- United States

- /

- Software

- /

- NasdaqGS:SNPS

What Recent Share Price Drop Means for Synopsys Valuation in 2025

Reviewed by Bailey Pemberton

Trying to figure out what to do with Synopsys stock? You are not alone. The company has had quite a journey. If you have held onto shares for the past five years, you are sitting on a gain of more than 115%. Over the past three years, the stock has climbed nearly 77%, which is no small feat in the tech industry. Recently, though, things have gotten a bit mixed. After reaching new highs earlier in the year, shares are down about 19.7% in the past month alone and 7.5% lower than a year ago. The past week was fairly quiet, with just a 0.1% move, but the broader trends show that markets are rethinking risk in software and semiconductor stocks, especially with industry consolidation and changing chip demand patterns grabbing Wall Street’s attention.

With all these cross-currents, the big question is how to value Synopsys now. Traditionally, analysts use several checks to judge if a stock is undervalued, looking at factors such as price-to-earnings, price-to-book, and others. On these measures, Synopsys scores a 0 out of 6, meaning the company is currently not undervalued by any of these standard valuation checks. Of course, there is more to a stock’s story than a simple tally of ratios. So let us dig in to see what insights these valuation approaches offer and why there might be an even better way to understand whether Synopsys is worth your attention right now.

Synopsys scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method for estimating the intrinsic value of a business by projecting its future cash flows and discounting them back to today’s value. In simple terms, it helps investors determine what a company is worth based on what it’s expected to earn in the future, with today’s dollars.

For Synopsys, the DCF model relies on a two-stage projection using Free Cash Flow (FCF) as the primary measure. Over the last twelve months, Synopsys generated $1.26 Billion in Free Cash Flow. According to analyst forecasts, FCF is expected to rise steadily, reaching roughly $4.56 Billion by 2029. Further growth is extrapolated by Simply Wall St through 2035.

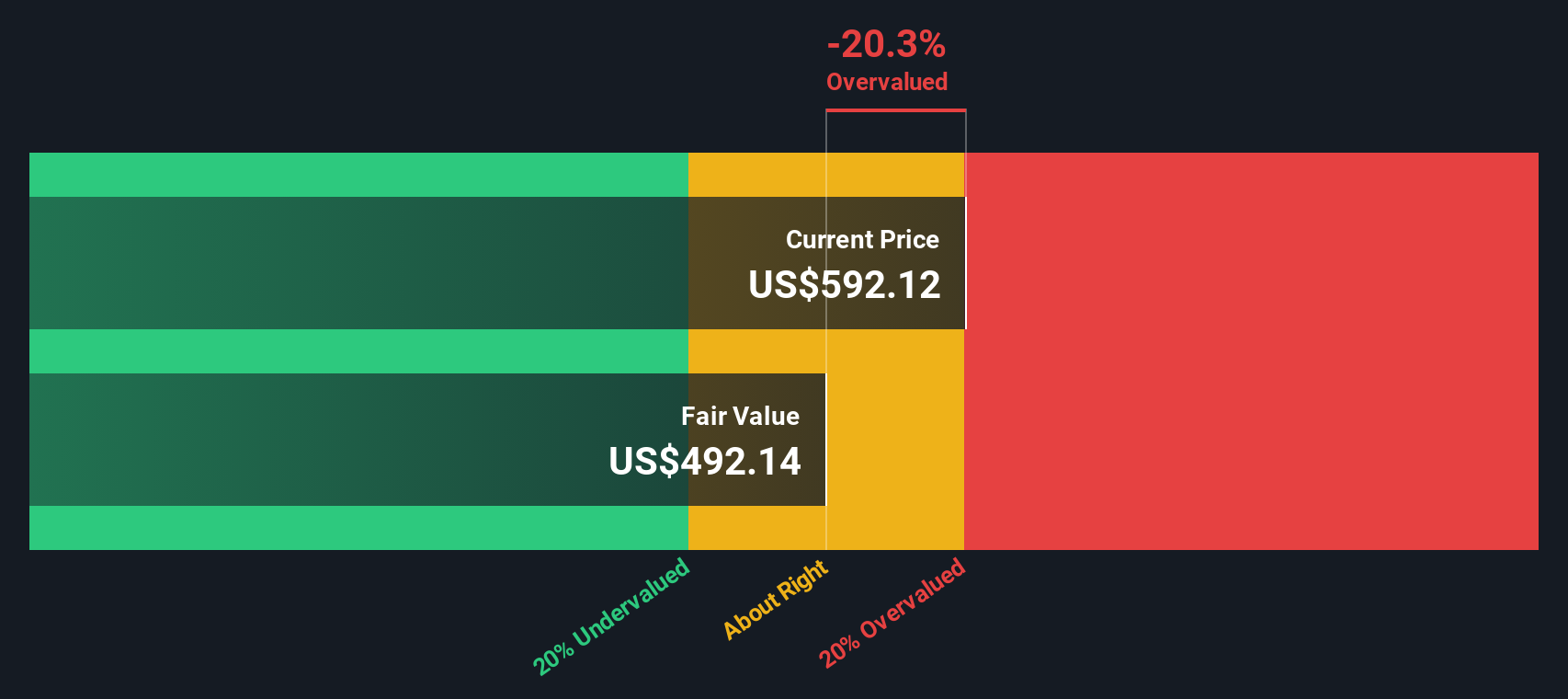

After discounting these projected cash flows to present value, the estimated intrinsic fair value for Synopsys stock is $421.04 per share. However, this is about 16.2% lower than the current trading price. This means Synopsys shares appear overvalued based on traditional DCF analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synopsys may be overvalued by 16.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Synopsys Price vs Earnings

For profitable companies such as Synopsys, the price-to-earnings (PE) ratio is a widely recognized metric for evaluating value. The PE ratio helps investors understand how much they are paying for each dollar of earnings. Generally, higher growth expectations or lower risks justify a higher "normal" or "fair" PE ratio. Companies with slower growth or more risks tend to warrant a lower PE.

Synopsys currently trades at a PE ratio of 77.9x. This is considerably higher than both the Software industry average of 36.0x and the average of its closest peers at 71.7x. Such a premium suggests the market is pricing in significant future growth or a lower level of expected risk relative to its competitors.

Enter the concept of the “Fair Ratio,” a proprietary assessment from Simply Wall St. The Fair Ratio goes beyond straightforward comparisons by factoring in Synopsys’s specific growth forecasts, risk profile, profit margins, industry classification, and market capitalization. This holistic view offers a more nuanced benchmark for what would be a reasonable PE ratio for the company today.

For Synopsys, the Fair Ratio is calculated at 47.6x. This means the current PE is notably higher than what would be justified by the company’s own fundamentals and risk-adjusted growth prospects. Comparing the actual PE of 77.9x to this Fair Ratio, the stock appears overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier, we mentioned that there is an even better way to assess valuation, so let us introduce you to Narratives. A Narrative is a simple, dynamic investment story: it is your perspective on the business, connecting your reasons for optimism or caution with specific forecasts for future revenue, earnings, and margins, which together lead to your own estimate of fair value.

Unlike static ratios, Narratives tie Synopsys’s unique story and recent developments directly to a numbers-based forecast and a fair value estimate, showing you exactly how your outlook leads to a buy, hold, or sell conclusion. Narratives are straightforward and easy to use, and are available on Simply Wall St’s Community page, where millions of investors rely on them to crowdsource high-quality perspectives on companies.

Because Narratives are automatically updated as new earnings, news, or forecasts emerge, this approach keeps you in sync with the market and your own convictions. For example, recent Synopsys Narratives show a wide spread in fair value estimates. Some investors see immense upside if AI and Ansys integration drive faster growth, placing fair value near the highest analyst target of $715, while others are more cautious about execution risk and margin pressures, suggesting a fair value closer to the low analyst target of $550.

Do you think there's more to the story for Synopsys? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives