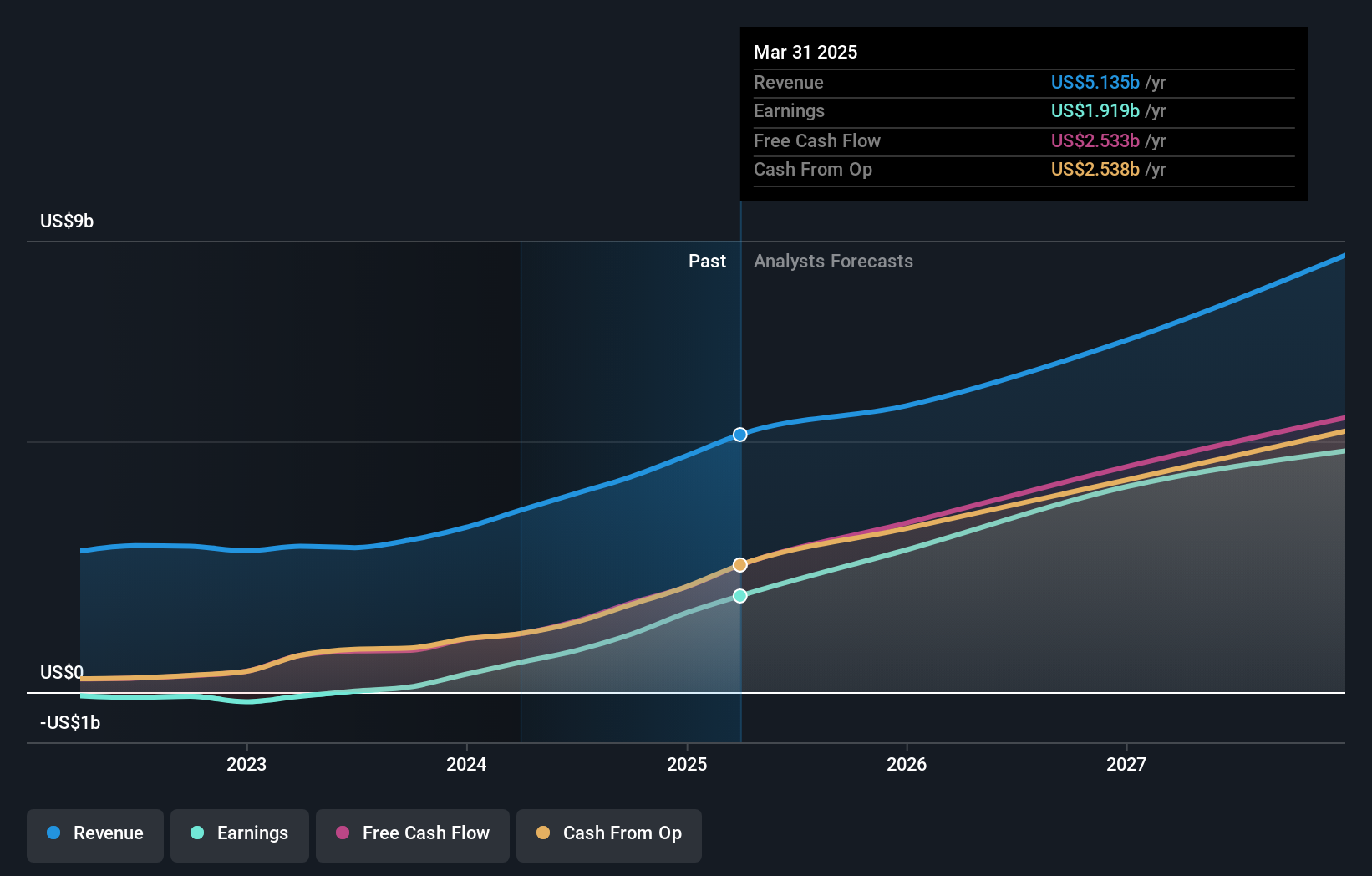

Overview: AAON, Inc. is involved in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of approximately $6.18 billion.

Operations: The company's revenue segments include Basx with $237.24 million, AAON Oklahoma contributing $818.91 million, and AAON Coil Products generating $248.90 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 19% p.a.

AAON, Inc. is experiencing growth with earnings projected to increase by 19% annually, surpassing the US market average. The company has high insider ownership, though recent months saw significant insider selling. Despite being dropped from several Russell indices, AAON's revenue is expected to grow at 12.7% per year, outpacing the US market rate of 9%. Recent advancements in their Alpha Class heat pumps underscore AAON's commitment to innovation and industry leadership.

- Unlock comprehensive insights into our analysis of AAON stock in this growth report.

- The analysis detailed in our AAON valuation report hints at an inflated share price compared to its estimated value.

AppLovin (APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform designed to improve marketing and monetization for advertisers globally, with a market cap of $118.44 billion.

Operations: The company's revenue is derived from two main segments: Apps, generating $1.43 billion, and Advertising, contributing $3.70 billion.

Insider Ownership: 30.9%

Earnings Growth Forecast: 23.7% p.a.

AppLovin's revenue is forecast to grow at 17.2% annually, outpacing the US market average. Despite a high level of debt and recent goodwill impairment of US$188.94 million, its earnings are expected to rise significantly by 23.7% per year, surpassing the market's growth rate. Recent index reclassifications saw AppLovin added to the Russell Top 200 Growth Index, while insider activity has been mixed with more buying than selling in recent months.

- Get an in-depth perspective on AppLovin's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that AppLovin's current price could be inflated.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $52.09 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $4.96 billion.

Insider Ownership: 37.3%

Earnings Growth Forecast: 50% p.a.

Atlassian's revenue is projected to grow at 14.8% annually, exceeding the US market average. Despite recent net losses and substantial insider selling over the past three months, Atlassian’s earnings are expected to turn profitable within three years, with a high forecasted return on equity of 41.2%. The company recently completed a significant share buyback worth $939.68 million and trades at a discount of 22.5% below its estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of Atlassian.

- Our valuation report here indicates Atlassian may be undervalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 190 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Interested In Other Possibilities? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives