- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (NasdaqGM:SOUN) Jumps 21% After Launching Advanced Voice AI For Restaurants

Reviewed by Simply Wall St

SoundHound AI (NasdaqGM:SOUN) made headlines with the launch of its advanced voice AI platform for restaurants, offering a comprehensive suite of solutions for automation and customer interaction. Alongside the introduction of customizable Brand Personalities for automotive applications, these developments likely contributed to the impressive 21% price surge in the last quarter. The firm's robust product enhancements came amid broader market fluctuations, where major U.S. indices experienced mixed reactions to tariff announcements and fluctuating tech stocks. Despite industry-wide challenges, SoundHound maintained its upward trajectory, underscoring its potential position in the AI sector. While companies like Nvidia faced pressure after earnings, the anticipation surrounding SoundHound's upcoming financial results and its product-driven momentum likely sustained investor interest. The broader market's 17% rise over the year, contrasted by recent declines, positioned SoundHound's innovation as a focal point of growth amid technological shifts in both the restaurant and automotive sectors.

Get an in-depth perspective on SoundHound AI's performance by reading our analysis here.

SoundHound AI's total shareholder return of 50.95% last year significantly outperformed the US market's 16.7% and the US Software industry’s 6.7% over the same period. This robust performance amidst industry challenges reflects the company's continuous advancements and strategic partnerships. Noteworthy developments included a partnership with Church's Texas Chicken, employing voice AI for drive-thru ordering, and a collaboration with Kia India for integrating voice AI technology in multiple languages. Additionally, SoundHound's integration in Stellantis brands and the launch of a voice commerce platform have broadened its reach and application, bolstering investor confidence.

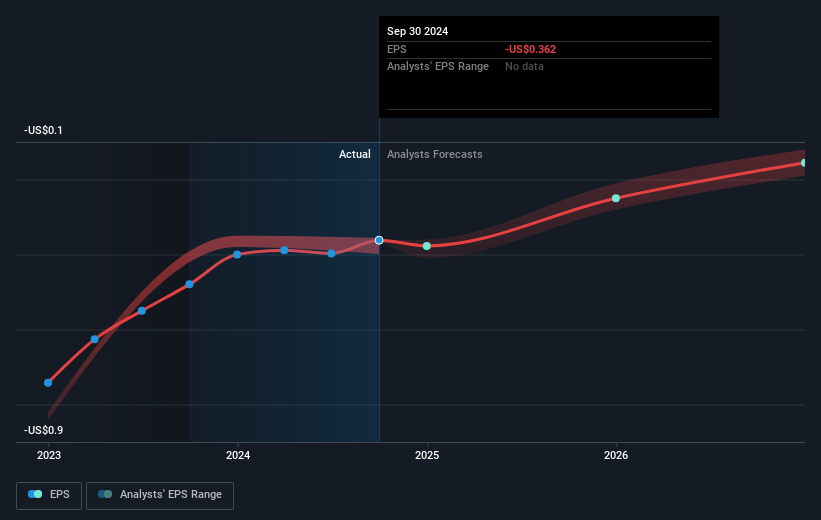

The company's financial milestones, including significant revenue growth and updated guidance, further supported share performance. Q3 2024 reported sales of US$25.09 million, showcasing considerable year-on-year growth. However, substantial insider selling and multiple follow-on equity offerings, such as a US$250 million offering, were notable financial events during the year. These initiatives aimed to solidify the company's financial foundation, despite the ongoing challenges of profitability.

- Unlock the insights behind SoundHound AI's valuation and discover its true investment potential

- Assess the downside scenarios for SoundHound AI with our risk evaluation.

- Hold shares in SoundHound AI? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives