- United States

- /

- Software

- /

- NasdaqGS:SNPS

Is Synopsys (SNPS) Pricing Look Stretched After Strong Multi‑Year Share Gains?

Reviewed by Bailey Pemberton

- If you are wondering whether Synopsys is priced attractively right now, it helps to step back and look at both the recent share moves and what they might be implying about value.

- The stock closed at US$525.18 recently, with returns of 9.3% over the last week, 15.9% over the last month, 9.3% year to date, 6.6% over 1 year, 57.7% over 3 years and 102.8% over 5 years. This gives plenty of context for any thoughts you might have about growth potential or shifting risk perceptions.

- Recent coverage around Synopsys has focused on its role in electronic design automation and chip design tools, which often puts it in the conversation when investors talk about semiconductor related software names. That broader context helps explain why the share price performance can attract attention from investors comparing it with other technology stocks.

- Simply Wall St currently gives Synopsys a valuation score of 0 out of 6. In the next sections we will walk through the standard valuation checks, then finish with a more holistic way to think about what the market might be pricing in.

Synopsys scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business might be worth today by projecting its future cash flows and then discounting those back to the present.

For Synopsys, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month Free Cash Flow is reported at about $1.33b. Analyst and extrapolated projections, provided by Simply Wall St, extend out to 2035, with forecast Free Cash Flow for 2030 at $4.87b. These longer term numbers beyond the first few years are extrapolations based on earlier estimates rather than direct analyst forecasts.

Based on these inputs, the DCF model arrives at an estimated intrinsic value of about $465.51 per share. In comparison, the recent share price is $525.18. This implies the shares are trading at around a 12.8% premium to the DCF estimate, which indicates Synopsys appears overvalued according to this specific cash flow model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synopsys may be overvalued by 12.8%. Discover 882 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Synopsys Price vs Earnings

For profitable companies, the P/E ratio is a straightforward way to link what you pay for the stock to the earnings it currently generates. It helps you see how many dollars investors are willing to pay today for each dollar of earnings.

What counts as a “normal” P/E really depends on how the market views a company’s growth prospects and risk. Higher expected growth or lower perceived risk can justify a higher P/E, while slower growth or higher uncertainty usually points to a lower multiple.

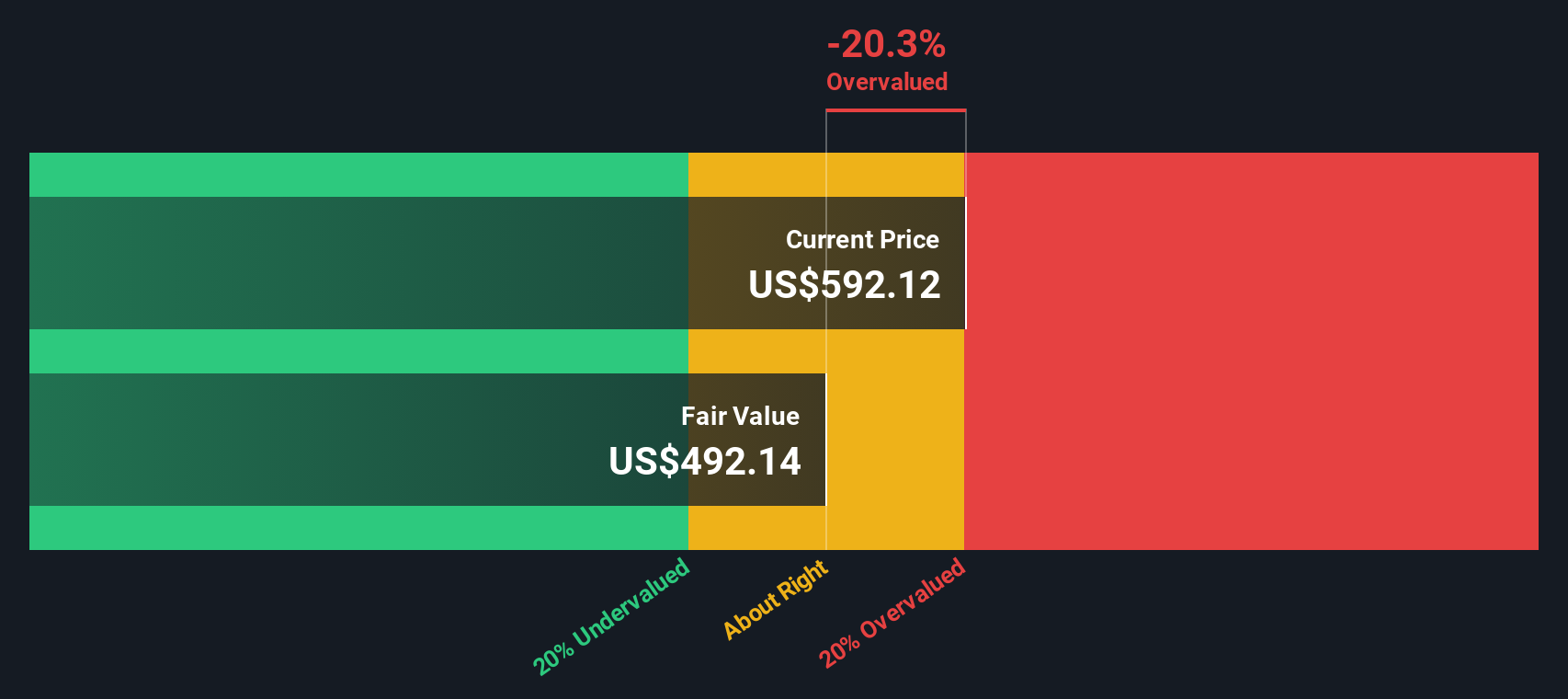

Synopsys currently trades on a P/E of 75.2x, compared with about 32.7x for the broader Software industry and 50.0x for its peer group on average. Simply Wall St’s Fair Ratio for Synopsys is 41.9x. This Fair Ratio is a proprietary estimate of what the P/E might be given factors such as earnings growth, profit margins, industry, market cap and risk profile. It provides a more tailored benchmark than a simple comparison with peers or the industry, which may differ on growth or risk.

Compared with this Fair Ratio of 41.9x, the current P/E of 75.2x suggests Synopsys is trading at a premium on this metric.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you turn your view of Synopsys into a clear story that links its business, a financial forecast and a fair value, then compares that to the current price to help you decide what to do.

On Simply Wall St’s Community page, millions of investors use Narratives to set their own assumptions for future revenue, earnings and margins, then see how those inputs translate into a Fair Value that updates automatically when new information such as earnings, legal developments or partnerships appears.

For Synopsys, one investor might build a Narrative that leans into the NVIDIA partnership, the Ansys integration and higher assumed profit margins, arriving at a Fair Value above the current analyst consensus of US$652.74. Another might focus more on export controls, IP business risks and legal actions, using lower earnings assumptions and landing closer to the most cautious analyst case around US$550. That simple comparison between each Narrative’s Fair Value and today’s share price can frame whether they see Synopsys as closer to a buy, a hold or a sell in their own portfolio.

Do you think there's more to the story for Synopsys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Mota-Engil's Intrinsic and Historical Valuation

Ferrari's Intrinsic and Historical Valuation

SAP's Intrinsic and Historical Valuation

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale