- United States

- /

- Software

- /

- NasdaqGM:SOUN

Can SoundHound AI’s (SOUN) Voice-Powered Parking Push Clarify Its Broader Voice Commerce Path?

Reviewed by Sasha Jovanovic

- In November 2025, Parkopedia and SoundHound AI expanded their partnership to roll out an in-vehicle voice AI parking agent that lets drivers find, compare, and pay for parking entirely by voice using Parkopedia’s database of more than 90 million spaces across over 20,000 cities.

- This move extends SoundHound’s voice commerce platform beyond food ordering into essential car-related services, highlighting how its conversational AI is being embedded more deeply into everyday driving experiences.

- We’ll now explore how this expanded voice-powered parking integration might influence SoundHound AI’s investment narrative built around broader voice commerce adoption.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

SoundHound AI Investment Narrative Recap

To own SoundHound AI, you need to believe that voice commerce will become a standard interface across cars and other everyday services, and that SoundHound can turn rapid revenue growth into sustainable profitability despite ongoing losses and cash burn. The expanded Parkopedia parking integration supports the near term catalyst of deeper in-car monetization, but does not materially change the central risk that high expenses and shareholder dilution could weigh on future returns if profitability remains elusive.

Among recent developments, the company’s third quarter 2025 results stand out beside this partnership: revenue rose to US$42.05 million with management raising full year 2025 guidance to US$165 million to US$180 million. This context matters because the voice powered parking rollout fits into a broader push to scale usage and revenue, while the widened net loss of US$109.27 million underlines how dependent the investment case still is on eventually improving margins and cost discipline.

Yet behind the promise of cars booking and paying for services by voice, investors should be aware that sustained losses and ongoing cash burn could...

Read the full narrative on SoundHound AI (it's free!)

SoundHound AI's narrative projects $308.5 million revenue and $40.4 million earnings by 2028. This requires 32.9% yearly revenue growth and a $265.8 million earnings increase from $-225.4 million today.

Uncover how SoundHound AI's forecasts yield a $16.94 fair value, a 51% upside to its current price.

Exploring Other Perspectives

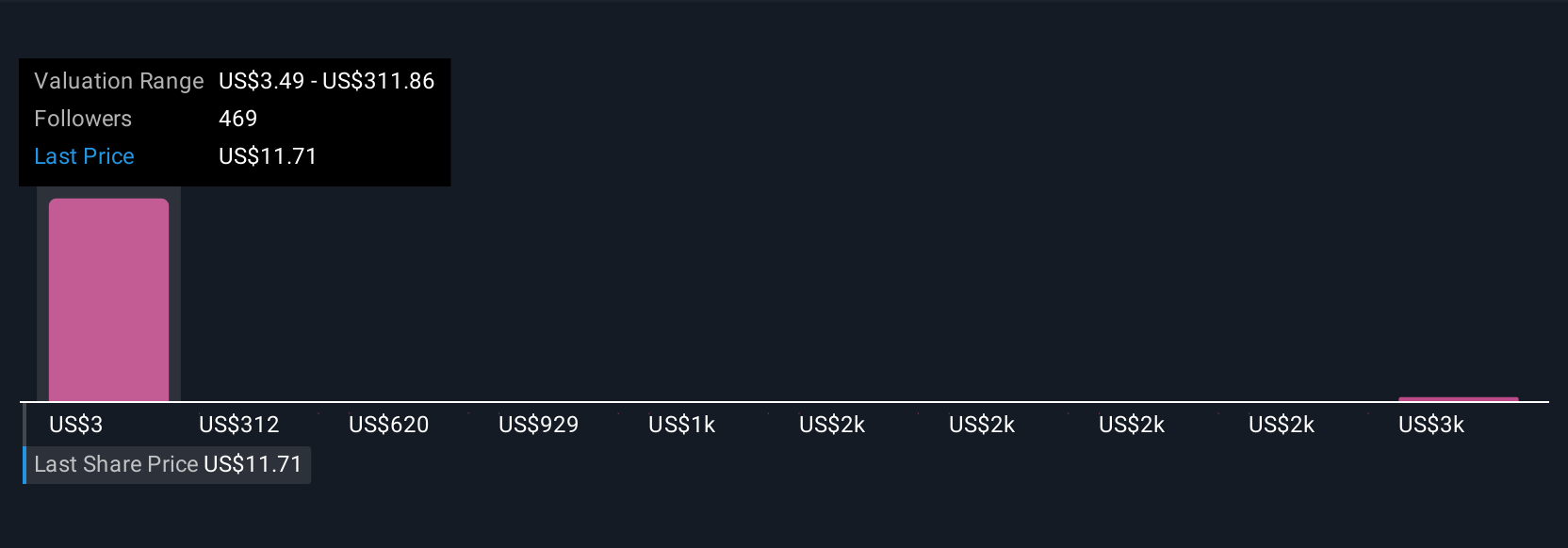

Fourteen members of the Simply Wall St Community currently see fair value for SoundHound AI between US$3.41 and US$28.58, reflecting a very wide spread of expectations. Against this backdrop, the core debate over whether rapid voice commerce adoption can overcome concentrated enterprise deal risk and lumpy revenues becomes especially important for anyone assessing the company’s long term performance potential.

Explore 14 other fair value estimates on SoundHound AI - why the stock might be worth over 2x more than the current price!

Build Your Own SoundHound AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free SoundHound AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoundHound AI's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026