- United States

- /

- Software

- /

- NasdaqCM:SSTI

Slammed 25% SoundThinking, Inc. (NASDAQ:SSTI) Screens Well Here But There Might Be A Catch

The SoundThinking, Inc. (NASDAQ:SSTI) share price has fared very poorly over the last month, falling by a substantial 25%. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

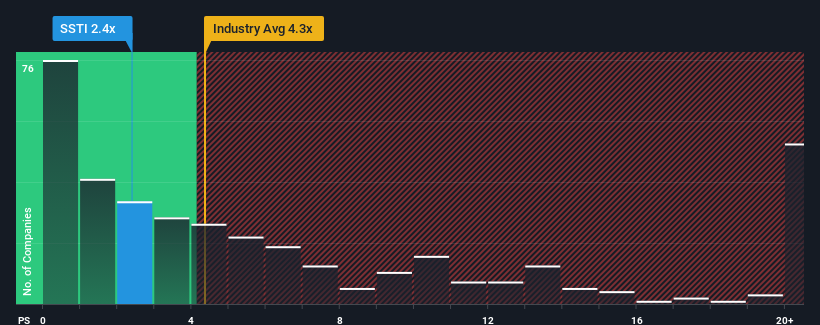

Since its price has dipped substantially, SoundThinking may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.4x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 12x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SoundThinking

How Has SoundThinking Performed Recently?

With revenue growth that's superior to most other companies of late, SoundThinking has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think SoundThinking's future stacks up against the industry? In that case, our free report is a great place to start.How Is SoundThinking's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SoundThinking's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen an excellent 99% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 15% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 15% per annum, which is not materially different.

In light of this, it's peculiar that SoundThinking's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

SoundThinking's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of SoundThinking's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 2 warning signs for SoundThinking that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade SoundThinking, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SSTI

SoundThinking

A public safety technology company, provides transformative solutions and strategic advisory services for law enforcement and civic leadership.

Good value with adequate balance sheet.